What to study to become a day trader?

To begin your career as a professional day trader, you should ideally have a bachelor's degree in finance. You don't technically need one, but undergraduate education helps you stand out in a competitive job market. Attempt to gain skills and experience in trading stocks on your own time or as part of an internship.

Is there a day trading course?

The course costs $119.99 and Udemy often discounts their courses. So you don't have to risk much if day trading isn't for you. That's why we chose Udemy as the best day trading course for educational content. As with all Udemy investing courses, Day Trading 101 is taught by an expert instructor.

Are day trading courses worth it?

Trading courses are worth it if you find somebody who trades for real, and isn't just after your money. By spending money on a good trading course you reduce the learning curve dramatically and will begin to make money much earlier.

How much money do you need to day trade?

$25,000For day traders in the U.S., the legal minimum balance required to day trade stocks is $25,000. If the balance drops below that level, day trading isn't allowed until a deposit is made bringing the balance above $25,000.

How much do day traders make per day?

Most Common Employers For Day TraderRankCompanyAverage Day Trader Salary11.Nasdaq$155,83622.Bloomberg$151,26333.Fidelity Investments$148,08844.G2 Crowd$147,4212 more rows•May 26, 2022

Is trading a good career?

If you are one of these people who like working alone, or at your own pace, trading is the perfect career for you. Everything you do – from the trades you take to the money you earn – stays under your control if you're a trader.

How long does it take to learn day trading?

To sum up, we can say that average individuals start day trading within about three month if they are dedicated enough and spend a lot of time applying their knowledge and using the day trading strategies they are taught on a simulator or demo accounts.

Where do I start day trading?

Best Online Day Trading CoursesWarrior Starter, Warrior Pro, and Warrior Inner Circle from Warrior Trading. ... Learn How to Trade Stocks. ... Asia Forex Mentor – One Core Program. ... Eagle Investors. ... Investors Underground. ... Zen Trading Strategies. ... Silvia Bellrock: The Bellrock Accelerator. ... Fast Lane Traders.More items...•

Do day traders sell every day?

Day trading is essentially a play on the short-term volatility (or price movement) of a stock on any given day. Day traders buy a stock at one point during the day and then sell out of the position before the market closes.

How much money do day traders with $1000 accounts make per day on average?

Over here, if you set up an account with $1,000, most of these brokers will give you a minimum of four times leverage. That means you can day trade with $4,000. Some of them will even give you up to six times. That means you could day trade with up to $6,000.

How can I make $100 a day in stocks?

0:447:45HOW TO MAKE $100 A DAY AS A BEGINNER INVESTOR - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo right above $100 profit do you remember what your position size was at first it was just 160MoreSo right above $100 profit do you remember what your position size was at first it was just 160 shares and then I under 40 more shares. So 200 shares.

How do day traders get paid?

Day traders usually get paid on commission when they buy and sell stocks for their customers. In other words, every time they sell stock and end up profiting from it, they receive a percentage of the profit. They also can make a salary if they work for an agency such as an investment bank or hedge fund.

Who is the best day trader for penny stocks?

Day trading penny stocks is considered a particular niche in the trading arena, and there's no better penny stocks day trader or instructor than Timothy Sykes, making his course the best for learning how to day trade penny stocks.

What is bear bull trading?

Bear Bull Traders offers the right combination of a comprehensive course offering, access to trading tools, and a trading community, with mentoring by a top trading guru—all at a reasonable price, making it our choice as the best overall trading course.

Does Udemy have coaching?

No coaching. Udemy is a global leader in online educational content with an extensive selection of investing courses. For those who just want to dip their toe in the day trading waters, Udemy's Day Trading 101 provides a clear view into the fundamentals.

Who is the founder of Sharpertrades?

As with all Udemy investing courses, Day Trading 101 is taught by an expert instructor. Luca Moschini is the founder of SharperTrades, LCC, an online trading education site. Luca has taught more than 125,000 students and has earned a 4.7 rating from nearly 7,000 Udemy reviews.

Does Investopedia have a day trading class?

Investopedia offers its own day trading class as part of the Investopedia Academy, but to maintain objectivit y, we opted to exclude it from this roundup. If you are interested in this course, please visit the Investopedia Academy.

What will I learn?

Learn a proven and to the point strategy that includes six different kinds of trades

About the Instructor

David Green is a Wall Street Trader with more than 30 years of experience. His rapid success enabled him to retire before he even turned 40. David oversaw trading in some of the largest listed companies at the NYSE, including IBM, Bank of America, and Best Buy.

Students are Saying..

Having lost a bunch of money day trading on my own self-taught knowledge, I needed a course that would provide me with a strategic and consistent way to trade. Investopedia’s ‘Become a Day Trader’ course provided significant value because I learned a proven and profitable day trading strategy.

Free Day Trading Course

If you’ve been searching for free day trading courses for beginners then you’ve come to the right place. In our videos, you’re going to learn how to day trade stocks, proper risk management strategies, preparing in the pre-market, scanning for low and high float stocks, trading red to green moves, gap & go’s, dip buying and so much more…

How Much Does the Average Day Trader Make?

How much does the average day trader make? New traders can make between $100-$1,000 per day depending on their brokerage account size. The top day traders make $150,000+ per year but those aren’t typical results.

How Much Do You Need to Become a Day Trader?

How much do you need to become a day trader. The minimum amount that you need is $25,000 to avoid the pdt rule. The pattern day trading rule mean that you can’t make more than 3 day trades within a 5 calendar day period if you have less than $25,000 in your brokerage account.

Basic & Advanced Training in Our Day Trading Courses

Our members are working towards the same goal; to be the best traders they can be. That is exactly what we help you become. Your best self as a trader.

How to Day Trade Live: After Our Day Trading Course

Here at the Bullish Bears, we post a day trade watch list with trade alert “setups” each night. Our trade alerts setups aren’t buy signals because we’re not pumpers. Instead we map out support and resistance and let you know what areas to be aware of for potential daily breakouts.

What is the fundamental of day trading?

One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. If you can quickly look back and see where you went wrong, you can identify gaps and address any pitfalls, minimising losses next time.

What is day trading pattern?

Day trading chart patterns paint a clear picture of trading activity which helps you to decipher individuals’ motivations. They could highlight s&p day trading signals for example, such as volatility, which may help you predict future price movements.

What is etoro trading?

eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs. Review. Forex.com boast a global reputation.

What is a cash account in day trading?

Cash account – Day trading with a cash account (also known as without margin), will allow you to only trade the capital you have in your account. This limits your potential profits, but it also prevents you losing more than you can afford. Margin account – This type account allows you to borrow money from your broker.

Why is speed of execution important?

Speed of execution – Due to the high number of trades you might make in a day, speed of execution is important – as is getting the price you need, when you need it. Costs – The lower the fees and commission rates, the more viable day trading is.

What is a day trader course?

In 2017, Investopedia launched its Become a Day Trader course, which covers everything from creating an overall trading plan to the nuts-and-bolts instructions for making trades.

What do day trading schools teach?

Key Takeaways. There are a plethora of day-trading schools that teach the tools for success. All qualified schools should helps students develop a keen understanding of the markets they wish to day trade, strategies to help them maximize profits, mentoring figures, and continued support, after the classes have ended.

What is a DTA?

The Day Trading Academy (DTA) teaches traders how to deal with a variety of market conditions in the futures space, by tracking a security's price over a prolonged time period. The DTA was founded in 2011 by professional day trader Marcello Arrambide, author of the popular Wandering Trader blog .

What is the DTA curriculum?

The DTA curriculum is siloed into beginner, intermediate, advanced, and professional sections. Topics range from simple themes like resistance areas, trend lines, and price action, to more advanced concepts like trading psychology, emotional intelligence and high-probability trades.

What is an OTA trading academy?

The Online Trading Academy (OTA), one of the largest trading schools, began as the training arm of a trading floor in 1997. Though it began by offering daily coaching sessions, it soon expanded its offerings to provide classes, workshops, online courses, and free trading resources.

Is it hard to analyze your day trading performance?

Simply put, it's hard to self analyze your own day-trading performance. Similar to the way it takes an outsider to correct your golf swing, it takes the sharp eye of a mentor, to detect and correct your day-trading flaws. Continuing Support.

Is cost important when choosing a day trading school?

Important. Although cost is an important factor when choosing a day-trading school, it should not be the only consideration.

1. Day Trader Training (Investopedia Academy)

Learn to trade in any market or online from an experienced Wall Street trader. This comprehensive program teaches a proven and to the point strategy that includes six different kinds of trades. With the skills you pick up, you can speak the language of the market, trade in any security in any market daily, and minimize your risk with every trade.

2. Complete Day Trading: Stock Trading With Technical Analysis (Udemy)

This course covers powerful stock market day trading strategies, scanning and trading momentum stocks, and Nifty. It will teach you how to take advantage of the market’s intraday volatility, choose the right stock for your trade, and trade in intraday.

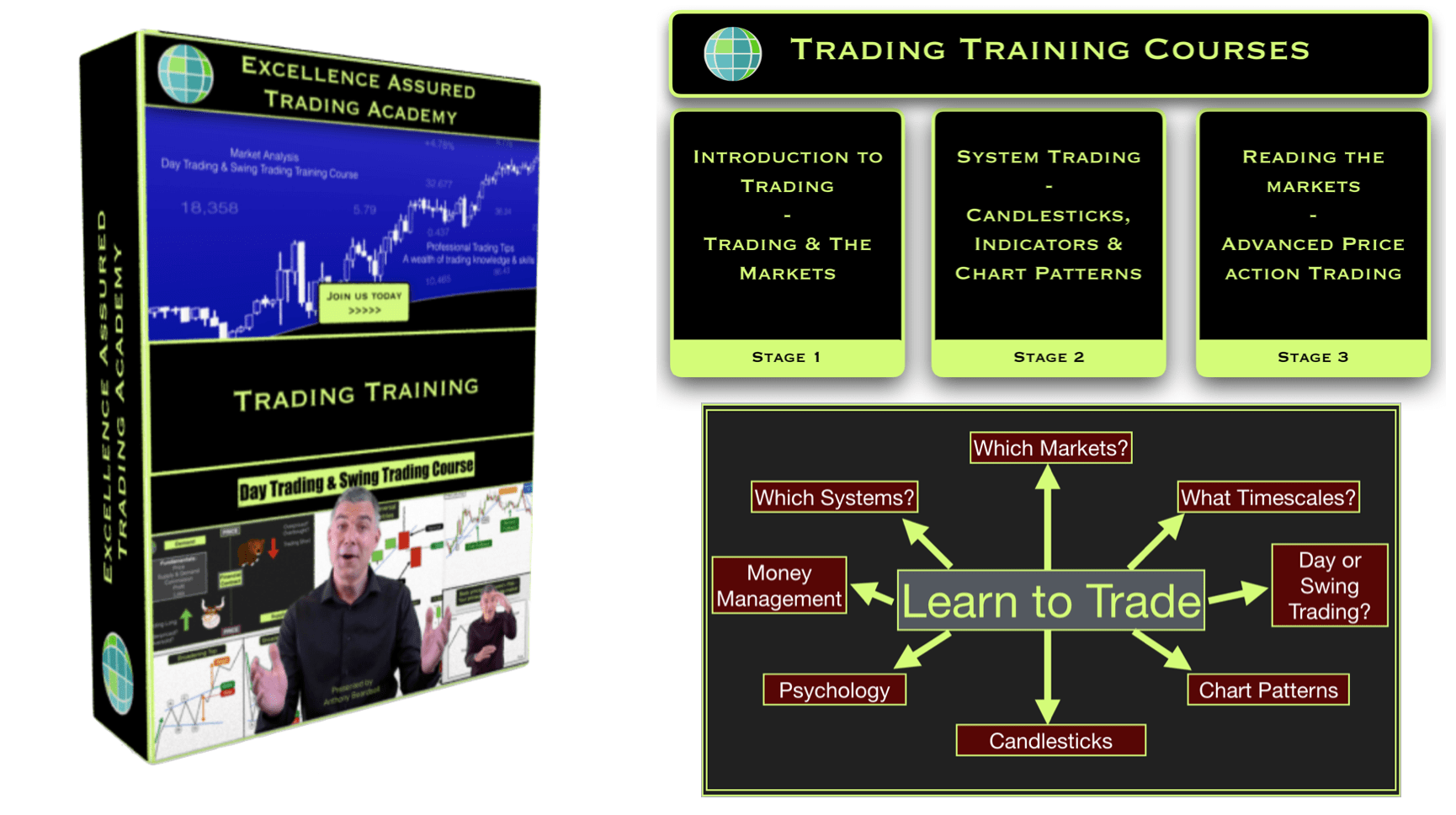

3. Day Trading and Swing Trading Strategies for Stocks (Udemy)

If you want to master Day Trading and Swing Trading strategies, this course is ideal. It introduces you to several strategies to know what a profitable trading strategy looks like and may also discover new strategies that you can implement.

4. 4 Strategies that will make you a Professional Day Trader (Udemy)

Discover four powerful strategies to master day trading. The course shows you how to analyze gaps, breakouts, candle patterns, and where to enter, exit, and place stops.

5. Day Trading 101: How to Day Trade Stocks for Passive Income (Udemy)

If you are exploring short-term courses to get you started with day trading, then rejoice because you have found it. This course teaches the basics of profitable day trading. It talks about chart setting, technical patterns, indicators, gappers, breakaway runners, and more.

6. Day Trading Course (Bullish Bears)

Learn which day trading indicators are best. Master the most popular momentum strategies. This course will teach you how to day trade stocks, prepare in the pre-market, scan for low and high float stocks, trade red to green moves, buy the dip, and much more.

How Exactly Does Day Trading Work?

In short, day trading is when you make trading on the stock or forex market your day job. For the U.S. stock markets, you get up and go online before they open, which is at 9:30 a.m. ET, and you call it a day at 4:00 p.m. come closing time. And, you do this every day.

Why Would a Beginner Need a Day Trading Course?

OK, so day trading is more complicated than dumping all your money into Crocs stock and waiting for the whole world to embrace the truth which is rubber footwear with holes. But luckily, you don’t need to know everything there is about trading—you just need to master the basics of day trading, as well as a few advanced strategies that work for you.

What Makes a Good Day Trading Course

If you’re convinced that you want to get a day trading course, that’s great! Now, the only thing you have to do is pick out a course among the hundreds that you can find online—many of which are by no means worth their weight in gold (or in fiat currency, for that matter).

What to Keep in Mind Before Buying a Day Trading Course

Some courses are great and some are a waste of time and money—and most of them probably belong to the latter category. Moreover, there’s a lot of marketing involved, so very few courses will tell you how devoted you really have to be to become very good at day trading.

Conclusion

As we can see, a good day trading course needs to be more than just a list of theoretical info and examples you need to learn. The best teachers create a whole community around their courses that encourage traders to interact with each other, making day trading into a lifestyle for students.

Popular Posts:

- 1. how does an f affect your gpa if its a 1 credit course

- 2. how to create a summer college course syllabus

- 3. what is the main difference between chapters 7 and 11 course hero

- 4. what grade to i need to pass course college

- 5. how long is the advanced emt course

- 6. when is the absolute worst month to take a course to the bahamas

- 7. how to change course instructor on connect

- 8. which of the following characteristics cannot be measured by personality tests? course hero

- 9. how to retrieve pages in canvas course

- 10. course hero answer which permissions does the administrator have?