- To become a holder in due course, a person must obtain a negotiable instrument by paying valuable and lawful consideration for it.

- When given as a gift or has been inherited, the transferee cannot be a holder in due course.

- A holder must acquire the instrument before its maturity in order to attain the status of holder in due course.

- The holder must have obtained the instrument in good faith

- The instrument must be complete and regular on the face of it.

- A Holder in Due Course may be either payee, or the possessor if the instrument is payable to bearer, or the endorsee if the instrument is payable to order.

- Be a holder of a negotiable instrument;

- Have taken it: a) for value, b) in good faith, c) without notice. (1) that it is overdue or. ...

- Have no reason to question its authenticity on account of apparent evidence of forgery, alteration, irregularity or incompleteness.

When is a person a holder in due course?

Section 3-302 establishes that a person is a holder in due course if: (1) the instrument when issued or negotiated to the holder does not bear such apparent evidence of forgery or alteration or is not otherwise so irregular or incomplete as to call into question its authenticity; and

How do I become a holder in due course (HDC)?

Under Section 3-302 of the Uniform Commercial Code (UCC), to be a holder in due course (HDC), a transferee must fulfill the following: 1. Be a holder of a negotiable instrument; 2. Have taken it:

Can a holder in due course accept an instrument of payment?

Additionally, the holder in due course must accept the payment in good faith. If there is any evidence of fraud or foul play, the holder in due course should not accept the instrument of payment. The holder in due course has specific rules and requirements they must follow to accept the instrument.

Why are the rules of due course so important?

The rules protecting the rights of a holder in due course to collect on debt are very important to facilitating business transactions. These rules make it possible for checks to move from bank to bank without worrying the check writer will try to assert a defense challenging the validity of the right to collect on the debt.

What does it meaning to be a holder in due course?

Definition of holder in due course : one other than the original recipient who holds a legally effective negotiable instrument (such as a promissory note) and who has a right to collect from and no responsibility toward the issuer.

Who is a holder and holder in due course?

A holder is a person who legally obtains the negotiable instrument, with his name entitled on it, to receive the payment from the parties liable. A holder in due course (HDC) is a person who acquires the negotiable instrument bonafide for some consideration, whose payment is still due.

What is the benefit of being a holder in due course?

The holder-in-due-course doctrine is important because it allows the holder of a negotiable instrument to take the paper free from most claims and defenses against it. Without the doctrine, such a holder would be a mere transferee.

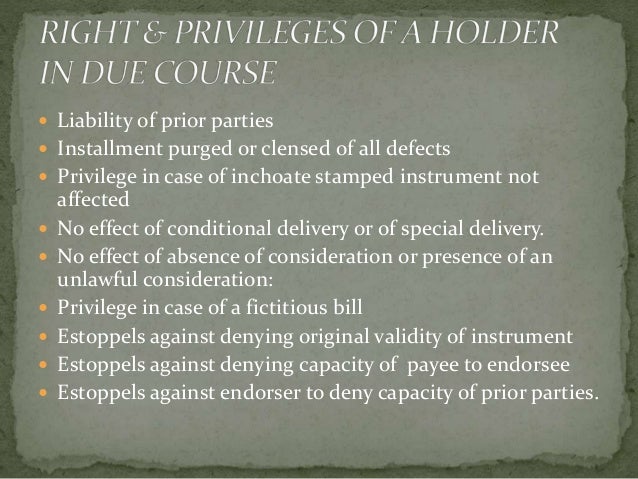

Who is a holder in due course what are his privileges?

Holder in due course is a person who takes a negotiable instrument for the value receivable by him in good faith and taken due care and caution while taking such instrument and he had no suspicion or reason to believe any defect existed in the title of the person, from whom he derived title possession of the instrument ...

Can a payee be a holder in due course?

(1) A holder in due course is a holder who takes the instrument (a) for value; and (b) in good faith; and (c) without notice that it is overdue or has been dishonored or of any defense against or claim to it on the part of any person. (2) A payee may be a holder in due course.

What is a holder in due course?

Holder in Due Course (HIDC) is part of the Uniform Commercial Code (UCC) that significantly impacts an organization’s liability for check fraud and the checks it issues. After learning about HIDC claims, prudent companies are often motivated to use high security checks and change check disbursement procedures to protect themselves. The following is a brief explanation of Holder in Due Course.

How does John Doe pick up a check?

Consider this scenario: John Doe picks up a check made payable to “John Doe” from a business or individual. He walks outside and deposits the check remotely using his smart phone. He then walks back inside and returns the check, asking that it be replaced with a new check made payable to John Doe OR Jane Doe. The issuing person or company reissues a new check payable to John Doe or Jane Doe. They don’t think to place a Stop Payment on the first check because it is in their possession.

What is UCC 3-302?

Under UCC Section 3-302, a holder in due course who is entitled to protection of the law and vested with the right of debt collection must have purchased the right to collect on the debt ...

What is the UCC doctrine?

Among the provisions set forth in the UCC are rules protecting the purchasers of debts and protecting those who are assigned the right to receive debt payments. The rules protecting the inheritors or purchasers who are assigned the right to receive debt payments from an original creditor are called the Holder in Due Course (HDC) doctrine.

Why are rules important to business transactions?

The rules protecting the rights of a holder in due course to collect on debt are very important to facilitating business transactions. These rules make it possible for checks to move from bank to bank without worrying the check writer will try to assert a defense challenging the validity of the right to collect on the debt.

What are the requirements for a holder of an instrument to become a holder in due course?

What are the requirements for a holder of an instrument to become a holder in due course? To qualify as a HDC, the holder of the commercial paper must meet the following requirements: Value - The holder must take the instrument for value. This means that the holder must provide money or goods for the instrument.

What is HDC status?

HDC status is determined at the time that the holder receives the instrument. If the holder meets the above requirement at the moment when she takes possession, she is a HDC. It does not matter if afterwards she learns of a potential defense. Each of the elements for HDC status is discussed separately. YouTube.

Is a transfer of an instrument a gift?

The transfer cannot be a gift or inheritance. Good Faith - The holder must receive the instrument in good faith. This means that the holder cannot have the intent to defraud anyone in receiving the instrument.

Can a transferor manipulate the law?

It is easy to imagine any number of schemes in which a transferor would try to manipulate the law by transferring an instrument to a holder with a greater right to repayment. Unaware of Defenses - The holder cannot have notice that there is a valid defense to enforcement of the instrument.

Why is the holder in due course important?

The holder-in-due-course doctrine is important because it allows the holder of a negotiable instrument to take the paper free from most claims and defenses against it. Without the doctrine, such a holder would be a mere transferee.

What is the shelter rule for holder in due course?

The shelter rule#N#Under Article 3 of the Uniform Commercial Code, the transferee of an instrument acquires the same rights his or her transferor had.#N#provides that the transferee of an instrument acquires the same rights that the transferor had. Thus a person who does not himself qualify as an HDC can still acquire that status if some previous holder (someone “upstream”) was an HDC.

What is a mere holder?

A mere holder is simply an assignee, who acquires the assignor’s rights but also his liabilities; an ordinary holder must defend against claims and overcome defenses just as his assignor would. The holder in due course is really the crux of the concept of commercial paper and the key to its success and importance.

What happens if the effect is to render the obligation of the instrument entirely null and void?

If under the state law the effect is to render the obligation of the instrument entirely null and void, the defense may be asserted against a holder in due course. If the effect is merely to render the obligation voidable at the election of the obligor, the defense is cut off.”.

What is a taking for value?

3. Antecedent debt. Likewise, taking an instrument in payment of, or as security for, a prior claim, whether or not the claim is due, is a taking for value.

What is a holder in a commercial paper?

A holder is a person in possession of an instrument payable to bearer or to the identified person possessing it. But a holder’s rights are ordinary, as we noted briefly in Chapter 22 "Nature and Form of Commercial Paper". If a person to whom an instrument is negotiated becomes nothing more than a holder, the law of commercial paper would not be ...

Is a person who has notice that an instrument is overdue an HDC?

The UCC provides generally that a person who has notice that an instrument is overdue cannot be an HDC. What constitutes notice? When an inspection of the instrument itself would show that it was due before the purchaser acquired it, notice is presumed. A transferee to whom a promissory note due April 23 is negotiated on April 24 has notice that it was overdue and consequently is not an HDC. Not all paper contains a due date for the entire amount, and demand paper has no due date at all. In Sections 3-302 (a) (2) and 3-304, the UCC sets out specific rules dictating what is overdue paper.

What is a holder in due course?

Holder in Due Course is defined as a holder who acquires the negotiable instrument in good faith for consideration before it becomes due for payment and without any idea of a defective title of the party who transfers the instrument to him. Therefore, a holder in due course.

When can a person become a holder in due course?

A person can become a holder, before or after the maturity of the negotiable instrument. On the contrary, a person can become a holder in due course, only before the maturity ...

What does HDC mean in a payment?

When the instrument is payable to bearer, HDC refers to any person who becomes its possessor for value, before the amount becomes overdue. On the other hand, when the instrument is payable to order, HDC may mean any person who became endorsee or payee of the negotiable instrument, before it matures.

What is a holder in a bill?

As per Negotiable Instrument Act, 1881, a holder is a party who is entitled in his own name and has legally obtained the possession of the negotiable instrument, i.e. bill, note or cheque, from a party who transferred it , by delivery or endorsement, to recover the amount from the parties liable to meet it. ...

When can a person become a holder of a negotiable instrument?

The instrument must be obtained in good faith. A person can become holder, before or after the maturity of the negotiable instrument. A person can become holder in due course, only before the maturity of negotiable instrument.

Is consideration necessary?

Consideration. Not necessary. Necessary. Right to sue. A holder cannot sue all prior parties. A holder in due course can sue all prior parties. Good faith. The instrument may or may not be obtained in good faith. The instrument must be obtained in good faith.

Can a holder possess a negotiable instrument?

A holder can possess negotiable instrument, even without consideration. As opposed to a holder in due course, possess the negotiable instrument for consideration. A holder cannot sue all the prior parties whereas a holder in due course, has the right to sue all the prior parties for payment. A holder may or may not have obtained ...

Popular Posts:

- 1. what premium reduction percentage do i get for 55 plus course

- 2. what does course hero cost

- 3. who rates donald trump's golf course

- 4. if installed, what aural and visual indications should be observed over the ils back course marker?

- 5. how to build a golf course

- 6. under what circumstances will a claim not able to be submitted electronically? course hero

- 7. how many days has trump been at a golf course since he became president?

- 8. how do you get course pass rates

- 9. how many years is culinary course

- 10. how many hours a week is barbri prep course