Which CPA exam is the hardest?

What is the hardest professional exam?

- The United States Medical Licensing Exam. …

- California State Bar Exam. …

- Master Sommelier Diploma Exam. …

- Uniform Certified Public Accountant Exam. …

- Certified Master Chef® Exam.

What degree do I need to become a CPA?

To become a CPA, a person must earn a bachelor's degree in accounting, with about 150 semester hours in subjects approved by the State Board of Accountancy. Required courses include classes in Accounting, Business Law, Finance, Business Statistics, Economics, and Liberal Arts. He must also gain on-the-job experience as an accountant.

What are the requirements to become a CPA?

- Significant increases in official accounting and auditing pronouncements and the proliferation of new tax laws have expanded the knowledge base that professional practice in accounting requires.

- Business methods have become increasingly complex. ...

- The staffing needs of accounting firms and other employers of CPAs are changing rapidly. ...

How hard is the CPA exam really?

Yes, the CPA Exam is hard. But that doesn’t mean you can’t pass it! How hard is the CPA Exam, really? Very. The overall CPA Exam pass rates hover slightly below 50%. This makes passing the CPA Exam a difficult, but achievable, goal.

How long does it take to study for the CPA?

between 300-400 hoursThe AICPA recommends that candidates spend between 300-400 hours to study for the entire exam CPA exam. Because we all learn differently, some sections will require more study hours than others due to the volume of material included in a section and how quickly one is able to grasp and retain the study material.

Is CPA certification difficult?

It is considered one of the most challenging exams for obtaining standardized professional credentials. When the national pass rate is approximately 1 in 2, those who will eventually need to take the CPA exam should use every resource possible to give them an edge against a nearly 50% fail rate.

Can I study CPA by myself?

If you are knowledgeable in financial accounting and audit procedures, and you are an extremely disciplined person, you can try the self-study route. However, the CPA doesn't just test your accounting knowledge.

Is becoming a CPA worth it?

As growth continues for accounting professionals in both public and private firms, hiring managers look for candidates with experience and certification. Earning your CPA puts you in the spotlight for promotion, rapid career advancement – and a better salary.

Is the CPA Exam the hardest exam?

The CPA Exam is considered one of the hardest accounting credentialing exams due to the sheer scope of the four exam sections. Going over a CPA Exam sections guide can help you determine which section you will feel most ready to tackle based on your own background.

What makes the CPA Exam difficult?

The CPA Exam is so difficult because: It covers a wide variety of topics at different skill levels. It tests those topics using multiple question types, including some that simulate real-world tasks CPAs are expected to perform.

Is the CPA Exam harder now than before?

In conclusion, the cpa exam is not getting more difficult. It has been getting easier in recent history.

How long does it take to become a CPA?

If you add up all of the time it takes to complete credits and to get experience, you can see that it takes about eight years to become a CPA from day one. If you would like to work towards earning your prestigious credential so that you can earn a larger salary or you can become more marketable, now is the time to start. Find the right degree program, be sure you are taking enough accounting courses, and reduce how long it takes to get a CPA degree by being prepared.

What Degree is Needed to Take the CPA Exam?

While there are not degree programs that specifically cater to CPA’s, any accredited accounting degree is acceptable as long as you take the appropriate number of credits and the right accounting courses.

How Long Will it Take to Meet Educational and Work Experience Requirements?

If you are enrolled in college full-time, it will take no less than four years to earn your bachelor’s degree. Once you earn this degree, you can expect to spend at least one more year completing the credit requirements in an MBA or Master’s in Accounting program. If you complete the graduate program before pursuing your designation, you will study for an additional two years.

What Does a CPA Do?

A certified public accountant keeps track of an organization’s financial records. Their work requires them to compile financial data, to analyze it and to verify it. They’re looking to see if the company’s or organization’s finances are in compliance with state and federal regulations. To file any reports with the Security and Exchange Commission, a person must be a CPA.

What is a CPA specialization?

However, these specializations lay a foundation that will be helpful as the aspiring CPA enters the workforce. A specialization allows him or her to move into a particular industry if that’s what the person wants to do.

How long do you have to be in the accounting field to get certified?

The professional requirements vary from state to state, but a majority of states will ask that you show proof that you have been working in the field of accounting for a minimum of two years. Some states will require your experience to specifically be in public accounting, but corporate accounting may also be acceptable.

How many credit hours do you need to be an accountant?

Again, this is often required in order for the person to meet the 150 credit hour requirement. Thankfully, education has changed. Many future accountants still go the traditional route when it comes to getting their accounting degrees. That is, they participate in a campus-based accounting degree.

How Long Does It Take to Prepare for the CPA Exam?

If you work a full or part-time job, you will probably have less time each day to commit to studying, so instead of being ready in 6-10 weeks, it may take you 15 weeks.

How to study for CPA exam?

If you have a more open schedule then you can have longer study sessions. Longer study sessions, frequent practice tests, and consistent review of the material may be able to shorten the overall amount of time it takes you to be ready to take the real CPA exam. Even though being able to commit to longer daily study periods, it is important to take breaks and get adequate amounts of sleep so you retain the information you’re studying.

How Many Hours Should You Study for the REG CPA Exam?

The REG CPA exam is full of random unrelated facts. You’ll excel in this section if you are good at memorizing information. Overall, you should plan to spend 90-110 hours reviewing for the REG section. On the REG CPA exam, you will be answering 72 multiple-choice questions and 6 task-based simulations.

How many questions are asked in the Far CPA exam?

The FAR CPA exam section is the largest of the four, with 7 task-based simulations and 90 multiple-choice questions. This portion of the test covers the widest range of information and touches on many different accounting topics, which is why many deem it to be the most difficult section.

How many people pass the CPA exam?

In fact, less than 50% of candidates pass the CPA test. Be sure to take your preparation seriously and commit enough time to ensure you are completely ready to take and pass the exam.

What to consider when developing a study plan for CPA?

When developing a study plan that is right for you, you might want to consider the use of CPA study guides or review courses. Be sure to check out our Best CPA Review Courses, researched and compiled by our team of experts.

How long does it take to study for AUD?

The recommended study time for AUD is between 70 and 90 hours.

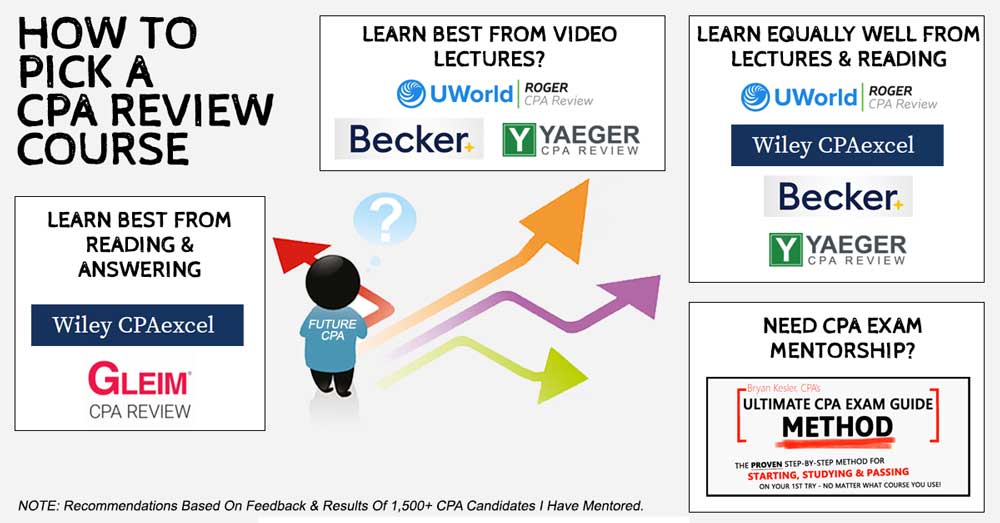

What should I look for in a CPA review course?

You should look for a CPA review course that matches your learning style, study schedule, and budget. I’ve tested and reviewed all of the most popular ones out there. Check them out to see which one is right for you.

What is the CPA score?

The exam is scored on a scale of 1-99. Candidates must get a score of 75 or higher in order to pass each section. The CPA exam is tested during four test windows throughout the year.

What is a NTS for CPA?

After your application is received and accepted, you will be issued a Notice To Schedule (NTS) that allows you to schedule and take a section of the CPA exam. You will need to get a new NTS for each section you take.

How long do you have to pass the exam after you pass the first section?

After you pass you first exam section, you will have 18 months to pass the next three. If you don’t pass all four in an 18-month window, your first passed exam will expire and you will have to retake it.

How many credits do you need to take accounting?

Some states go beyond the traditional 120-credit hour accounting degree requirement and require candidates to have 150 semester hours to simply sit for the exam. This is the exception to the rule, however. The majority of states will let you sit for the exam with only a qualified bachelor’s degree. Almost all states, however, do require you ...

What to do after you complete your work experience?

After you complete your work experience, all that is left to do is pay your state board its licensure fees and wait for you certificate to come in the mail. 🙂

How many hours do you need to get a driver's license?

Almost all states, however, do require you to earn 150 credit hours in order to get your license.

How long does it take to study for CPA?

Generally speaking, most CPA candidates should plan to study 300-400 hours to adequately prepare for the CPA exam, meaning you should plan to spend anywhere from 80-120 hours studying for each section of the CPA exam.

How Many Hours to Study for the AUD CPA Exam?

The AUD section of the exam is considered one of the easier sections of the CPA exam, but that doesn’t mean it’s easy! AUD can be challenging because it’s perhaps the most niche of the 4 CPA exam sections: Most candidates take less auditing courses in college than financial accounting, tax and business / economics courses.

Why is the CPA exam so hard?

FAR is widely considered the one of the most difficult sections of the CPA exam due to the sheer volume and range of topics covered on the exam. Even if you have a strong foundation in financial accounting you should be prepared to spend as much or more time studying for FAR than any other section.

What is REG in CPA?

REG can be one of the more challenging sections of the CPA exam, especially if you aren’t familiar with the U.S. tax code or don’t work as a tax accountant in the U.S. REG covers several rules and regulations within the U.S. tax code, including both personal and business tax rules.

Which CPA exam is the easiest?

Many consider BEC to be the easiest CPA exam section, and the historical pass rates certainly support that theory!

What is the importance of paying careful attention to the wording of practice and exam questions?

Pay careful attention to the wording of practice and exam questions, as answers can hinge on subtle differences in how a question is written

Is it easier to study for CPA?

Studying for the CPA exam is a slog, but it might be a bit easier if you take it right out of college or shortly thereafter since some of the exam material will still be fresh in your head. This is especially true if you finish with a Masters in Accountancy (MAcc) degree, since your final year will consist of several higher-level accounting courses. You’ll also have the added advantage of still being accustomed to “study mode”.

How long does it take to study for CPA exam?

How Long to Study for CPA Exam: Estimate = 330-440 Hours . As a general rule, you’ll need 80-150 hours to study for each session of the exam, assuming you have basic accounting knowledge. Roughly speaking, you will need around 330-440 hours.

How to study for CPA exam?

If you don’t use a review provider that has a customizable study planner, you can create your own. Start by listing all of the topics you need to review for the CPA Exam. Then, based on the target date you want to sit for the exam, figure out your deadlines to study each topic. Then, you can keep track in an Excel sheet or mark important milestones in your calendar.

What are the parts of the CPA exam?

The CPA Exam is an aggressive exam with four parts: 1 AUD: Auditing and Attestation 2 BEC: Business Environment and Concepts 3 FAR: Financial Accounting and Reports 4 REG: Regulation

What is a CPA study planner?

A CPA Exam study planner will help you break down all of the topics you need to review and gives you benchmarks so you cover all of your study materials before your exam. Review providers like Becker , Gleim , and Wiley CPAexcel have interactive online study planners that help you plan ahead.

What is a good review course for CPA?

A good CPA Exam review course will include all of the materials you’ll need to pass the exam on your first attempt. There are several good exam prep providers on the market, and I have a review of the best review courses in this article. Most courses come with textbooks, lectures (video and/or audio), mock exams, and test question banks. Many courses are now using adaptive e-learning platforms that access your progress and create personalized study plans that help you maintain your focus. Some even include personalized support and face-to-face classroom-style instruction. If you find a review course that fits your learning style and stick to your study plan, you will probably spend less time studying and end up with a higher exam score.

Is CPA exam smoother?

Today’s review providers have created courses that make studying for the CPA Exam go much smoother and much faster than doing it on your own. The best CPA study materials are designed to cover all of the topics that appear on the CPA Exam as outlined in the AICPA’s Uniform CPA Examination Blueprints.

Is passing the CPA exam important?

At this point in your career, passing the CPA Exam is just as important as everything else on your “To Do” list. So make it a priority. Figure out when you will study every day, add it to your daily schedule, and keep those study promises you make to yourself.

How long does it take to get a CPA license?

You must complete all the CPA exam sections within 18 months for successful licensure. An average CPA candidate requires 9-14 months to pass all the sections of the CPA Examination. However, this period may vary as per your familiarity with the material, acquired skills, and study time devoted.

How long is the CPA Exam?

The exam is an overall 16-hour long assessment. Now, the 16-hour duration is broken down into four sections, each spanning four hours:

How long does it take to take the CPA Prometric?

Besides the four hours testing time, the CPA Prometric CPA Prometric Prometric is a company providing computer-based testing and assessment services through its global network of test centers. read more appointment time includes an additional 30 minutes. This extra time is allotted for exam login, standardized break, and candidate survey at the end of the test. However, you cannot use this additional time for taking the test. You must finish the test within four hours.

How many sections are there in the CPA exam?

Once you pass the first CPA exam section CPA Exam Section The Uniform Certified Public Accountant (CPA) Exam comprises four sections, namely, Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG). The unique content, structure, format, and scoring of the CPA exam earn it the title of one of the most challenging professional exams. read more, you get 18 months to pass the remaining sections. Please note that the starting of the 18-month window may vary for a few jurisdictions. So, kindly check with your BOA before proceeding.

What is a CPA exam?

CPA Exam CPA Exam A Certified Public Accountant (CPA) is a US state board-issued license to practice the accounting profession read more is a four-section, 16-hour long computerized assessment. It is one of the most demanding professional exams. It aims to assess a candidate’s ability to practice as a licensed accountant.

How old do you have to be to become a CPA?

The age limit for a CPA aspirant may vary for different jurisdictions. However, a majority of jurisdictions have a minimum age limit of 18 years. This is because it takes this much time for a person to fulfil the education and experience requirements.

Who organizes the AICPA exam?

The exam is organized by the American Institute for Certified Public Accountants ( AICPA) in association with the National Association of State Boards of Accountancy ( NASBA) and the 55 US State Boards of Accountancy (BOA).

How long does it take to become a CPA?

So, it takes another year to fulfill the requirement. Therefore it takes around 5 to 7 years including your degree years.

How many papers are required to clear CPA?

CPA consists of four papers that one must clear within the 18-month window. The papers are-

How much does a CPA make?

According to the AICPA survey, a qualified CPA with less than one year of experience can earn around $66,000 per year. In the United States, the average salary of an experienced CPA is $119,000. A person with 20 years of experience in CPA could command more than $152,000 annual pay.

How much does it cost to get a foreign credential evaluation?

NASBA International Evaluation Services ( NIES) is one of the approved agencies and it costs $225 for the evaluation report.

What is an ACCA membership?

ACCA membership equips you with the skills and knowledge to become a complete finance professional. CPA –It is a US-based accounting body established in the 1800s. It is organized by the American Institute of CPA. Entry requirements –Anyone with a 4-year bachelor’s degree and master’s degree.

How many sections are there in CPA?

As CPA has only 4 sections- Single level exam unlike other professional courses, the duration becomes shorter accordingly.

How long does it take to clear all 4 exams?

Some people clear all four exams within 4-5 months, others might take more than 18 months. Do not stress out by comparing yourself with others. Everyone has their own pace to achieve success. Good luck!!

How long does it take to get a CPA notice?

Obtain Your Notice to Schedule (NTS) It takes about 4 weeks after applying for the CPA exam to receive your notice to schedule in the mail. This is the legal document that allows you to sit for and take the CPA exam in your state. Yup, it’s a big deal.

How long is the CPA exam good for?

This document allows you to sign up for a CPA exam section in your state. It’s usually only good for 90 days, so you’ll have to decide which section you want to take first before it expires.

How long do you have to schedule your NTS exam?

You have 6 months from receiving your NTS (step 5) to schedule your exam dates. If the time limit is exceeded, your exam fees will be lost and you will have to pay them again. This is probably the stupidest part of the application process because there is no reason for state boards or NASBA to do this.

What is the first step in the CPA application process?

The first step in the CPA exam application process in the United States is to determine if you are eligible to take it. This is the first big misstep that many CPA Candidates make. They start filling out their application before they are even qualified to sit for the exam. They send in their app and hear back months later that it got rejected.

How much does it cost to take the NASBA exam?

Each state charges slightly different exam fees, but most range $180 – $250 per section.

How long do you have to wait to apply for NTS?

There are a few states that have different NTS windows. CA, HI, LA, and UT give you 9 months. ND, SD, and VA give you 12 months. Texans BEWARE! You only have 90 days from your application date.

When to order transcripts from colleges?

It’s good to order your transcripts from the colleges as soon as you graduate or fulfill the state requirements and send them into your state board. Once the state board receives them, they will keep them on file and wait for your application.

Popular Posts:

- 1. how to add drive companion to schoology course

- 2. is based on the rates at which intelligence develops in children course hero

- 3. does a course from which i withdrew count toward my gpa

- 4. environment management refers to when a company course hero

- 5. the long run is that period in which firms: course hero

- 6. which cell type(s) typically has/have cell walls course hero

- 7. what are the mountains behind the golf course at the pga this weekend

- 8. what is the best translation for natures changing course in shakespeare sonnet 18

- 9. what bindings are already defined course hero

- 10. how much is a hairdressing course