Free Online Tax Preparation Courses

- IRS. The Internal Revenue Service provides many free educational resources for individuals and business owners.

- Platinum Professional Services. Platinum Professional Services offers IRS-approved tax prep courses online as well as CPA and notary courses.

- Liberty Tax. ...

- H&R Block. ...

Full Answer

How to become a tax preparer online for free?

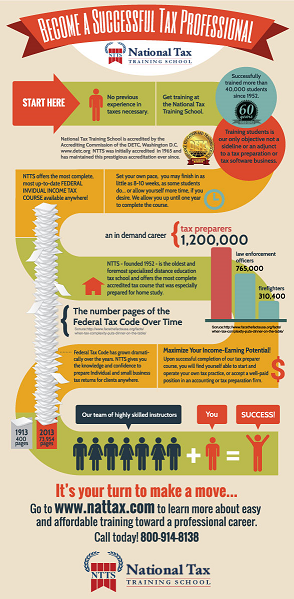

May 25, 2021 · Tax Prep Course Wins For Why We Picked It Cost Length of Course; Surgent Income Tax School: Best Overall: Tax preparation courses available for all levels of experience: $29 to $1,497: 12 to 18 months: Federal Income Tax Course by the National Tax Training School: Best for Beginners: Program will prepare you for a career in tax preparation: $625 to $720

Which companies provide free tools for online tax preparation?

The HR Block’s one of the best online tax preparation courses comprises 73 hours of in-person and online education and training. In addition, there will be professional, interactive sessions to make the course more engaging for you.

What is the best free tax preparation program?

Oct 20, 2021 · Online Rapid Course is a self-paced, accelerated course that covers the basics of preparing a simple individual income tax form. This course, which was made available in 2018, requires only 15 hours of study, plus a $49 textbook fee. H&R Block

What is the best online tax preparation service?

These courses will help you with navigating these complexities. Client communication: Some tax preparation courses also teach you about the importance of client communication, especially when it comes to how to explain complex tax laws that the average person may have difficulty comprehending. Ethics: IRS approved tax preparation courses will ...

Which taxation course is best?

There are various taxation courses in India that provide the best platform to gain knowledge and start a career in the taxation field.Udemy. ... Super 20 Training Institute. ... Tally Academy Institute of learning. ... NIFM. ... Gulati Institute of Finance and Taxation. ... Save My Tax Academy. ... Spark Training Academy.More items...•Feb 18, 2022

Which course is best for tax consultant?

Best Courses after Graduation in Taxation, Tax Courses, After graduation courses in Taxation comes best options from ICA institute.Certified Tax certification Program. CTP - Certified income Tax Professional.Professional Courses. Certified Company Accountant (CCA) ... Technician Certificates. ... Level Certificate.

What is the best way to learn tax preparation?

Surgent Income Tax School.Federal Income Tax Course by the National Tax Training School.Advanced Tax Preparation by the National Tax Training School.National Association of Tax Professionals CPE Packages.Gleim Enrolled Agent Review.H&R Block Income Tax Preparation Course.IRS Link and Learn Taxes.Final Verdict.More items...•May 25, 2021

Is it worth becoming a tax preparer?

If you're looking for a profession that features stability, flexibility, and high earning potential, there are several reasons to consider becoming a tax preparer, especially if you're proficient in math, you exhibit organization and attention to detail, and you enjoy working with clients and helping them save money.Feb 8, 2017

Is there any taxation course?

Diploma in taxation is a one year certificate level diploma course that covers a variety of technical and practical areas with relevance to direct and indirect taxes, financial accounting, income tax, auditing , accounting management and more such related matters.Jun 17, 2021

How do I become a certified tax practitioner?

You can qualify if you obtained a three-year Bachelor degree with Tax as a major subject and at least Accounting 3, have three years of verifiable practical experience in a tax environment, and pass the CoTE Professional Tax Examination.

How much do tax preparers make?

Median Salary The Bureau of Labor Statistics (BLS) reports the average salary of a tax preparer as $46,860, however this number can increase if you earn an additional degree and gain experience. In addition, firms in cities with a higher cost of living tend to pay tax preparers more.Dec 9, 2021

Does the IRS provide training?

The IRS provides free tax law training and materials. Volunteers receive training materials at no charge. The tax law training covers how to prepare basic federal tax returns electronically. The training also covers tax topics, such as deductions and credits.Oct 20, 2021

How long does it take to learn how do you do taxes?

In most cases, it takes about two seasons to learn the basics of tax preparation.

Is tax preparer a stressful job?

Stress and High Pressure Even income tax preparers who love their job are not immune from stress during tax season. Pressure is intense to meet with clients every hour of the day. In your role of tax preparer, you will scramble to find time to research questions related to IRs regulations.

How do I start a career in tax?

Courses in Taxation A B.Com degree is mandatory to take admission in the two-year M.Com course. Students who do LLB or LLM can also specialise in Taxation Laws and join the field. Bachelor of Management Studies (BMS) or an MBA degree with specialization in Finance may also give you an edge in the field.

How hard is being a tax preparer?

The task of becoming a tax preparer can be relatively easy compared to the rocky road of some similar ventures, such as becoming a real estate agent or an insurance agent. Tax preparation can be a quirky profession, meaning it is essentially not a year round profession but a more seasonal one.

Why is it important to review the syllabus before enrolling?

It’s essential to review the course description and syllabus before enrolling to ensure the topics you’re most interested in are covered. Otherwise, you could waste time working through a class that won’t serve you well.

What is the Illumeo course?

Created by Illumeo Learning, this advanced course teaches you how to compute corporate taxable income with ease. There are lessons on the corporate tax formula, accounting period and methods, the tax treatment of capital gains and losses, Section 1231 and 291 gains, cost recovery deductions, amortization and much more.

Who is Joe Correa?

Serial entrepreneur and personal finance expert Joe Correa brings you this in-depth course on preparing tax returns with TurboTax. It features 29 lectures that walk you through a simple step-by-step process to use the software with ease.

Is tax preparation self-paced?

There’s so much to know about properly preparing your tax returns. So, you want a course that’s self-paced and allows you to work when it’s convenient. You can spend as much time as you need on challenging concepts and revisit lessons that apply to what you’re working on later on down the line.

What is the 1040 course?

Created by the practicing Certified Public Accountant (CPA) – Robert (Bob) Steele, this course is designed to help you with Income tax preparation Form 1040 and supporting schedules. Taking up this path will help you learn how to calculate taxes using tax formula, the concept of filing status, completion of tax return while understanding list itemized deductions, and credits description. The course is created for students who want to learn tax law, tax & accounting students who wish a reasonable explanation and practical examples of tax concepts. This course will help you know the steps of filling out a tax form and make you aware of filing status and dependents.

What is Liberty Tax?

Liberty Tax is known for offering multiple Income tax preparation courses to help students understand the tax code to enable them to earn extra income while getting a tax return. Since learning about various tax deductions is always essential to manage your finances, this platform is a perfect fit to find the one that is relevant to you. There are various other resources available on the website that can help you explore legal tax deductions and additional information to be assessed during the procedure. The platform instructors are experts in their field and cover all the tax schedules, forms, and credits that can be filed with an individual tax return. Don’t forget to check our list of Best Fintech Courses.

What is H&R Block?

H&R Block is a great platform to learn about income tax preparation and implementing the best practices to follow the laws. This course can help you invest in your skills and master your return or initiate a potential career. Enrolling in the curriculum will help you get an overview of the Tax theory, current tax laws, and filing practices with the understanding of client communication skills and interactive discussions, and more. It will guide you through filing requirements, qualifying dependents and support, EITC & ACTC, along with other income and adjustments. This virtual learning is accessible to any person across the globe and very flexible to adapt for the students or professionals.

Does tickmark provide legal advice?

Tickmark, Inc. and its affiliates do not provide legal, tax or accounting advice. The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction. The content on this website is provided “as is;” no representations are made that the content is error-free.

How much does it cost to become a CE provider?

To do this, you’ll need to review the IRS’s standards for becoming an approved CE provider, apply online, and pay an annual fee (which is currently $460). If your application is approved, you’ll receive a provider number for your organization.

How old do you have to be to take H&R Block?

You must be at least 18 years of age at the time of enrollment to enroll in the H&R Block Income Tax Course. This school has a Certificate of Approval from the Texas Workforce Commission (TWC). The TWC-assigned school number is: S0140. The school’s programs are approved by TWC.

How many hours is a symlink?

The course consists of 71-73 hours* of instruction which includes instructor-led sessions, online training, and practice sessions. Additional time commitments outside of class homework will vary by student.

What is tax lesson?

Students will go through an interactive e-learning tool with lessons that include tax topics, case studies, and interview simulations . Each lesson has media icons linking to any available media concerning the subject, and includes links to Tax Facts, Assessments, Software Tutorials, Job Aids and the Practice Lab. Once lessons are completed, students may certify at the level appropriate to their training. Returning students may complete a “What’s New This Year” lesson and then certify at the level appropriate to their training and experience.

What is link and learn tax?

Link & Learn Taxes is the web-based program providing six certification courses for volunteers and a refresher course for returning volunteers. This training prepares Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) partners and volunteers to provide quality tax return preparation services in their local communities. This fun, interactive course teaches you to accurately prepare income tax returns for individuals, and you can obtain volunteer certification along the way at your own pace! Some tax professionals can even earn continuing education credits when certifying at the designated level and meeting other specific requirements.

What is an international course?

International (optional specialty course): Covers the completion of returns for taxpayers, military and non-military, living outside the United States and assisted by volunteers working at U.S. embassies and consulates or military installations. It includes the Foreign Income Exclusion and Foreign Tax Credit.

What is the Circular 230 test?

The test covers new provisions and tax law changes. Volunteers with the professional designation of Attorney, Enrolled Agent or Certified Public Accountant have the option of certifying via the Circular 230 Federal Tax Law Update Test. A volunteer who completes this certification level can prepare all tax returns that fall within the scope of the VITA/TCE program as well as perform all volunteer roles such as tax preparer, quality reviewer and/or instructor. This is an optional test for Circular 230 professionals. Volunteers who would like additional training beyond this certification can choose the traditional certification paths (Basic, Advanced, etc.) available to all new and returning volunteers. Please refer to the Fact Sheet PDF for additional information.

What is a CE credit?

Continuing education credit. Tax Professionals can earn continuing education (CE) credits by completing the required tax law certifications and serving as an IRS tax law certified volunteer instructor, tax return preparer, and/or quality reviewer in the SPEC Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) Programs.

What is tax preparation service?

Tax preparation services are full-service offerings to complete your annual tax filing forms for the IRS and, if needed, state tax agencies. Unlike online and desktop tax preparation software where you do your own taxes, a tax preparation service will review your tax forms and complete your taxes for you.

Who is Eric Rosenberg?

Eric Rosenberg is a finance, travel, and technology writer. He has 10 years of experience in banking, corporate finance, and corporate accounting. Learn about our editorial policies. Eric Rosenberg. Reviewed by. Full Bio. Follow. LinkedIn with Background. Linkedin.

What is KPMG Spark?

KPMG Spark is the service that’s best for modern small and mid-size companies that want online tax support from a team of business experts.

Does Jackson Hewitt do taxes?

Jackson Hewitt makes tax preparation easy with several options to file either online or through a network of 6,000 locations, giving it the win for ease of use. If you want to have your taxes done while you shop for groceries, you may want to use one of the 3,000 locations inside of Walmart stores.

Popular Posts:

- 1. what is your first priority when starting a business course hero

- 2. coursera what happens if i dont finish my course on time

- 3. which of the following statements is false regarding the threat of new entrants? course hero

- 4. can't repeat the past why of course you can just you wait

- 5. which first aid course also has cpr and aed

- 6. how does the main character's approach to farming evolve over the course of the video

- 7. how to copy course wike pages in blackboard to another course

- 8. put the following events of the neuromuscular junction in the order in which they occur course hero

- 9. what is an adj course in college

- 10. when a sender and a reciever beonging to the same group course hero