Do you have to take a course before filing bankruptcy?

Nov 09, 2021 · The 2005 Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 requires you to take a means test to see if you’re even eligible to file for bankruptcy. You calculate your income for the last six calendar months and see how it compares to the median income for your state. If it’s below the state average, you qualify to file Chapter 7.

Which credit counseling course do I take when I file bankruptcy?

Aug 25, 2020 · In contrast to the pre-filing counseling requirement, the pre-discharge education course is completed after you file for bankruptcy, but before you receive a bankruptcy discharge. The education course will address a variety of issues including how to use credit responsibly and developing a manageable budget. The course will last from one to two hours, and the fee for …

Can you fail the means test and still qualify for bankruptcy?

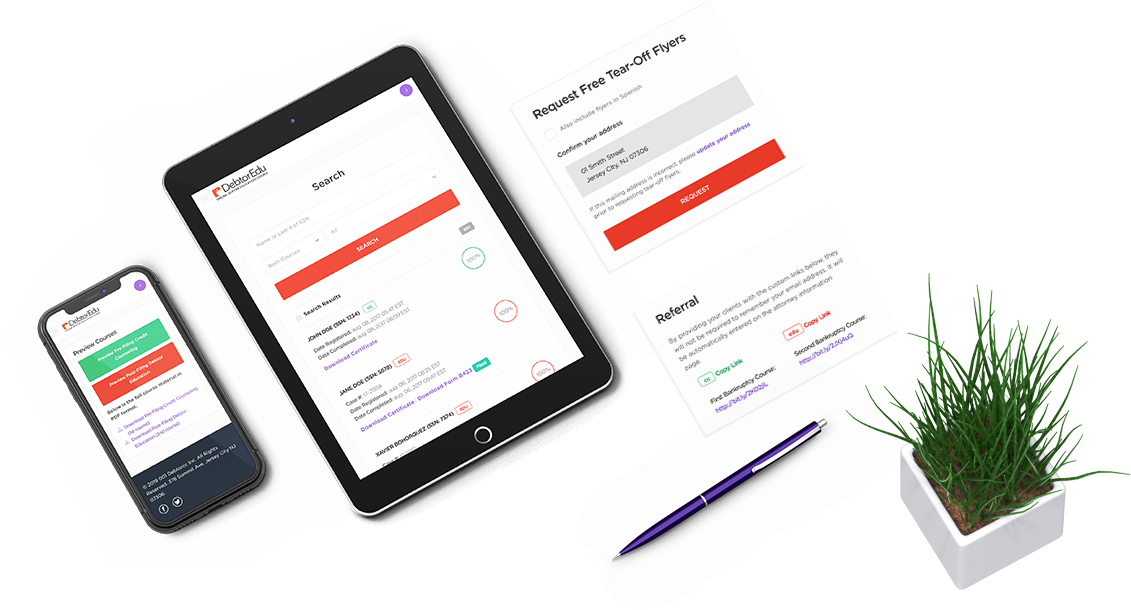

Pre-filing Bankruptcy Credit Counseling Course Online ... can potentially review client information as needed. The EOUST has only reviewed and approved Pre-filing credit counseling and Post-filing debtor education services ... creditors and factors that led you to consider bankruptcy. There is a requirement by law that you must have interaction ...

What is the pre-filing bankruptcy process?

7031 Koll Center Pkwy, Pleasanton, CA 94566. master:2021-11-17_10-05-35. When you file for bankruptcy, you'll complete two courses—a credit counseling course and a debtor education course. If you're unsure which to take or how to find approved providers, these basics will help: You'll take the credit counseling course before bankruptcy.

What happens when you fail for bankruptcies?

You'll still have to pay court-ordered alimony and child support, taxes, and student loans. The consequences of a Chapter 7 bankruptcy are significant: you will likely lose property, and the negative bankruptcy information will remain on your credit report for ten years after the filing date.

What happens if your Chapter 7 bankruptcy is denied?

The reason for the denial will determine the consequences. In some cases, you can convert the petition to a Chapter 13. In others, you remain liable for the debt. If the trustee dismisses the petition due to fraud, you could lose assets and remain responsible for your debts.Sep 18, 2020

What Cannot be discharged under bankruptcy?

Debts Never Discharged in Bankruptcy Alimony and child support. Certain unpaid taxes, such as tax liens. However, some federal, state, and local taxes may be eligible for discharge if they date back several years. Debts for willful and malicious injury to another person or property.

Why do you think the law requires a debtor to receive credit counseling prior to being allowed to file for bankruptcy?

Why You Must Take Pre-Bankruptcy Credit Counseling Counseling is required even if it's pretty obvious that a repayment plan isn't feasible (that is, your debts are too high, and your income is too low) or you are facing debts that you find unfair and don't want to pay.

What would disqualify me from Chapter 7?

5 Reasons Your Bankruptcy Case Could Be Denied The debtor attempted to defraud creditors or the bankruptcy court. A previous debt was discharged within the past eight years under Chapter 7. A previous debt was discharged within the past six years under Chapter 13.Mar 9, 2022

How do you pass Chapter 7 means test?

How to pass the Chapter 7 Means Test?Step 1: Outline your expenses.Step 2: Subtract the average of taxes, social security, and living expenses.Step 3: Calculate disposable income limits.

What types of debts are not dischargeable?

Non-Dischargeable Debt in BankruptcyDebts that you left off your bankruptcy petition, unless the creditor actually knew of your filing;Many types of taxes;Child support or alimony;Fines or penalties owed to government agencies;Student loans;Personal injury debts arising out of a drunk driving accident;More items...•Oct 18, 2021

How far back does a bankruptcy trustee look?

Your bankruptcy trustee can ask for up to two years of bank statements. The trustee will look at your statements to verify your monthly payments to make sure they match the expenses you put on your bankruptcy forms.Dec 6, 2021

What Cannot be discharged in a Chapter 7 bankruptcy?

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

What are two things creditors can do if a debtor defaults on a debt?

Either way, if you or the business can't pay back the debt, a secured creditor can repossess or foreclose on the secured property, or order it to be sold, to satisfy the debt.

How soon before credit counseling should I file bankruptcy?

within 180 daysIf you plan to file for bankruptcy protection, you must get credit counseling from a government-approved organization within 180 days before you file. You also have to complete a debtor education course before your debts can be discharged.

Which is better Chapter 7 or Chapter 13?

Most consumers opt for Chapter 7 bankruptcy, which is faster and cheaper than Chapter 13. The vast majority of filers qualify for Chapter 7 after taking the means test, which analyzes income, expenses and family size to determine eligibility.

What Is The Debtor Education Course Requirement?

To receive a discharge in Chapter 7 or Chapter 13 bankruptcy, you are required to take a debtor education course after you file your case. The goal...

Who Must Take The Debtor Education Course?

With a few exceptions, all Chapter 7 and Chapter 13 bankruptcy debtors must complete a course in debtor education before they can receive a dischar...

Approved Debtor Education Course Providers

You must take the debtor education course from a provider approved by the U.S. Trustee (or the Bankruptcy Administrator if you live in Alabama and...

When Do You Have to Complete The Debtor Education Course?

If you file for Chapter 7 bankruptcy, you must take the debtor education course and file your certificate of completion (discussed below) with the...

How Much Does The Debtor Education Course Cost?

The cost of the debtor education course will depend on the provider you select. But the new rules published by the Executive Office for U.S. Truste...

What Happens During The Debtor Education Course?

You can usually take the debtor education course in person, over the phone, or on the Internet. Regardless of the method of instruction, the course...

Filing Your Certificate of Completion

When you complete the debtor education course, you must file a form called Debtor’s Certification of Completion of Postpetition Instructional Cours...

What is bankruptcy education?

What Is Bankruptcy Debtor Education? In order to be discharged from Chapter 7 or Chapter 13 bankruptcy, you must complete a Pre-Discharge Debtor Education course. The purpose of this bankruptcy course is to help you remain financially secure and use credit wisely so you don’t end up in bankruptcy again.

How to get credit counseling after bankruptcy?

With Pre-file Credit Counseling, you’ll start online, then receive a personal counseling session by telephone to discuss the details of your current financial situation with a Certified Financial Counselor. Your counselor will help you build an accurate picture of your current finances, then give specific advice on actions you can take to improve it. You’ll also discuss short- and long-term financial goals and determine if there are any alternatives to bankruptcy. The counselor will explain consequences of bankruptcy and actions you can take to get back on sound footing after a bankruptcy.

What is the bankruptcy law?

This act was signed into law on April 20, 2005, and includes checks and balances to ensure that consumers are equipped to make informed decisions when it comes to filing bankruptcy. It includes the requirement that all Chapter 7 or 13 bankruptcy petitioners complete approved credit counseling and provide to the court a certificate of completion from a U.S. Trustee-approved, nonprofit credit counseling agency . The law also requires all consumers who file for bankruptcy to successfully complete two bankruptcy courses prior to having debts discharged.

What happens if you miss Chapter 13 bankruptcy?

Those who file for Chapter 13 bankruptcy must complete the class and file the certification of completion before your last repayment plan payment or before you file a motion for discharge. If you miss these deadlines , the court will dismiss your case. To reopen it, you must repay the bankruptcy filing fee.

What happens if you don't complete the test?

If you don't complete the test in a satisfactory manner or receive a score of less than 70%, the provider must communicate with you directly. For telephonic courses, the instructor must contact you either in person or by phone. For online courses, the communication can be by email, live chat, or phone.

How to get discharged from Chapter 7?

To receive a discharge in Chapter 7 or Chapter 13 bankruptcy, you are required to take a debtor education course after you file your case. The goal of the debtor education requirement is to educate you on making smart financial choices so that you won't have to seek bankruptcy relief in the future. When you take the debtor education course, you ...

What is debtor education?

The purpose of the debtor education course is to teach you how to manage money and use credit wisely after bankruptcy. If you don't complete the debtor education requirement, the court won't issue a discharge in your bankruptcy. Read on to learn more about the debtor education course requirement in bankruptcy.

How many classes do you need to take before filing for bankruptcy?

In both Chapter 7 and Chapter 13 bankruptcy, you (and your spouse if you file jointly) must take two courses before you receive a bankruptcy discharge (the order that wipes out qualifying debt)—one before you file your paperwork, and another afterward. Read on to learn about the second class, a personal financial management course known by several ...

What form do you need to file for bankruptcy?

If that happens, you'll have to reopen your case and repay the entire filing fee. In Chapter 13 bankruptcy, you must file Form 423 and the certificate no later than the date on which you make your last plan payment.

What is debtor education?

It's a financial management course that you take after you've filed for bankruptcy but before you get a discharge. The debtor education course teach es you strategies that will help you stay financially healthy after your bankruptcy.

How long does it take to file a 423?

Filing Deadlines. In Chapter 7 bankruptcy, you must file Form 423 and the certificate no later than 45 days after the date on which your meeting of creditors was first scheduled. Don't miss the deadline. If you do, the court might close your case.

When do you file a 423?

In Chapter 13 bankruptcy, you must file Form 423 and the certificate no later than the date on which you make your last plan payment. You can take the course early on in your case, however, and some attorneys recommend this because the course provides information that may help you budget and complete your plan.

How is income analyzed in Chapter 7?

First, The Means Test measures the total “regular” income received in the six months prior to the Chapter 7 bankruptcy filing and averages that income (less social security types of income). Second, the “present day” income that exists on any given day during ...

What is the meaning of the means test?

The Means Test is simply a burden-shifting mechanism. If you “pass” The Means Test, then there is a presumption that you qualify for Chapter 7 and anyone that disputes that fact has the burden of proof to demonstrate that you do not qualify.

Can you dismiss a Chapter 7 case?

This is a real-life fact pattern. Yes, The Means Test was “passed”, but the “present day” income dictated that my Client had the means available to repay at least a portion of the debt in a Chapter 13 payment plan.

How long does it take to file a bankruptcy certificate?

The post-filing financial management program must be taken, and a certificate of completion filed with the court, within 45 days after the Chapter 7 debtor attends the 341 meeting of creditors. In a Chapter 13 bankruptcy, in which creditors are paid over several years, debtors must file the certificate before the last payment is made through ...

What is life after bankruptcy?

Life after bankruptcy, when people need to rebuild their damaged credit, is also explored in the debtor education course. People can learn how to review credit reports and scores and how they can be improved during the class.

What is debtor education?

Debtor education course focuses on post-bankruptcy financial issues. After debtors have completed several steps in a bankruptcy proceeding, they are expected to take a financial management course that will help them avoid accumulating significant debt in the future.

What is AFT in banking?

The benefits of taking the post-filing course range widely, states the Academy of Financial Literacy (AFT), one of the agencies approved by the U.S. Department of Justice Trustee Program to provide the courses.

Do you need credit counseling before filing bankruptcy?

Along with a credit counseling class before filing bankruptcy, there is a post-filing course that is required by the U.S. Bankruptcy Court before debts can be discharged. But rather than reviewing alternative ways for a person to resolve their current financial troubles, as the counseling course does, the second program is focused on ...

What to do if you aren't sure about something?

If you aren't sure about something, contact your attorney for guidance. There are also some things you should avoid doing. If you find you've already done some of the things to avoid, let your attorney know right away. If you try to undo your actions, you could actually make the situation worse.

Can I use my credit card before filing bankruptcy?

Speak with your attorney prior to doing this. DO NOT use your credit cards or acquire new debt. Unplanned medical debt may be an exception, as you may not have a choice about incurring the debt. But if you use credit shortly before filing bankruptcy, you may end up having to repay some or all of that debt.

Can I withdraw money from my retirement account?

DO NOT withdraw funds from your retirement accounts to repay debts without discussing this with your attorney. This is almost always a bad idea. DO NOT transfer any assets (real estate, car, money, or anything of value) to family or friends, without first contacting your attorney.

Can I open a new bank account if I owe money?

Your attorney may also ask for copies of bills and collection letters, as well. DO consider opening a new bank account, especially if you do your banking somewhere that you owe money. The bank may close your account when you file bankruptcy, so it's a good idea to already have a new bank account set up when you file.

Popular Posts:

- 1. why are deals done on the golf course

- 2. which of the following statements is true of interactive leaders course hero

- 3. of course i can poster what does the artist want people to do

- 4. what i do to myself i do unto you and what i do to you i do unto myself a course in miracles

- 5. why did jacques-louis david's paintings have a frozen quailty to them ? (course hero)

- 6. how many years course is ias

- 7. which of the following will decrease aggregate demand course hero

- 8. how toget answers for course hero person

- 9. what course classification is greek classics for amcas

- 10. where to enter aarp hartford insurance defensive driving course completion date