- Step 1: Verify your state's CPA licensing requirements. ...

- Step 2: Complete your degree and gain experience. ...

- Step 3: Pass the CPA Exam. ...

- Step 4: Finalize your certification.

What training is necessary to become a CPA?

Oct 28, 2020 · The steps to becoming a CPA involves a 4-year undergraduate degree, as well as getting 30 additional credit hours over the course of one year. Most states also require two years of work experience. All this adds up to a 7-year process if …

How to become a CPA?

Feb 21, 2022 · CPA Eligibility. To pursue CPA certification programme, the candidate must have a Graduation degree or equivalent. To earn the CPA license, the candidate must complete 150 hours of the CPA course semester. Many states require candidates to …

What degree do I need to become a CPA?

Mar 03, 2022 · Top Tips. Make a Study Schedule. Start preparing well ahead of your exam date. To stay focused, create a consistent schedule that specifies when and where you ... Familiarize Yourself With the Exam Format. The CPA exam uses a fixed format with a set number of testlets and question formats. ...

What is coursework and why coursework matters so much?

Jun 03, 2016 · The 4 sections of the CPA exam are as follows: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR) Regulation (REG), Business Environment Concepts (BEC) Here is the direct links to download the AICPA revised new syllabus 2019 Huge number of aspirants are preparing for the Certified Public Accountant (CPA) in various countries.

How do I start a CPA course?

To pursue CPA certification programme, the candidate must have a Graduation degree or equivalent. To earn the CPA license, the candidate must complete 150 hours of the CPA course semester. Many states require candidates to have 1-2 years of experience under a CPA.

What are the requirements to study CPA?

All 50 states require a bachelor's degree with at least 150 credit hours of coursework to become a licensed CPA. Some states will let you sit for the CPA Exam with 120 hours of study, though you still must complete 150 hours before you can apply for a license (these are called two-tier states).

How many years course is CPA?

CA vs US CPACriteriaCA (Chartered Accountant)CPA (Certified Public Accountant)EXAM STRUCTURE3-4 years18 MonthsPROGRAM DURATION3 Level of examsJust 1 examOPPORTUNITIESIndiaIndia and GlobalEXPENSEProgram cost low if time and opportunity cost not accountedProgram fees slightly higher2 more rows•Jun 3, 2016

Can I do CPA after 12th?

You cannot do this directly after class 12th: A career in accounting with the CPA qualification will certainly prove to be extremely rewarding in terms of increased credibility, opportunities and pay. Companies providing accounting, taxation and other financial services to US clients.Mar 12, 2018

Is CPA difficult to pass?

With national CPA Exam pass rates hovering around 50%, the Uniform CPA Examination is one of the most difficult professional credentialing exams.

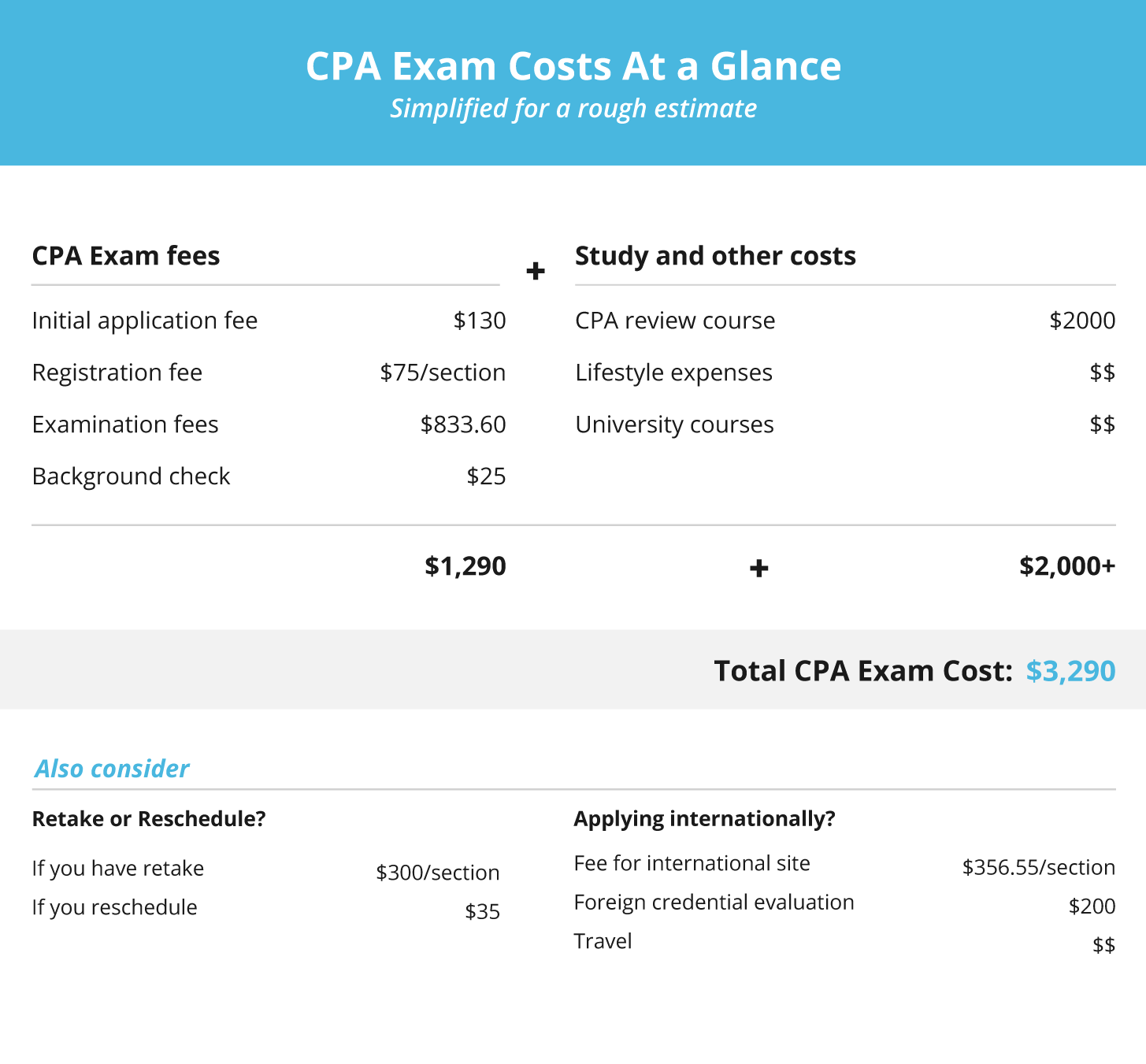

How much is the CPA Exam?

Average Total CPA Exam Cost BreakdownCPA Exam FeesRegistration Fee$300$175Examination Fee$833.60$1,000/yearCPA Review Course$2,000Approximate Total Cost$4,7001 more row

Can I do CPA in India?

Candidates who possess a bachelor's degree from NAAC- A grade university in commerce and first division are eligible to take the regular CPA exam. To appear for the Certified Public Accountant Examination, the candidates must possess any of these qualifications. Member of the Company Secretaries in India.Feb 7, 2022

Is CPA valid in India?

CPA is recognized in USA, India & around the world compared to CA, which is recognized only in India. With the global presence CPA has more job opportunities compared to CA. CPA covers US GAAP & IFRS, while CA covers Indian GAAP.

What is CPA syllabus?

The sections are namely, Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), Business Environment and Concepts (BEC) and Regulation (REG). The candidates have to clear all 4 sections within 18 months and earning a minimum required score of 75 on each part.

Is CA better than CPA?

Both types of accountants are highly qualified, but here are some differences in course content for each qualification. The CA course has a strong focus on the technical aspects of accounting and complex tax matters. The CPA course has a broader focus on accounting and business management.Dec 6, 2018

Can I do CPA after BCOM?

The answer is no because CPA requires at least 4 years of education after 12th and you only have 3 years of experience. The next best alternative is to do ACCA as you are fully eligible for this and you will also get some exemptions. In order to be eligible to give the exams, you would need 120 educational credits.Mar 10, 2017

How many CPA are there in India?

CPA Council of IndiaTypeConstituent unit of the ICFAI UniversityProfessional titleCPAMembership6,000+ (10,000+ Students)PresidentVice Chancellor, ICFAI UniversityWebsitewww.cpaindia.org1 more row

Is CPA a degree or certification?

CPA a term used for both the certification and those who hold the credential is the only officially approved certification qualification in account...

Is it hard to get CPA certified?

The difficulty of the CPA certification process depends on your accounting skills and exam prep. Pass rates for the four exam sections, as of 2021,...

What are the CPA testing windows?

The CPA testing windows are 18 months. Once you are verified for the CPA exam, you must pass all four sections of the exam within that testing window.

How often can you take the CPA exam?

The AICPA administers the four sections of the CPA exam on a rolling basis throughout the year. You must pass all four parts of the test in an 18-m...

What is a CPA certification?

CPA certification is a professional recognition most beneficial for CA, CS, MBA, Financial Advisors, Cost Accounting professionals, etc. Finance and accounting professionals can pursue CPA course to earn certification for career ascent, from the AICPA by fulfilling three criteria – Education, CPA Exam and Experience.

What is a CPA?

Certified Public Accountant or CPA is a certification offered by the American Institute of Certified Public Accountants (AICPA), for competency in the field of Accountancy. One may a CPA is an accountant with higher level of education and experience in the field. The AICPA defines a CPA as “a trusted financial advisor who helps individuals, ...

How long is the CPA exam?

CPA Exam. The exam is a 16-hour, four-part assessment designed to test skills and knowledge required of a CPA. The computer-based test is conducted at designated test centres in various countries and is same for candidates from all the countries. Medium of the test is English.

What is the job of a CPA?

The job role of a CPA is financial management which includes assessing and analyzing financial status of the client, reviewing financial documents, preparing reports related to capital, tax and audits, offer advice on book keeping and inform the client about changes in government regulation. The main tasks one performs as a CPA are listed below: 1 Prepare and assess financial records and statements. 2 Maintain records of all financial activities along with the records of assets, liabilities and tax. 3 Prepare financial reports for clients. 4 Ensure compliance with government regulations.

What is the exam for a CPA?

Licensure requirements for CPAs vary by state, but include passing the American Institute of Certified Public Accountant’s (AICPA) Uniform Certified Public Accountant Exam.

How many credits do I need to become a CPA?

Depending on the state where you live, you may need to earn 120-150 postsecondary credits.

Why do companies need accountants?

Companies and organizations of all sizes need accountants to prepare and maintain financial documents. Accountants can significantly impact their employers’ success, so organizations seek out professionals with education, experience, and expertise in their field. This means employers pursue CPAs to fill many of these open positions.

What are the benefits of being a certified public accountant?

Certified public accountants enjoy increased salaries, greater job security, and more respect in the accounting field. The five benefits below represent just a few that certified public accountants may receive.

How many credits do I need to get a bachelor's degree?

Depending on the state where you live, you may need to earn 120-150 postsecondary credits. If you live in a state that requires 120 credits, you must earn a bachelor’s degree. You also need a master’s degree if you live in a state that requires 150 credits.

What are the benefits of being a CPA?

The five benefits below represent just a few that certified public accountants may receive. Keep in mind that if you also possess relevant experience and/or an advanced degree, you may receive additional/enhanced benefits once you become a CPA. Better Salary.

How many credits do I need to become a public accountant?

While you do not need to hold a bachelor’s degree in accounting or finance, you should possess either a minor in accounting or at least 24 credits related to accounting or a similar field. Please contact your state board to learn more about the latest educational requirements to become a certified public accountant.

What is the CPA course?

The CPA course is considered as the ultimate qualification that has unlimited possibilities to show your potential in the accounting field. Listed below are the detailed benefits of CPA course.

How long does it take to get a CPA?

CPA exams consist of following four parts that take a total of 14 hours to be completed. The CPA exam scoring is done on an independent basis for every candidate. With this kind of scoring pattern, the candidate is adjudged on the grounds of knowledge levels, skills, and analytic approach.

What are the sections of CPA exam?

CPA exam syllabus is broken down into 4 sections. Each of these sections have their own syllabus and exam which you need to be proficient in. The 4 sections of the CPA exam are as follows: 1 Auditing and Attestation (AUD), 2 Financial Accounting and Reporting (FAR) 3 Regulation (REG), 4 Business Environment Concepts (BEC)

What is a CPA?

A Certified Public Accountant ( CPA) is the highest standard of competence in the field of Accountancy across the globe. The exam is administered by the American Institute of Certified Public Accountants (AICPA), which is the world’s largest accounting body. If you ever consider a career in accounting and want an illustrious career, ...

Which country has its own accounting body?

Every country has its accounting body. India has the Institute of Chartered Accountants of India (ICAI), Canada has the Canadian CPA, Australia has the Australian CPA, UK has the Association of Chartered Certified Accountants (ACCA). So, every country has its own accounting body.

What is the minimum score to get a CPA license?

Application for the CPA exam is a different process from applying for a CPA license. Once you have cleared the uniform CPA exam with a minimum passing score of 75 , you are eligible for a license as a CPA and can start the application process for a CPA license.

Is CPA a good career?

If you ever consider a career in accounting and want an illustrious career, CPA Course is the best option for you. CPAs are globally recognized as premier accountants and are hired across industries throughout the world.

Why become a CPA?

Globally recognized and respected, the Chartered Professional Accountant (CPA) designation is your key to a successful career.

Pathways to becoming a CPA

Depending on your educational background, you can take different pathways to gain or earn entry to the CPA PEP.

Collaborate with the Competency Map Task Force

The Competency Map Task Force (CMTF) is collaborating with stakeholders to develop a new Competency Map (CM 2.0) that reflects the changing landscape of the accounting profession. Provide your comments on the newly released CM 2.0 draft.

The CPA certification program

Learn more about the components that make up the CPA certification program.

International credential recognition

Learn how the Canadian CPA profession assesses international credentials and provides streamlined programs to help internationally trained accountants become Canadian CPAs.

COVID-19 updates for the CPA certification program

The CPA profession is carefully monitoring the COVID-19 public health risk for any new developments and is committed to ensuring that we keep students and candidates informed of any updates that may impact the CPA certification program.

Foresight: The CPA podcast

This podcast brings to light evolving technological and social business changes and their effect on the accounting profession. As newfound opportunities and challenges begin to emerge, we ask CPAs—are you prepared for what's coming?

Popular Posts:

- 1. which of the following statements is/are true of this course?

- 2. how to plate main course food

- 3. what is the longest golf course in the wichita area

- 4. how to add another course using the same book already bought webassign

- 5. how do i insert google doc within a canvas course

- 6. how to identify and create an online course that sells

- 7. what is a quick comm marine net course

- 8. what do i need my hunter saftey course for

- 9. how did many american republicans feel about president barack obama? course herro

- 10. when can you take a tefl course