How to do financial analysis in Excel?

What are the BEST EXCEL courses for financial analyst?

What is this course on financial analysis?

To learn more, check out our Advanced Excel Formulas Course. #10 SLOPE Formula: =SLOPE (dependent variable, independent variable) Finance professionals often have to calculate the Beta (volatility) of a stock when performing valuation analysis and financial modeling. While you can grab a stock’s Beta from Bloomberg or from CapIQ

What is the Excel crash course?

Jan 25, 2020 · Excel is a necessity for every financial analyst who wishes to present often complex financial statistics. Of course, you can also use financial spreadsheets to manage personal budgets. However, with this course on financial dashboards in Excel, you will learn the art of presenting insights into your business financial performance.

What Excel skills does a financial analyst need?

Financial Analysts primarily carry out their work in Excel, using a spreadsheet to analyze historical data and make projections Types of Financial Analysis, (7) data tables, (8) pivot tables, (9) charts and graphs, and (10) formatting.

Do financial analyst use Excel?

Corporations may use Excel to run a capital budgeting analysis, risk analysis or discount cash flows. Options traders often use Excel to run Black-Scholes pricing. There are hundreds of standard financial analysis models that can be performed through Excel.

What are the best Excel courses for finance?

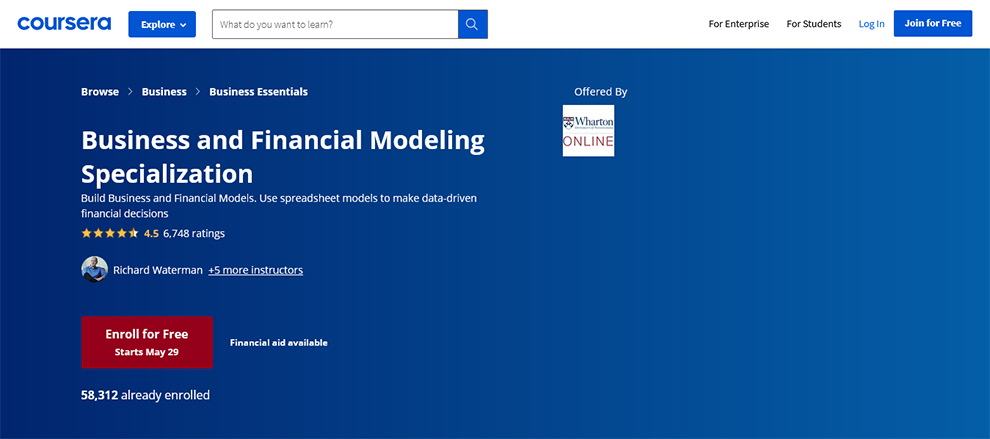

Seven Of the Best Excel Courses for Finance1 – Udemy: Introduction to Financial Modeling for Beginners. ... 2 – Macquarie University: Excel Skills for Business Specialization. ... 3 – Udemy: Real Estate Financial Modeling Bootcamp. ... 4 – Coursera: Business and Financial Modeling Specialization by Wharton.More items...•Sep 26, 2021

How do I practice Excel for finance?

0:021:15:57Excel Crash Course for Finance Professionals - YouTubeYouTubeStart of suggested clipEnd of suggested clipLet's understand the formula bar and how to use it as well as how it can help us find formulas. AndMoreLet's understand the formula bar and how to use it as well as how it can help us find formulas. And then let's explore the ribbon and look at all the various functions contained within the ribbon.

Why Excel is used in finance?

Excel is an invaluable source of financial data analysis. Every day, an uncountable amount of financial data is analyzed by financial experts. These data helps investors to improve investment portfolios and dig deeper into the financial market.Mar 11, 2021

What is Vlookup in Excel?

The VLOOKUP function is a premade function in Excel, which allows searches across columns. It is typed =VLOOKUP and has the following parts: =VLOOKUP(lookup_value, table_array, col_index_num, [range_lookup]) Note: The column which holds the data used to lookup must always be to the left.

How many types of Excel courses are there?

Best Excel Training Classes Online Couse NameRatingCertificationData Visualization with Advanced Excel4.5 out of 5YesUnlock Excel VBA and Excel Macros4.6 out of 5YesMicrosoft Excel – Advanced Excel Formulas & Functions4.6 out of 5YesBeginner to Pro in Excel: Financial Modeling and Valuation4.5 out of 5Yes12 more rows•Mar 15, 2022

Can I get certified in Excel?

MOS Expert--Pass exams in Word or Excel to earn a Microsoft Office Specialist Expert certification. Being certified as an MOS Expert demonstrates you have advanced skills in key Office programs. MOS Master--Pass exams in Word or Excel to earn a Microsoft Office Specialist Master certification.

How long to become proficient Excel?

If you practice every day and dedicate around 2-3 hours every day to learn the concepts, then you can learn it within four weeks. But, to master the concepts in Excel, you need to use the tricks and formulas on a daily basis. You need about 8-10 days to finish the Basic and Advance excel course.

What formula is in Excel?

ExamplesData=A2+A3Adds the values in cells A1 and A2=A2+A3=A2-A3Subtracts the value in cell A2 from the value in A1=A2-A3=A2/A3Divides the value in cell A1 by the value in A2=A2/A3=A2*A3Multiplies the value in cell A1 times the value in A2=A2*A310 more rows

What are the basics of Excel?

Excel documents are called workbooks. Each workbook has sheets, typically called spreadsheets. You can add as many sheets as you want to a workbook, or you can create new workbooks to keep your data separate. Click File, and then click New.

What Excel formulas are used in finance?

Top 6 Excel Formulas Every Finance Analyst Must KnowXNPV. The first formula that financial analysts should master is XNPV. ... XIRR. This has a close relation with XNPV. ... MIRR. This formula helps to calculate the cost of borrowing, cash flows, and reinvestment rate. ... PMT. ... IPMT. ... EFFECT.Sep 28, 2019

Description

Learn all the tips, tricks, shortcuts, functions and formulas you need to be an Excel power user. This course is designed specifically for Excel users who are performing professional financial analysis and financial modeling. We cover all levels - from beginner to advanced users.

Who this course is for

This Excel course is meant for all levels from beginner to advanced. Power users should skip the earlier chapters.

What is asset beta?

Finance professionals often have to calculate the Beta#N#Unlevered Beta / Asset Beta Unlevered Beta (Asset Beta) is the volatility of returns for a business, without considering its financial leverage. It only takes into account its assets.#N#(volatility) of a stock when performing valuation analysis and financial modeling. While you can grab a stock’s Beta from Bloomberg#N#Financial Data Where to find data for financial analysts - Bloomberg, CapitalIQ, PitchBook, EDGAR, SEDAR and more sources of financial data for financial analysts online#N#or from CapIQ#N#CapIQ CapIQ (short for Capital IQ) is a market intelligence platform designed by Standard & Poor’s (S&P). The platform is widely used in many areas of corporate finance, including investment banking, equity research, asset management and more. The Capital IQ platform provides research, data, and analysis on private, public#N#, it’s often the best practice to build the analysis yourself in Excel.

What is the internal rate of return?

Here is another variation of the internal rate of return#N#Internal Rate of Return (IRR) The Internal Rate of Return (IRR) is the discount rate that makes the net present value (NPV) of a project zero. In other words, it is the expected compound annual rate of return that will be earned on a project or investment.#N#that’s very important for finance professionals. The M stands for Modified, and this formula is particularly useful if the cash from one investment is invested in a different investment.

What is dashboard in accounting?

By definition, a dashboard refers to a management tool that helps businesses and organizations handle various financial matters, from tracking expenses to guaranteeing the best cash management. The financial KPI dashboard illustrates the effectiveness of business strategies (generated revenue and profit).

Why are dashboards important?

Interactive dashboards are excellent choices for management reporting. While they are prevalent in financial reports, their use can be extended to other areas. For instance, marketing specialists can create dashboards to illustrate the effectiveness of their marketing strategies and correlations to sales.

Is Excel a good business tool?

Benefits include: Excel is undoubtedly a fantastic business tool. The trainer-led, intensive course is necessarily hands-on at all points with the participants harnessing Excel to create solutions to a wide variety of financial and organizational tasks.

How many words can a picture paint?

A picture paints a thousand words. In the right hands, so can a chart. Quickly creating and updating the chart to make it as flexible as possible is the key.

Course Description

Monitoring the evolution of traded assets is key in finance. In this course, you will learn how to build a graphical dashboard with spreadsheets to track the performance of financial securities. You will focus on historical prices and dividends of the hypothetical stock ABC.

Join over 9 million learners and start Financial Analytics in Spreadsheets today!

By continuing, you accept our Terms of Use, our Privacy Policy and that your data is stored in the USA. You confirm you are at least 16 years old (13 if you are an authorized Classrooms user).

Why is Excel used for financial analysis?

It is used for financial analysis because it makes it easy to add, sort, and manipulate data. For many learners, mastering the tools, tricks, and complex features of Excel is enough to help them in their careers. For others, it's a first step toward learning other software platforms and programming languages to do more complex financial analysis.

What is Excel Finance?

Excel Finance is the use of Microsoft Excel (or such similar spreadsheet programs as Google Sheets) for financial and accounting use. Spreadsheets are simple and yet extraordinarily powerful for quantitative analysis. They're the workhorses of the modern office, with features that allow for both simple lists and complex analysis. Chevron Right.

Popular Posts:

- 1. osrs when to start a city course

- 2. how to find a ligtimiate tefl online course

- 3. how to find your driver's test course certification online

- 4. how can i certify my course for category 1 cme

- 5. when was a course of love published

- 6. when is golf course unlocked gta 5

- 7. what is the meaning of a pleiotropic trait and provide an example. course hero

- 8. the united states subscribes to which legal system course hero

- 9. how to add course in canvas instructure

- 10. how long is a lifeguard course nyc