How much does Dave Ramsey course cost?

I'm still working through the actual baby steps, so I thought I'd share exactly what FPU — which costs $129 per family for a year-long membership — teaches you to do.Oct 4, 2019

What makes Dave Ramsey qualified?

At age 18, Ramsey took the real estate exam and began selling property, working through college at The University of Tennessee, Knoxville, where he earned a Bachelor of Science degree in Finance and Real Estate.

What is the Dave Ramsey program?

Dave Ramsey's 7 Baby Steps: Baby Step 1: Save $1,000 in an emergency fund. Baby Step 2: Pay off all debt (except your mortgage) using the debt snowball method. Baby Step 3: Save 3-6 months of expenses in an emergency fund. Baby Step 4: Invest 15% of your household income for retirement.Jan 9, 2021

Is Ramsey classroom free?

And great news! You can try Ramsey+ for free today. You'll get all the video lessons, plus plenty of awesome tools and resources to help you get your money on the right track—right now.Sep 23, 2021

Is Dave Ramsey a billionaire?

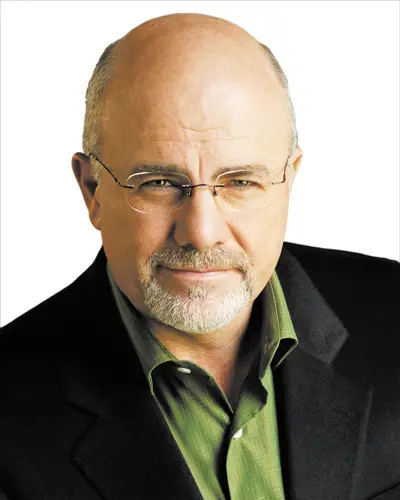

As of 2022, Dave Ramsey's net worth is approximately $200 million. He is an American radio show host and businessman from Tennessee. Ramsey is best known for the syndicated radio program, 'The Dave Ramsey Show'. He has written numerous books including five The New York Times bestsellers.Apr 2, 2022

Did Dave Ramsey go to college?

University of Tennessee1982Antioch High SchoolDave Ramsey/Education

What are the 7 steps of Dave Ramsey?

Dave Ramsey's 7 Budgeting Baby StepsStep 1: Start an Emergency Fund. ... Step 2: Focus on Debts. ... Step 3: Complete Your Emergency Fund. ... Step 4: Save for Retirement. ... Step 5: Save for College Funds. ... Step 6: Pay Off Your House. ... Step 7: Build Wealth.Feb 15, 2022

How long are Dave Ramsey classes?

45 to 90 minutesMost classes meet once a week for nine weeks for 45 to 90 minutes.

What is the 50 20 30 budget rule?

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

What are the four walls?

Basically, the four walls are the things you absolutely must pay for to keep on living. As Dave Ramsey lists them, the four walls are food, shelter, basic clothing, and basic transportation.

What are the five foundations?

The Five Foundations: The five steps to financial success: (1) A $500 emergency fund; (2) Get out of debt; (3) Pay cash for a car; (4) Pay Cash for College; (5) Build wealth and give.

What is the fifth foundation?

5th Foundation. build up wealth and give. a developmental partnership through which one person shares knowledge , skills, and perspective to foster the personal and professional growth of someone else. mentorship. a form of federal or state financial aid that does not need to be repaid.

Foundations Self-Study

Fully digital online courses designed for middle school & high school students to continue their education at their own pace.

Homeschool: High School

Homeschooling your high school student just got easier with our award-winning Foundations in Personal Finance homeschool curriculum and online self-study courses.

Homeschool: Middle School

These curriculum options offer both digital and one-on-one options for homeschooling your middle school student.

Foundations: School Edition

The School Edition of our award-winning Foundations in Personal Finance curriculum is designed to be used by public school teachers in a middle school or high school classroom setting.

Foundations: College Edition

Foundations in Personal Finance: College Edition is a turn-key academic curriculum that engages students and teaches them practical and relevant financial skills.

What will you get from Ramsey Pro Training?

Don’t worry—no useless certificates or long, rambling graduation speeches. We have something better to offer you. When you finish the lessons and pass the final assessment, you’ll get these three things:

The Three Pillars of Ramsey Pro Training

After 20 years of listening to our customers, we’ve discovered the values that every rockstar professional in our program has. Ultimately, at the end of this course, you’ll know why these values are important to our fans—and how to exhibit them.

So, what exactly is Ramsey Pro Training?

Ramsey Pro Training is an online course that will take you step-by-step through our financial principles and business best practices. Think of it as the Ramsey boot camp: When you finish this course, you'll know exactly what it takes to be a Ramsey professional.

Dave Ramsey

We’ve made it easy with great courses like Financial Peace University. You’ll learn the timeless principles of paying off debt, saving for emergencies, and investing in your future. You’ll learn the timeless principles of paying off debt, saving for emergencies, and investing in your future.

Sign in - The Dave Ramsey Show

Only five states require schools to teach a full semester personal finance course. Your Teen Can Be Different You can help ensure your teen's real-world success by empowering them with Dave Ramsey's proven personal finance principles.

Foundations in Personal Finance ... - The Dave Ramsey Show

With auto-graded assessments, engaging video content and—best of all—no need for an instructor, this self-paced online course can easily fit into even the busiest of schedules. Dave and his team of experts will do all the teaching, and you can have peace of mind about your child’s financial future.

Financial Coach Master Training

Once you have successfully completed the FCMT online lessons and attended the live training sessions, you will earn the designation of Ramsey Solutions Master Financial Coach. This is a designation you can use when promoting your coaching services.

Ramsey Education

Foundations in Personal Finance is designed as a semester-long course with stand-alone chapters. We provide you with 45-, 90- and 180-day pacing guides that you can choose from, but if you don’t need a full semester course, the stand-alone chapters allow you to make the course fit your schedule—not the other way around.

Kids & Youth Money Education Products - The Dave Ramsey Show

Don't let today's debt-loving money culture educate your children. Instead, give them the future you want them to have with the perfect books and tools that will teach them to win with money!

What is the best method to study?

For every 30 minutes, you study, take a short 10-15 minute break to recharge. Make studying less overwhelming by condensing notes from class. Underline or highlight keywords. Create visual aids like charts, story webs, mind maps, or outlines to organize and simplify information and help you remember better.

Popular Posts:

- 1. what is course semolina

- 2. which statement is not true about party identification course hero

- 3. taxable income rises by $1,500 and taxes rise by $435. what is the marginal tax rate? course hero

- 4. how to make a canvas course publicly accessibl;e

- 5. how far to drive from brautarholt golf course, iceland to namshestar, iceland

- 6. course hero: what do throughput and output combine to accomplish?

- 7. ocean county college how to register for online course

- 8. course how to write blog posts

- 9. how to choose your course load

- 10. why did the united nations take the lead role in decolonization? course hero