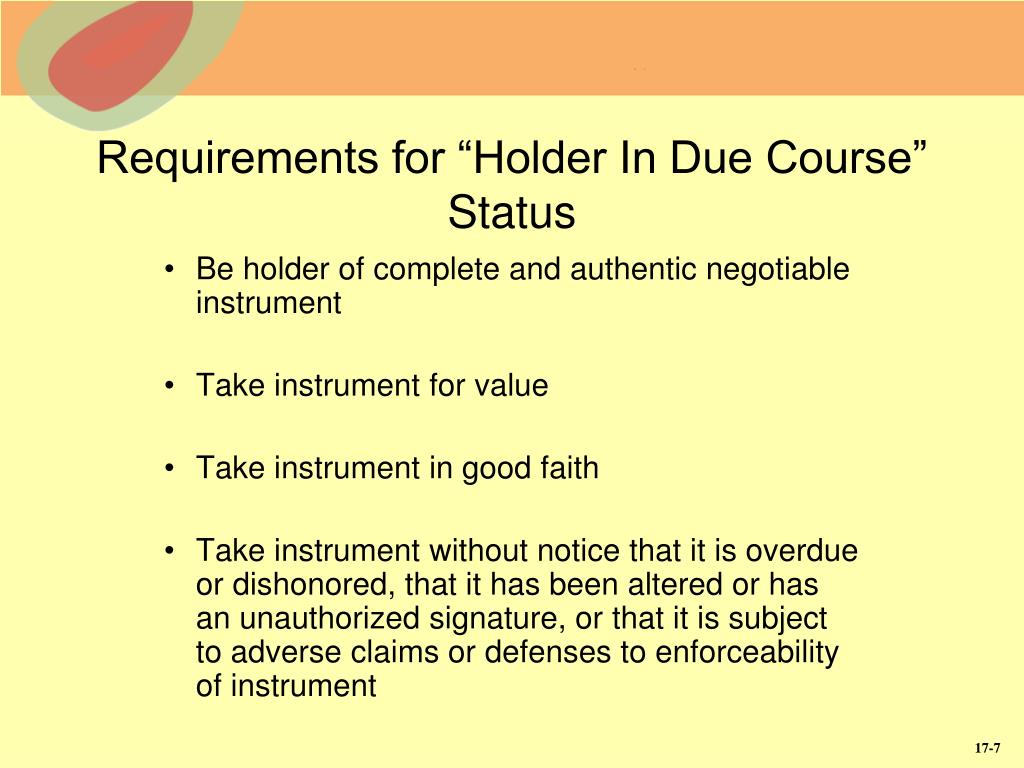

Meaning of holder in due course: – Holder in Due Course is defined as a person who acquires the negotiable instrument in good faith for consideration before it becomes due for payment and without any idea of a defective title of the party who transfers the instrument to him.

Full Answer

What is a holder of a negotiable instrument?

Holder refers to a person, the payee of the negotiable instrument, who is in possession of it.

Who is a holder in due consideration of an instrument?

Now the person who took it for value in good faith now becomes a real owner of the instrument and is known as “holder in due consideration”.

What is difference between negotiable instrument and holder in due course?

Whereas a holder in due course is a person who can possess an instrument for a consideration. The person must become the holder of the instrument before it gets matured and the negotiable instrument must be complete in all forms and requisites and the holder must have received the instrument in good faith.

Who is a holder of an instrument of possession?

The person by way of the instrument must be entitled to recover or receive a sum of money or amount which the parties are liable to pay the holder. Therefore not only possession but the right to receive is also an important aspect in order to be termed a holder.

What is a holder in due course of a negotiable instrument?

Holder” in due course” means any person who for consideration becomes the possessor of a promissory note, bill of exchange or cheque if payable to bearer, or the payee or indorsee thereof, if payable to order, before it became overdue, without notice that the title of the person from whom he derived his own title was ...

Is a holder for value a holder in due course?

In commercial law, a holder in due course is someone who takes a negotiable instrument in a value-for-value exchange without reason to doubt its legitimacy. A holder in due course acquires the right to make a claim for the instrument's value against its originator and intermediate holders.

What is a holder in due course and what are the requirements for a person to be a holder in due course?

The UCC provides that to be an HDC, a person must be a holder of paper that is not suspiciously irregular, and she must take it in good faith, for value, and without notice of anything that a reasonable person would recognize as tainting the instrument.

What are the conditions for a holder to be considered a holder in due course?

To become a holder in due course of a negotiable instrument, a party must first qualify as a “holder” of the instrument. This means that the person must have possession of the instrument, and the instrument must be payable to that person or payable to bearer.

Who is holder of negotiable instrument?

“Holder”. —The “holder” of a promissory note, bill of exchange or cheque means any person entitled in his own name to the possession thereof and to receive or recover the amount due thereon from the parties thereto.

Who is holder for value in negotiable instrument?

One who has given a legal consideration for a negotiable instrument is a holder for value. The holder of a negotiable note taken as collateral security for a preexisting debt is a holder for value in due course of business.

Who is the holder in due course in Philippine law?

(1) A holder in due course is a holder who takes the instrument (a) for value; and (b) in good faith; and (c) without notice that it is overdue or has been dishonored or of any defense against or claim to it on the part of any person. (2) A payee may be a holder in due course.

Who is holder in due course with example?

Holder in Due Course is a legal term to describe the person who has received a negotiable instrument in good faith and is unaware of any prior claim, or that there is a defect in the title of the person who negotiated it. For example; a third-party check is a holder in due course.

What does it meaning to be a holder in due course?

Definition of holder in due course : one other than the original recipient who holds a legally effective negotiable instrument (such as a promissory note) and who has a right to collect from and no responsibility toward the issuer.

What is holder for value?

: a holder to whom an instrument is issued or transferred in exchange for something of value (as a promise of performance, a security interest or lien in the instrument not obtained by judicial process, payment of or use of the instrument as security for a claim against another person, a negotiable instrument, or the ...

Who among the following is the holder of a negotiable instrument originally payable to order?

The original payeeB 3. Who among the following is the holder of a negotiable instrument originally payable to order? a. The original payee who has negotiated the instrument.

What is a holder in due course quizlet?

Holder in Due Course (HDC) A holder who acquires a negotiable instrument for value, in good faith, and without notice that the instrument is overdue, that it has been dishonored, that any person has a defense or claim against it, or in any way question its authenticity. Indorsee.

What is the holder of a negotiable instrument?

What is the holder? Sec 8 of Negotiable Instrument act defines the term, “Holder”-The holder of a negotiable instrument is any person who is for the time being entitled in his own name and right to the possession of the instrument and to receive and recover the amount due on the instrument.

What is the name of the holder on an order instrument?

In the case of an order instrument, the name of the holder appears on the document as payee or endorsee. In the case of a bearer document, a payee claims the money without having his name mentioned on the cheque. According to this section, the holder has the capacity to receive payment or recover the amount by filing a suit in his own name ...

What is the difference between a holder and a holder in due course?

The difference between Holder and Holder in due course-. Holder refers to a person, the payee of the negotiable instrument, who is in possession of it. A person, who is entitled to receive or recover the amount due on the instrument from the parties to that, whilst the holder in due course connotes a person who incurs the instrument for value ...

What is the meaning of Section 8 of the Negotiable Instruments Act?

October 15, 2020. Section 8 of Negotiable Instruments Act 1881defines the term Holder as The holder of a negotiable instrument is any person who is for the time being entitled in his own name and right to the possession of the instrument and to receive and recover the amount due on the instrument.

Who is the holder in due consideration?

Now the person who took it for value in good faith now becomes a real owner of the instrument and is known as “holder in due consideration”. According to Section 9, “Holder in due course means any person who for consideration became the possessor of a promissory note, bill of exchange or cheque is payable to bearer, ...

When can a person become a holder?

A person can become a holder before or after the maturity of negotiable instrument, on the other hand, a person can become holder in due course, only before the maturity of the negotiable instrument.

Who is entitled to possession of an instrument?

A holder is entitled in his own name to the possession of the instrument, whilst a holder in due course acquires the possession of the instrument for consideration.

What is the term for a person who is not entitled to receive an instrument?

Thus he is not called a holder .

What is the difference between a holder in due course and a holder in due course?

Holder. Holder in Due Course. Holder is a person who can lawfully possess an instrument and receive or recover the amount from parties. A holder in due course takes the instrument in bonafide faith for a consideration before the instrument’s maturity. Consideration is not necessary.

What is Sec 120?

Sec 120 of the Act contemplates that when a holder in due course files a suit for recovery of amount which is due on the instrument, then the maker of the promissory note, bill of exchange or cheque cannot take the plea to evade his liability that when the instrument was drawn it was invalid.

What happens if a negotiable instrument is acquired by a person bonafidely for

If a negotiable instrument is acquired by a person bonafidely for a value and he believes there is no defect in the title from whom he took the instrument in good faith becomes the true owner of the negotiable instrument and a holder in due course.

What are the rights of a holder?

The rights of a holder are: As per Sec 8 of the act to possess an instrument and to receive and recover the amount which is due as per the instrument; As per Sec 50 of the Act to endorse the instrument; As per Sec 125 of the Act to cross the instrument after it is issued.

What is the Negotiable Instruments Act?

The Negotiable Instruments Act, 1881 (hereinafter referred to as the Act) is a statute which regulates the working of instruments which can be negotiated for amount. It lays down the frame work under which these instruments operate and any contravention in these rules has been made punishable.

Can a holder in due course recover an instrument?

Therefore a holder in due course is entitled to recover amount mentioned in the instrument even though the payee has no capacity to endorse the instrument. Sec 36 of the act contemplates that until the instrument is satisfied; all the parties to an instrument are liable to the holder in due course. The liability is joint and several.

What is a holder in due course?

The holder in due course is a concept that refers to the party who holds an important, and often negotiable, document. This document is sometimes referred to as an instrument because it is often an instrument of payment. This might include a bank note, draft, or check. The holder is temporarily the owner of the document that holds value.

Who is the holder of a document?

At some point, the document is negotiated and used as a useful commercial tool. The holder is referred to as the assignee. They are in possession of the assignor's rights and liabilities. The holder is in a very important role. They are responsible for the document that is free of claims from other owners.

What happens if one party accepts an instrument but does not complete their end of the deal?

If one party accepts the instrument but does not complete their end of the deal, they are not the true holder of the item. There are two exceptions to this executory promise rule: If the instrument is given in exchange for a negotiable item. If the instrument is transferred from an irrevocable obligation to a third party.

What happens if you transfer an instrument of payment to a third party?

If the instrument is transferred from an irrevocable obligation to a third party. Additionally, the holder in due course must accept the payment in good faith. If there is any evidence of fraud or foul play, the holder in due course should not accept the instrument of payment. The holder in due course has specific rules ...

What is due course in law?

The holder in due course is in a unique position with protection against others. In order to prevent this power from becoming abusive; they are still required to follow these rules: There cannot be any clear proof of forgery or unauthenticated action of the negotiable document, or instrument.

Can a lien be accepted after accepting an instrument?

The holder in due course fulfilled a promise after accepting the instrument. The holder can also accept the instrument through means of a lien through a court ruling or bankruptcy sale. The holder could collect the instrument to eliminate preexisting debt.

Can a document be accepted as a gift?

This means that the transfer of the document must have been for its value. In contrast, it cannot be accepted as a gift. There are five different methods in which the holder in due course can accept the document as a source of value: The holder in due course fulfilled a promise after accepting the instrument.

Popular Posts:

- 1. how to access course guides uga library

- 2. payment by salary or wage most closely approximates which schedule of reinforcement? course hero

- 3. which of the following is not a consideration in conducting a meeting? course hero

- 4. how will this course benefit your career essay

- 5. what happens trespass in golf course

- 6. how can my school find out if i'm using course hero

- 7. which of the following will increase genetic diversity, but is relatively slow? course hero

- 8. when your online course is put up for adoption

- 9. what is transition to higher mathematics course

- 10. where does a sensei virtual course go after being purchased