What is the duration of Chartered Accountancy course?

7 rows · CA Course Duration – Chartered Accountancy is one of the most reputed courses in the ...

How long does it take to become a Chartered Accountant (CA)?

Dec 16, 2021 · A: There is no defined course duration to complete CA course, however, ideally all courses of CA are completed within five years. The course is considered complete only after a student clears all papers and levels of the Chartered Accountancy courses. Q: What are the different course levels of Chartered Accountancy? A: The CA course has three ...

What is the duration of CA course?

Post all the examinations, when you successfully enroll yourself as a professional chartered accountant, you are all set and will be bestowed with the title of a “Chartered Accountant”. Latest CA Course Duration: The council has taken the decision of reducing the chartered accountant course duration from 5 years 3 months to 3.5 years.

What are the exams to get admission in Chartered Accountancy (CA)?

The career path to becoming a Chartered Account (CA) is challenging but very promising as well. The entire Chartered Accountancy course duration is almost 5 years. Therefore, if you are willing to take up a career as a Chartered Accountant, you will have to be prepared to devote that much time to your education.

Can I complete CA in 2 years?

The minimum duration to pursue CA after graduation is 3 years as you can directly take IPCC exams after 9 months from registering yourself after which you also need to complete 2.5-3 Years of Articleship to become a Chartered Accountant.

How many years is the CA course?

5 YearsCA SubjectsCourseChartered AccountancyShort FormCAOffering BodyThe Institute of Chartered Accountants of India (ICAI)Levels of the Course3 LevelsDuration of Course5 Years1 more row

How many years of course is CA after 12th?

4.5 years“Hence the total duration of CA course after 12th class is 4.5 years!”...CA Course Duration after 12th:ProcessMonthsTimelineRegister for CA Intermediate level (both group)31st August 2022–Appear for Intermediate examsMay 2023–10 more rows

Can I complete CA in 5 years?

Candidates need to clear various exams at various levels.It takes a duration 5 years to become a Chartered Accountant ,it can take more time as it totally depends on the hard work and consistency of the candidates . Candidates first need to be appeared in CPT and then enroll for the ATC .Jun 29, 2021

Can I complete CA in 3 years after 12th?

CA is divided into 3 levels along with 3 years of practical training which requires approx. 4.5 years after class 12th. One can become a CA after class 12th or graduation. The candidates must clear three levels of examinations conducted by ICAI, which we will discuss in the later section of the blog.Nov 16, 2021

How many subjects CA?

7 Subjects✅ How many subjects are there in CA? Ans. There are 7 Subjects in CA divided into the group of 4 and 3.Dec 10, 2019

What is the salary of CA?

The average salary is between INR6-7 lakhs per annum in India. A CA's Salary, on average, could rise to INR40-60 lakhs depending on his skills and experience. If he gets an International posting, he could earn INR 75 lakh pa. At the recent ICAI placement, INR 8.4lakhs is the average salary of CA.

Is 12th marks important for CA?

If you want to be a doctor or engineer or any other field expert, then your college might consider your 12th standard marks but the only field that judges you based on your hard work and not your marks is CA. Therefore, the marks you got in your 12th standard board exams do not matter for CA.

Can I start CA at the age of 25?

You can start and complete CA at any age.

Can I start CA after 10th?

To become CA, you can select any stream after class 10th like – Science, Arts, Commerce. The students become eligible to register for the CPT exam after class 10th, but they can appear in the exam only after class 12th.

Can I study CA at home?

Currently ICAI is also providing live virtual classes at very affordable prices like INR 3750 for whole group. It is advisable to take classes for all the subjects at CA Intermediate level -- once student clear their basics then they can even do self study at CA Final levels.

How can I start CA?

Here's how you need to go about it.Step 1: Enrol yourself in the CA Foundation Course after completing XIIth.Step 2: Complete a 4 month study period and appear in the CA Foundation Examination.Step 3: Enrol into CA Intermediate Course after clearing CA Foundation Exam.More items...•Oct 23, 2019

Can I complete CA in 3 years after 12th?

CA is divided into 3 levels along with 3 years of practical training which requires approx. 4.5 years after class 12th. One can become a CA after class 12th or graduation. The candidates must clear three levels of examinations conducted by ICAI, which we will discuss in the later section of the blog.Nov 16, 2021

How do I complete a CA in 4 years?

The CA course duration after the 12th is around 5 years. Finally, you'll get a 5 months study period for the CA Final exam preparation, after that you become a Chartered Accountant....CA (Chartered Accountancy) Course Duration.CA Course DetailsDurationPreparation Period for CA Final6 MonthsCA Final Result2 Months5 more rows

How long is CA exam?

ICAI Exam HighlightsFeaturesDetailsExam ModeOnlineExam DurationTwo hoursLanguageEnglishExam PurposeTraining and certifying Chartered Accountants in India8 more rows

Can I complete CA in 2 years?

The minimum duration to pursue CA after graduation is 3 years as you can directly take IPCC exams after 9 months from registering yourself after which you also need to complete 2.5-3 Years of Articleship to become a Chartered Accountant.

What is the salary of CA?

The average salary is between INR6-7 lakhs per annum in India. A CA's Salary, on average, could rise to INR40-60 lakhs depending on his skills and experience. If he gets an International posting, he could earn INR 75 lakh pa. At the recent ICAI placement, INR 8.4lakhs is the average salary of CA.

Can I clear CA in 4 years?

You should go through 3 years/4 years for graduation. From that point onward, you can enlist yourself for CA Intermediate and join the useful preparation (Articleship) which is for a long time. ... You clear CA in 3 (Graduation) + 3 (CA Intermediate, Articleship and CA Final) = 6 years.Mar 18, 2020

What are the 7 subjects in CA?

Chartered Accountancy (CA) SyllabusPaper No.Name of the SubjectPaper 5Advanced AccountingPaper 6Auditing and AssurancePaper 7Enterprise Information System & Strategic ManagementPaper 8Financial Management & Economics for Finance4 more rows•Oct 21, 2021

Can I study CA at home?

Currently ICAI is also providing live virtual classes at very affordable prices like INR 3750 for whole group. It is advisable to take classes for all the subjects at CA Intermediate level -- once student clear their basics then they can even do self study at CA Final levels.

How many CA are selected every year?

2019 is 73,019, the total number of candidates (passed) is 16,880, and the percentage for Nov 2019 is 23.11%. 16880, candidates qualified as chartered accountants in Nov. 2019(Old Course).

What is CA syllabus?

Syllabus. Paper-1: Principles and Practice of Accounting. Paper-2: Business Laws and Business Correspondence and Reporting. Paper-3: Business Mathematics, Logical Reasoning and Statistics. Paper-4: Business Economics and Business and Commercial Knowledge.

What is CA final?

CA final is the last level course to be completed for an aspirant of Chartered Accountancy. Once the student has cleared the Intermediate level, he/she enters the last leg of CA, i.e., CA Final Course.

Ques:- How many years to complete a CA course?

The Chartered Accountant Course duration after 12th is 5 years and after graduation, it is 4.5 years. The duration is mentioned keeping in mind tha...

What is the CA Course Duration after B.Com?

It will take around 4.5 years duration to complete CA Course after doing B.Com.

Can I do CA after the 10th class?

Students can take the provisional admission in the CA Foundation after completing their 10th class. However, they need to complete their class 12th...

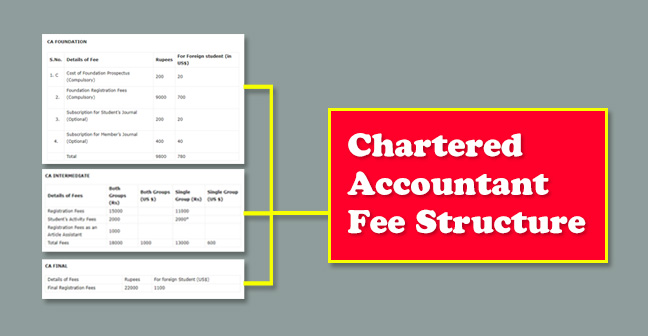

What is the total CA fee in India?

You have to pay the total fee of Rs. 49, 800 for the courses and the articleship. This does not include examination fee, tuitions fees and other ex...

What is the biggest challenge students face during the CA course?

The career you are talking about itself is the biggest challenge. But if you work hard and do what is needed, then you can complete the course and...

What is the importance of CA?

Chartered Accountancy is a recognized profession by an industry that mainly focuses on Finance, Auditing, and Accounting. Chartered Accountants are...

Can I pursue CA while completing B.Com?

Yes, you can prepare for the Chartered Accountancy (CA) exams while completing your B.Com degree. Clearing all three exams of CA in one go is possi...

What is the starting salary of a CA in India?

The starting salary of a Chartered Accountant (CA) ranges between Rs. 4 - 6 lacs per annum. It varies depending upon the city and organisation in w...

What are the eligibility criteria for becoming a CA?

The eligibility criteria for becoming a Chartered Accountant are as follows: The candidate must have completed class 12th. Students of the commerce...

What are the exams of Chartered Accountancy?

The course of Chartered Accountancy is considered complete when candidates qualify all three exams of the programme. These exams include: Common Pr...

Which course do I have to pursue to become a CA?

In order to become a Chartered Accountant (CA), you can pursue an undergraduate degree in your desired course. Additionally, you will have to compl...

How do I become a Chartered Accountant?

To become a Chartered Accountant, the candidate has to go through a process of training and exams as various levels, conducted by the Institute of Chartered Accountants of India (ICAI).

What is the CA course?

A: CA course can be pursued right after Class 12th by registering for the Foundation course of ICAI. Also, there is direct entry route for those who have completed a bachelor or masters degree in commerce discipline with at least 55% marks and in other disciplines with 60% marks or have passed the Intermediate course of Institute of Company Secretaries of India. For direct entry admission, candidates have to register for the Intermediate course of ICAI.

What is ICAI in India?

The ICAI, is a statutory body which regulates and maintains the profession of chartered accountancy in India. Under the Scheme of Education and Training, a candidate can pursue Chartered Accountancy course either through, Foundation Course Route or Direct Entry Route.

What is a CA in accounting?

Chartered Accountants today, have acquired important position in public as well as private sectors. A CA also acts as business advisor who helps in the preparation of financial reports, securing loans, preparing financial projections, showing how the loans will be repaid, and determining the viability of business.

How many levels are there in CA?

The CA course is divided into three levels: Foundation Level, Intermediate Level and Final Level. Below are the papers covered at each level and marking schemes (officially known as skill assessment) of education and training at all levels of CA courses:

How long does it take to complete CA?

A: There is no defined course duration to complete CA course, however, ideally all courses of CA are completed within 5 years. The course is considered complete only after a student clears all papers of Chartered Accountancy courses.

How old do you have to be to take CA?

A: There is no maximum age limit for the CA course. However, minimum age should by 17 years (Class 12 pass). A finance or accounting professional can pursue the CA course at any phase of their career.

How long is a Chartered Accountant course?

The entire Chartered Accountancy course duration is almost 5 years. Therefore, if you are willing to take up a career as a Chartered Accountant, you will have to be prepared to devote that much time to your education. There is a good demand for Chartered Accountancy professionals in India within private as well as public organisations.

What is a Chartered Accountant?

Chartered Accountant is a designation that is given to a professional of accounting who has received certification from a statutory body that states he/ she possesses the necessary qualifications to take care of the matters related to accounting and taxation of a business.

What are the CA exams?

The Chartered Accountant exams or CA exams that a student has to give in order to receive the designation of a CA are given below. Only when the candidate has qualified all these exams is he/ she considered a Chartered Accountant and gets authenticated as the same. The exams of CA are: 1 CPT (Common Proficiency Test) 2 IPCC (Integrated Professional Competence Course) 3 FC (Final course)

Is Chartered Accountant a good career?

Chartered Accountancy is a good career option if you are interested in subjects like taxation and accounting. The career path to becoming a Chartered Account (CA) is challenging but very promising as well. The entire Chartered Accountancy course duration is almost 5 years. Therefore, if you are willing to take up a career as a Chartered Accountant, ...

Popular Posts:

- 1. how to drop a course usc

- 2. how does screening for disease relate to health policy considerations course hero

- 3. how to make comic book course

- 4. what page is bargain on in the holt elements of literature first course

- 5. complaint about a college course what to do

- 6. which of the following do life course theorists argue? quizlet

- 7. how to book at tee time at st andrews old course

- 8. women who changed the course of history gorham bells photos

- 9. how does taking a college course during high school help

- 10. how much is it to park at u of m golf course