How can I become a Chartered Accountant in India?

Here's how you need to go about it.Step 1: Enrol yourself in the CA Foundation Course after completing XIIth.Step 2: Complete a 4 month study period and appear in the CA Foundation Examination.Step 3: Enrol into CA Intermediate Course after clearing CA Foundation Exam.More items...•Oct 23, 2019

How many years is CA course?

5 YearsCA SubjectsCourseChartered AccountancyShort FormCAOffering BodyThe Institute of Chartered Accountants of India (ICAI)Levels of the Course3 LevelsDuration of Course5 Years1 more row

How much money is required for CA course in India?

What is the total fee for the CA Course for 5 years in India? Ans: The total fees for the complete CA course that candidates have to pay in India is around 1.9 lakhs.

How can I take admission in CA course?

Eligibility & Admission After the completion of 12th standard, students can take the admission in the CA programme through the CPT (Common Proficiency Test). Interested students can register for the test after passing their 10th examination, though they are supposed to appear for the test after 12th.

What is the salary of CA?

The average salary is between INR6-7 lakhs per annum in India. A CA's Salary, on average, could rise to INR40-60 lakhs depending on his skills and experience. If he gets an International posting, he could earn INR 75 lakh pa. At the recent ICAI placement, INR 8.4lakhs is the average salary of CA.

What is the age limit for CA?

Candidates must successfully clear their 10th and 12th exams from a recognised educational institute. Also, the minimum marks they need to attain in their 12th standards is 50% aggregate. There is no age restriction to apply for the CA foundation course.Apr 4, 2022

What are the 7 subjects in CA?

Chartered Accountancy (CA) SyllabusPrinciples and Practices of Accounting.Business Law & Business Correspondence and Reporting.Business Mathematics and Logical Reasoning & Statistics.Business Economics & Business and Commercial Knowledge.Apr 4, 2022

Can I start CA at the age of 25?

You can start and complete CA at any age.

What if I fail in CA Inter?

What if CA aspirants fail in the CA final exams? If CA aspirants fail in the CA final exams, then he/she can appear for the CA final exams in the next attempt. They have to appear only for the CA final exams, not all the exams.

Can I complete CA in 2 years?

The minimum duration to pursue CA after graduation is 3 years as you can directly take IPCC exams after 9 months from registering yourself after which you also need to complete 2.5-3 Years of Articleship to become a Chartered Accountant.Sep 30, 2021

Can I study CA at home?

Currently ICAI is also providing live virtual classes at very affordable prices like INR 3750 for whole group. It is advisable to take classes for all the subjects at CA Intermediate level -- once student clear their basics then they can even do self study at CA Final levels.

What is CA exam syllabus?

4.2 ICAI-CA-Foundation Syllabus 2021-Business Laws and Business Correspondence and Reporting. 4.2.1 CA-Foundation - Business Laws and its Provisions (60 marks) 4.2.2 CA-Foundation - Business Correspondence and Reporting. 4.3 CA-Foundation Syllabus for PAPER -3 Business Mathematics, Logical Reasoning, and Statistics.

How many marks do you need to be a Chartered Accountant?

A Chartered Accountant is much need for any enterprise. You would have taken a lot of trouble to complete the CA Course to score the maximum out of 100 marks. You want to secure a job that makes you happy.

What countries does the ICAI work with?

The ICAI has an agreement with Canada, Singapore, and Ireland Institutes for Chartered Accountants. That makes it possible for Indian Chartered Accountants to work in those countries and earn a handsome salary.

What is CA in banking?

CA is an opening to many great careers. A newly appointed CA can either choose to start his practice or work for an organization in a respectable position. He can study further and specialize. From academics to finance, Banking to taxation, Investment banking to outsourcing, he can pick a profile that he most desires.

Why is an in-depth study of the industry in which you want to make a career necessary?

An in-depth study of the industry in which you want to make a career is necessary to make an impression during the interview for the job. It is an indispensable tool in the hands of CA's to forecast future trends and manage risks for the enterprise he is working for.

Is it impossible to become a Chartered Accountant?

However, the syllabus is vast, and the student must work hard. Chartered Accountancy is not an impossible career for you. The difficulty to become a Chartered Accountant is in improper preparation and dedication.

Is a Chartered Accountant highly paid?

Secondly, Chartered Accountant is respected and is highly paid, and has a scope for a high position in an enterprise. Thirdly CA's are not restricted to a particular field of work but are indispensable for all enterprises including, non-profit earning ones. He can choose the job he may want to do.

What is the ICAI in India?

In India, the Institute of Chartered Accountants of India (ICAI) is responsible for maintaining highest standards in CA education. Once a student enters class 12, apart from the stress of board exams, they also struggle with the decision about their future career path. Often enough, lack of information about possible career choices can lead ...

What is the ICAI?

In India, the Institute of Chartered Accountants of India (ICAI) is a statutory body established by an Act of Parliament, viz. the Chartered Accountants Act, 1949 (Act No.XXXVIII of 1949) for regulating the profession of Chartered Accountancy in the country. ICAI is also responsible for maintaining highest standards in CA education.

How long does it take to pass the foundation exam?

Students who pass in Foundation course exam move to Intermediate course. Students have to complete 8 months of study course as on first day of the month in which the intermediate exam will be held to be eligible for appearing in the Intermediate exam.

How do I become a Chartered Accountant?

To become a Chartered Accountant, the candidate has to go through a process of training and exams as various levels, conducted by the Institute of Chartered Accountants of India (ICAI).

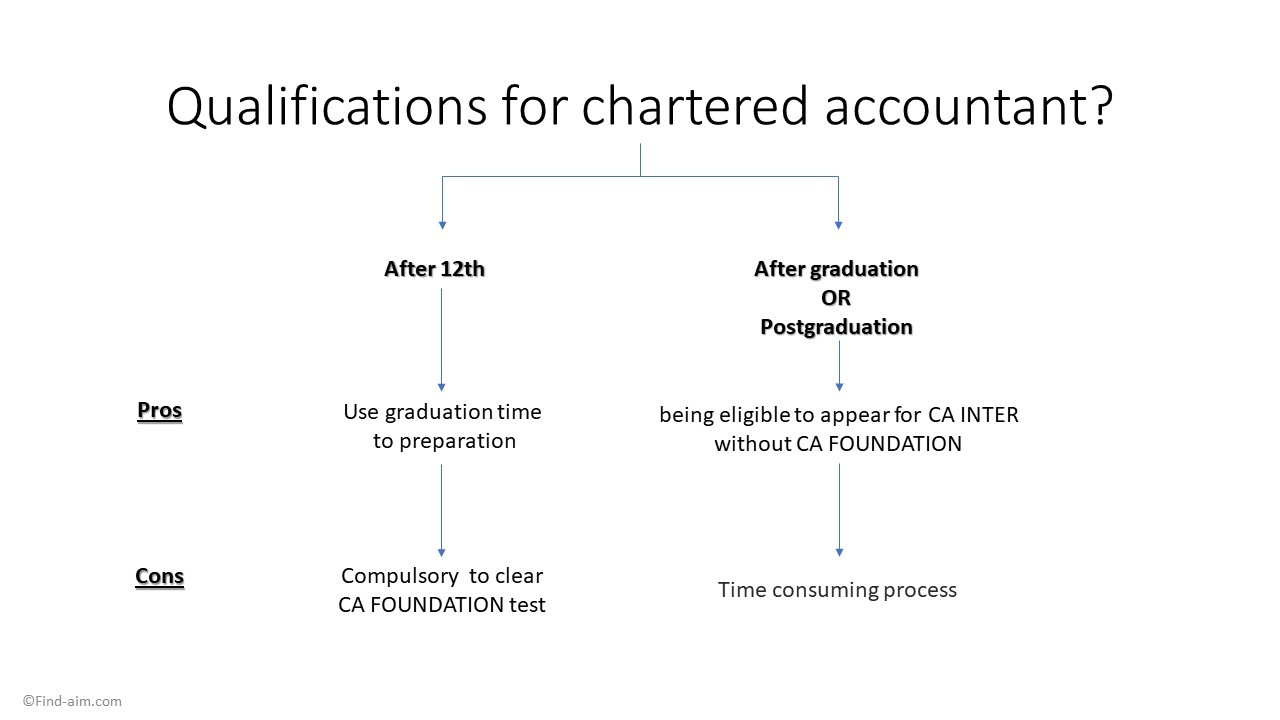

What is ICAI in India?

The ICAI, is a statutory body which regulates and maintains the profession of chartered accountancy in India. Under the Scheme of Education and Training, a candidate can pursue Chartered Accountancy course either through, Foundation Course Route or Direct Entry Route.

What is a CA in finance?

Chartered Accountants today, have acquired important position in public as well as private sectors. A CA also acts as business advisor who helps in the preparation of financial reports, securing loans, preparing financial projections, showing how the loans will be repaid, and determining the viability of business. The CA also helps its client to comply with tax laws and represent him before government agencies.

What is the CA course?

A: CA course can be pursued right after Class 12th by registering for the Foundation course of ICAI. Also, there is direct entry route for those who have completed a bachelor or masters degree in commerce discipline with at least 55% marks and in other disciplines with 60% marks or have passed the Intermediate course of Institute of Company Secretaries of India. For direct entry admission, candidates have to register for the Intermediate course of ICAI.

Is CA a professional degree?

A: Yes, it is a recognised professional degree for pursuing a career as a chartered accountant. The University Grants Commission on March 15, 2021 announced that CA qualification will be treated equivalent to PG Degree based on requests submitted from the ICAI. Click here to read more.

What can a chartered accountant do?

They are generally hired to take care of the accounting, taxation and the financial statements of the businesses and the firms, but they can offer much more than that. They instill in them the knowledge and the skills to analyze the financial report to suggest different measures to improve it and to make effective financial strategies. They can open up their own offices to provide advice to the individuals and the businesses about how to make improvements.

What is CA course?

CA course focuses on accounting and taxation procedures. These are the people who can take care of the accounting and the taxation for a business or a firm. This course is minimu of 4 years duration if you choose foundation path. But if you choose direct path then it can be completed in 6 months only. The three levels of this course are designed by ICAI ( Institute of chartered accountancy of India ). And kindly note that direct entry path is for the candidates who have completed their post graduation degree. There is a wide scope of this course not only in India as well as foreign countries. And the professionals of this course mainly works in business, cooperatives or in firms.

Is Chartered Accountant an easy degree?

Chartered accountancy is not an easy professional degree to pursue as it requires long hours of focused studies, understanding of concepts and dedication to achieve the goals in a set time. Since there is no age limit for the perusal of this degree, it certainly depends on the time management and the efficiency of the candidates to know how fast they can complete their degree to work as a professional. The work-related to chartered accountancy requires the utmost attention to details and concentration while working because even if a single entry goes wrong, it will affect the entry work. There are a certain set of skills that should be inculcated into the candidates so that they can work efficiently as a professional chartered accountant.

Can I take a class 12 in accounting?

Yes, candidates from all the streams who have completed their class 12 are eligible to pursue chartered accountancy. They will have to clear the Common Proficiency Test to be eligible to register with the ICAI for the intermediate level exam.

Can a tax accountant work in accounting?

Though they possess the knowledge about how to take care of the whole account ing and the taxation procedure in a firm, they can still choose to work only in accounting, or taxes or other things.

Can I skip the foundation level of chartered accountancy?

These graduates can skip the foundation level of the chartered accountancy course to directly register themselves with the ICAI for the intermediate exam level.

What is a Chartered Accountant?

Chartered Accountant, such a huge name not only from the length of its characters but also from its reputation. This reputed course provides you everything beginning from name to wealth. Great honor and respect in society. Chartered Accountants are the only persons who are authorized to audit the Financial Statements.

How many years of practical training is required to become an accountant?

However, Practical training is a mandatory requirement of this course. One has to complete 3 years of practical training to be a Chartered Accountant. Commencement of Industrial Training –.

How long can an associate member train?

Only a member of the Institute is authorized to train you for the Industrial training. An associate member (i.e. member less than 5 years ) who is a member with the Institute not less than 3 years can train in his under one article at a time.

How long does it take to become an industrial trainer?

The duration of Industrial training lies between a minimum of nine months and a maximum of twelve months.

Who is authorized to audit financial statements?

Chartered Accountants are the only persons who are authorized to audit the Financial Statements. They are enjoying a monopoly in this field since its incorporation. And why not, they should enjoy.

What can a student learn during his time into biding the accounting course?

There are various aspects that a student learns during his time into biding the accounting course and they can apply the safe into making sure that they make the most of their career. There are various ways a student can make the most of their career with the help of accounting course.

What is the scope after accounting courses in commerce stream?

The scope after accounting courses in commerce stream. Accountancy is the major field in today’s era. There is hardly any time where you can discount accounting at all. It has culminated into being one of the best courses that you can take along and make a good career.

What is a B.Com in accounting?

There are different sorts of B.Com courses on offer and people tend to join along. And for those who want to make a major in the accounting field, this B.Com in Accounting and Finance is the best go-to option for everyone. A student can take along this course and go ahead to learn the aspects of accounting and management and grow along. This will also make you step into the world of accounting and finance. This is a three year program and is offered by all major university and colleges.

Why is accounting important?

Accounting is a major part of our daily life. Although we might not notice much , accounting plays a vital role in making sure that we know all about finances, managing and all. It’s engrained in even the smallest of the things. It’s not surprise that we see people so interested in accounting field and as a result, ...

How long is a diploma course?

This course is normally of 2 years.

What is the hardest CMA exam?

The course covers both the business as well as accounting sides to provide appropriate knowledge about the field to students. The cost management accounting course is divided into three levels, and these are foundation level, intermediate level, and final level. One needs to clear all these levels to become a certified CMA.

Difficult to become a CA - Myth or Truth

There is a fear in the minds of the students that it is difficult to become a CA. It is because the percentage of those who clear the exams is low. Many students had prepared well for the exams, anticipated to do well, ended up failing the exams or passing with a small margin.

The Reason for Failure to get the passing mark in CA

The truth is that the exam is not difficult, but the approach of the student or teacher is inappropriate. If one studies the way he should, passing the exams will not be difficult.

Tips to Pass CA-Exams in your First Attempt with Flying Colors

You must study the study material thoroughly for all the subjects to get through the exams.

Levels of CA Course

ICAI tries the capabilities of aspirants in three levels of examinations.

Eligibility Criteria

You can register for the CA-Course provided that you have completed the 12th.

Chartered Accountancy Course - Admission Procedure

The following points should be kept in mind while enrolling for chartered accountancy :

CA-Foundation Admission After Graduation or Post Graduation

For graduates or postgraduates, there is no need to start the course with the CA-Foundation course. They can register for the CA-Intermediate course directly.

Popular Posts:

- 1. how to accomplish a widespread rollout of a new wireless system course study

- 2. how to copy one page into another course

- 3. what does the ap statistics course incorporate

- 4. what are course tremors

- 5. which of the following statements best reflects the principle of behavioral consistency course hero

- 6. what is the best course for digital marketing

- 7. how long does it take to plan out a course

- 8. how to build a short course rc track

- 9. how much does prep course improve your score dat

- 10. what is the objective of intor to design course