Certificate courses in Taxation duration ranges from 1 hours to 30 hours that deal with topics like Direct taxes, Indirect Taxes, etc. These courses are ideal for professionals already working in the Finance industry or for individuals who are already looking to start working in the industry.

Full Answer

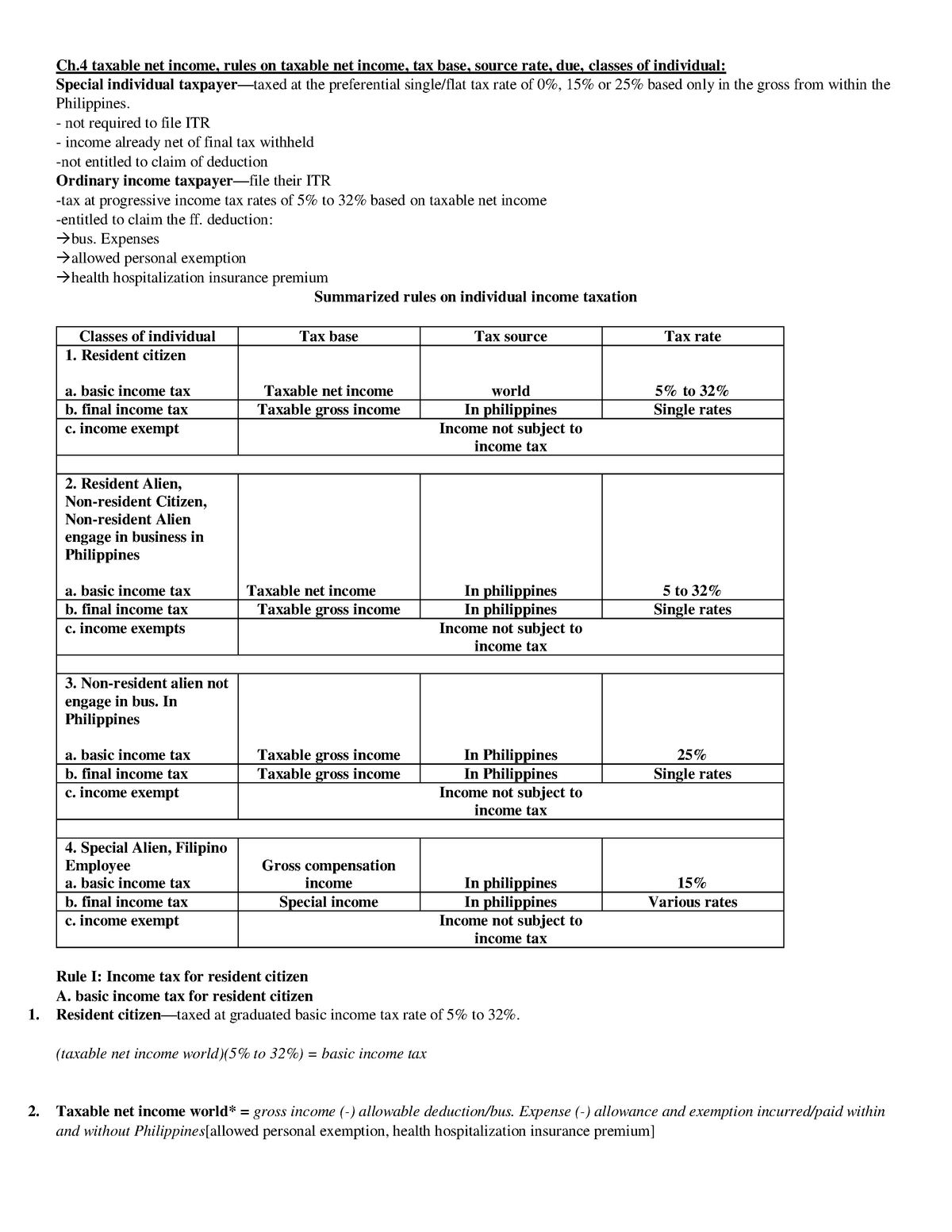

What are the taxation courses?

Taxation courses provide knowledge to the students on local, federal and state taxes. The students who get themselves enrolled for the courses solve complex problems related to taxation. Students who wish to study Taxation have numerous course options available to them.

What topics can I study that are related to taxation?

Topics you can study that are related to taxation include international tax law if you’re working in global business. Contract law and business entities are other topics you could study that are related to taxation. Additionally, you could study financial planning or learn about land transfers in coordination with your taxation studies.

What can you do with a Taxation degree?

Taxation covers all types of taxes, including income, property, payroll, and real estate tax. Unlike general accounting degrees, taxation concentrations focus on one part of the accounting process. These concentrations prepare graduates for positions like tax analyst and tax manager.

What are the job options after certification Taxation course?

What are the Top Job Options After Certification Taxation Courses? 1 Tax Analyst. Tax Analysts help in the preparation, review, and filing of taxes for individuals and businesses. Tax Analysts also look for ways to help ... 2 Accountant. 3 Finance Manager. 4 Tax Accountant. 5 Tax Advisor.

What are the qualifications for taxes?

As of the 2021 tax year, the minimum gross income requirements are:Single and under age 65: $12,550.Single and age 65 or older: $14,250.Married filing jointly and both spouses are under age 65: $25,100.Married filing jointly and one spouse is age 65 or older: $26,450.More items...

Which course is best for taxation?

Courses & EligibilityDiploma in Accounting & Auditing.Post Graduate Diploma in Accounting.Diploma in Taxation.Diploma in Tax & Company Law.Advance Diploma in Financial Accounting & Taxation.Advance Diploma in Taxation.Post Graduate Program in Tax Management.

Where do I start to learn about taxes?

Compare the Best Tax Preparation CoursesTax Prep CourseWins ForCostSurgent Income Tax SchoolBest Overall$29 to $1,497Federal Income Tax Course by the National Tax Training SchoolBest for Beginners$625 to $720Advanced Tax Preparation by the National Tax Training SchoolBest for Advanced$745 to $7604 more rows

What skills do tax preparers need?

Required Skills/Abilities:Excellent verbal and written communication skills.Excellent interpersonal and customer service skills.Ability to understand and apply tax laws and changes in the preparation process.Excellent organizational skills and attention to detail.Accurate math and accounting skills.More items...

What are taxation courses?

Taxation course is offered at certification, UG, PG and Diploma Levels. The duration of the taxation course is a maximum of 3 years. The course aims at imparting practical and theoretical knowledge of financial accounting, direct taxation, indirect taxation and auditing.

What does diploma in taxation do?

Diploma in Taxation is a 3-year programme in the Faculty of Accounting and Informatics. The program is designed to provide students with knowledge of Taxation and Auditing. This qualification serves as the academic progression toward the membership with South African Institute of Professional Accountants.

How do I become an income tax practitioner?

According to the rule the qualification to become an income tax practitioner are:Law degree with second division.Commerce degree with subjects such as income tax law and accounting.Degree in business administration and management with the subject of accounting, law at the very least.Bachelor of Accounting.

How much does it cost to Learn How do you do taxes?

BASIC COURSES Federal Basic $199.00: Includes over 50 hours of Federal Law, textbooks, and a workbook. California $249.00: Includes 50 hours of Federal Law, 2 hours of Ethics, and 15 hours of California Law content.

Why do we learn tax?

Why study taxes? To pay taxes is a part of nearly every adult's life. Whether it's income tax, state tax and federal tax, or business tax, taxpayers must plan for these payments. The internal revenue service (IRS) keeps records and ensures that everyone who owes taxes pays them.

Is tax preparation a good career?

High Earning Potential According to the U.S. Bureau of Labor Statistics, or BLS, tax preparers earned an average salary of $52,710 per year as of May 2020. The BLS reports that accountants working in tax preparation services averaged an annual salary of $85,050 per year as of May 2020.

Do you need to be good at math to be a tax preparer?

Tax-related math is hardly straightforward, so strong math skills are paramount. Being good with numbers will help you be successful as a tax preparer and can help you catch some mistakes, but the trait that will save you time and time again in this industry is attention to detail.

What is tax accountant?

Accountants that specialize in the laws, rules, and regulations for the preparation and calculation of federal, state, and local taxes are typically known as tax accountants. Tax accountants provide a range of tax-related services to both individuals and businesses, which can include preparing and filing tax returns.

What is taxation, and why is it important to learn about?

Taxation is the imposition of levies on individuals as well as businesses and corporations by governments. The revenues raised by taxes are used to...

What kinds of careers can I have with a background in taxation?

Almost all companies, from sole proprietors to multinational corporations, rely on accountants to ensure that their taxes are paid properly and on...

Can I learn about taxation by taking online courses on Coursera?

Yes! Coursera offers a wide range of courses on a variety of business topics, including in-depth courses and Specializations spanning multiple cour...

What kind of people are best suited for roles in taxation?

People with good analytical skills and who are good with numbers are typically best suited to roles in taxation. Since taxation revolves heavily ar...

What are common career paths for someone in taxation?

Common career paths for people in taxation can typically include working for the government, performing tax accounting for accounting firms, and of...

What topics can I study that are related to taxation?

Topics you can study that are related to taxation include international tax law if you’re working in global business. Contract law and business ent...

What types of places hire people with a background in taxation?

Agencies that prepare taxes for people and individuals typically hire people who have a background in taxation. Some of the job titles for these jo...

Ques: Is it worth doing a business accounting and taxation course?

Ans: Yes, business accounting and taxation courses are quite popular in India and will give you an excellent career.

Are certificate courses in Taxation available?

Yes, a lot of certification courses are available in both online as well as offline mode.

Can I study Taxation abroad?

There are multiple foreign universities from where you can study Taxation.

What are the most popular Taxation courses?

The most popular Taxation courses are the BCom and MCom courses in taxation.

What is the average salary of Taxation students?

The average starting salary for the Taxation course students is around INR 2,00,000 to 8,00,000.

Is there any specific Bachelor degree course for Taxation in India?

Yes, the BCom Taxation course is quite popular among the students of India.

How can I make a career in Taxation?

You can seek jobs at various governmental and non-governmental organizations. You may also take up the job of a financial consultant.

What is the scope of LLB in the taxation field?

An LLB in Taxation will give you the job profile of a Tax Lawyer.

What is the average tuition fee for the Taxation courses?

The average tuition fee for the Taxation courses is around INR 5,000 to INR 2,00,000.

Is the course ADIT (Advanced Diploma in International Taxation) really worth doing?

The ADIT course will help you to take up the job of a Tax Manager at various foreign countries.

What is taxation course?

Taxation is a method initiated by the government of a country to collect tax from the citizens to pay for various public-related expenses. Taxation courses provide knowledge to the students on local, federal and state taxes. The students who get themselves enrolled for the courses solve complex problems related to taxation.

How long is a tax certificate course?

The certificate courses mostly have a short duration of around 6 months to 1 year. Few online certificate courses may even be a few weeks. The diploma and PG diploma Taxation Courses are of 1 year while the degree courses are of 2 to 3 years. The course fee is around INR 5,000 to 2,00,000.

How long is a bachelors in taxation?

These courses are meant to prepare the students to become a part of the revenue department of the country. The course mostly has a duration of around 3 years. Master Taxation Courses.

How long is a tax doctorate?

The doctorate Taxation courses mostly have a duration of around 3 to 5 years.

What is the role of mathematics in taxation?

Mathematics plays a vital role in the study of Taxation. Until and unless you have a good grasp on Mathematics, you will not be able to prosper in the subject.

What is a tax manager?

A Tax Manager delivers a full range of tax-related services within a particular time frame. They interact with the clients and provide consultations. They are also responsible for overviewing complex tax returns. A Tax Manager also works for government organizations.

What is the job of a tax accountant?

The responsibilities of a Tax Accountant include preparing documents related to tax returns, advising on investment opportunities, assisting clients with income tax statements, developing different types of strategies to minimize the income tax.

What is federal taxation?

Federal Taxation I: Individuals, Employees, and Sole Proprietors. This course is the first course in a five-course US Federal Tax Specialization. It covers and focuses on the U.S. federal tax system as it relates to individuals, employees, and sole proprietors.

What is a Coursera specialization?

A Coursera Specialization is a series of courses that helps you master a skill. To begin, enroll in the Specialization directly, or review its courses and choose the one you'd like to start with. When you subscribe to a course that is part of a Specialization, you’re automatically subscribed to the full Specialization.

What is a cost recovery course?

This course examines the U.S. federal tax system as it relates to property transactions of business owners and shareholders. Topics include cost recovery, such as depreciation, amortization, and depletion; calculation of realized versus recognized gains and losses; evaluation of the potential tax effects of nontaxable exchanges; and the combining, or netting, gains and losses that are different in nature. Assignments facilitate self-discovery of knowledge and development of a variety of professional skills.

Why do people with a bachelor's degree in taxation make more money?

More Job Prospects: Employers seek a combination of education and experience , and many taxation concentrations supply learners with both, expanding their job opportunities.

How much do tax specialists make?

Many taxation specialists work as accountants or auditors. According to the BLS, accountants and auditors earn a median annual salary of $71,550, with the top 10% of earners making more than $124,450. According to the BLS, tax examiners and collectors, who only need a bachelor’s degree, earn a median salary of $54,890.

What is accounting field?

The accounting field includes many concentrations aside from taxation, which lead to a variety of careers. For example, professionals who want to perform government tax audits benefit from forensic accounting or auditing concentrations.

What does a tax accountant do?

Tax accountants work for individuals, private companies, and public organizations to prepare and submit tax documents. They also advise clients on how to strategically pay, defer, and eliminate taxes while complying with local, state, and federal laws.

What is a tax manager?

Tax Manager. A high-level position for tax professionals, tax managers prepare and file taxes for companies; oversee internal public offerings, mergers, and acquisitions; and ensure that clients remain compliant to avoid audits. Tax managers must hold a master’s degree and CPA credentials.

What is the National Society of Accountants?

National Society of Accountants: A large organization for all types of accounting professionals, the NSA offers members access to industry information, professional development resources, and exam study materials. NSA also awards scholarships to current accounting and taxation students across the nation.

What is federal income tax?

Sometimes split into an introductory and advanced course, federal income taxation covers the basic principles of income tax, including various tax brackets, tax rules, and definitions used to determine taxable income. Some programs focus on the relationship between federal and state income taxes.

How many semesters are there in a tax diploma?

A Diploma in Taxation is usually of one year, dividing it into two semesters. Given below are the subjects and topics taught under the course: Income Tax. Indirect Taxes. Financial Taxes and Analysis. Advance tax- Assessment procedures and Provisions. Computation of Total Income and Determination of Tax Liability.

What is a tax diploma?

Diploma in Taxation. Taxes are essentially levied by government organisations in order to be utilised for funding public expenditures. For those aspiring for a career in commerce stream, the field of Accounting and Taxation is particularly alluring if you are good at calculations and are interested in how the financial aspects of an economy work.

Is a tax degree full time?

Generally offered as a one-year programme, Diploma in Taxation can be pursued in either full-time or distance mode. Amongst the varied diploma courses after graduation, it is a specialised one that aims to prepare students for the lucrative job profiles of accountants and tax law specialists.

Is a tax diploma a good option?

Diploma in Taxation is a great option for those interested in exploring this specialised field irrespective of what they have studied in graduation. Since it is a short term program with the flexibility of doing it full-time or in distance mode, it is a perfect one for working professionals as well.

The 2021 Comprehensive Tax Course is available and better than ever!

Now includes pointers you’ll appreciate as useful, practical advice to be applied in your daily work. Materials concentrate on advancement of careers and profitability. Plus, relevant updates provided regularly so you remain informed on your craft!

About the Comprehensive Tax Course

In this beginner tax preparer course, you will learn to prepare tax returns and research tax issues for most Form 1040 individual, non-business taxpayers; plus the basics of Schedule C/self-employed tax returns.

Easy to Understand

Written in plain English, with real-world examples to apply what you learn.

FREE AFTR Course

FREE Annual Federal Tax Refresher Course to qualify for voluntary IRS Annual Filing Season Program.

Business Start-up Guide

Start your own home-based tax business without franchise fees or royalties! Guide available for as low as $99.

Group Pricing

Group pricing is available for two or more students taking the same course.

Digital Badging

A secure, online version of your credential. Digital badging is available for 4 of our core tax training programs. Learn more

What is a certificate in taxation?

Certificate Courses In Taxation. Certificate courses are short term courses that are usually popular among full-time students or working professionals. They are self-paced meaning the courses can be completed at one’s own pace. The duration of certificate courses ranges from a few hours for online courses to up to 1 year for offline certificate ...

What is a tax analyst?

Tax Analysts help in the preparation, review, and filing of taxes for individuals and businesses. Tax Analysts also look for ways to help reduce the tax amount to be paid. Most Tax Analysts work in a full-time capacity in organizations or as contractors.

How long is a certificate course?

The duration of certificate courses ranges from a few hours for online courses to up to 1 year for offline certificate courses. Admissions are done on a merit basis and courses admit students who have completed their Class 10 or 12.

How long is a tax certificate?

Certificate courses in Taxation duration ranges from 1 hours to 30 hours that deal with topics like Direct taxes, Indirect Taxes, etc. These courses are ideal for professionals already working in the Finance industry or for individuals who are already looking to start working in the industry.

What is the job of an accountant?

They prepare and maintain financial statements and prepare predictions based on them. Another part of their job responsibility is to prepare tax statements to submit at the end of the financial year.

What is tax advisor?

Tax Advisors are experts in Income Tax and Financial Accounting. They help look for ways to reduce the amount of tax to be paid. Tax Advisors possess law degrees and/or Finance degrees.

What is GST in India?

Goods and Service Tax or GST for short is an all encompassing indirect tax that is charged on the manufacture, sale and consumption of goods and services. GST was introduced to reduce limitations in existing indirect taxes. Companies across India have to make significant changes to be ready for GST changes. Taxation professionals need in-depth knowledge of GST to assist organisations in the change.

What is tax preparation course?

Tax preparation courses can help beginner and experienced tax preparers advance their careers by providing information and curriculum on everything from basic knowledge to Enrolled Agent (EA) exam prep to continuing education credits. The best tax preparation courses are offered by reputable companies, come with an affordable cost, ...

How long does it take to complete the tax preparation program?

You complete the program’s 20 online modules at your own pace, which means it can be completed in as quickly as eight weeks or it could take up to a year. Expect it to take about eight hours to finish each unit.

How long does it take to prepare taxes for volunteer?

If you want to serve as a VITA/TCE volunteer, you can get tax preparation training from the IRS for free. You can expect it to take about 30 hours to complete this training course. Before you can begin preparing taxes, you’ll need to pass the training exam with a score of at least 80%.

How long is H&R Block tax course?

If you’re interested in exploring a career as a tax preparer, H&R Block offers a low-cost, 12-week virtual federal income tax course. You can expect to spend 80 to 90 hours of work on this course.

When was the National Tax Training School founded?

The National Tax Training School was founded in 1952 and is accredited by the Distance Education Accrediting Commission (DEAC). Its Federal Income Tax Course is delivered nationally and covers tax return preparation for individuals and small to medium-size businesses.

How old do you have to be to enroll in a tax prep school?

You’ll need to be at least 18 to enroll. Although the specific requirements vary slightly by state, you’ll usually need to have at least a high school diploma to be admitted. Classes open for enrollment in August each year. The goal is to teach you how to prepare taxes before the next tax season begins.

When are tax practitioners classes scheduled?

Note: The Tax Practitioner Institute classes are only scheduled at certain times of the year. Classes are normally scheduled by July each year. Prior to that you may find only a very small number of states with classes scheduled. Tax Practitioner Institutes are generally sponsored by state universities ...

What is a tax practitioner institute?

Tax Practitioner Institutes are generally sponsored by state universities and community colleges in partnership with the IRS to deliver high-quality continuing education credits to the tax professional community at reasonable cost.

Overview

Subjects Covered

- A Diploma in Taxation is usually of one year, dividing it into two semesters. Given below are the subjects and topics taught under the course: 1. Income Tax 2. Indirect Taxes 3. Financial Taxes and Analysis 4. Advance tax- Assessment procedures and Provisions 5. Computation of Total Income and Determination of Tax Liability 6. Organisation and Management 7. Computer Applic…

Eligibility Criteria For Diploma in Taxation

- Before pursuing this diploma program, it is essential for aspirants to qualify for the provided eligibility criteria which can mainly differ as per the course and university. Below, we have elucidated the basic prerequisites that are commonly asked from those applying for a diploma in Taxation: 1. The general requirement for a Diploma in Taxation is that the aspirant must have co…

Major Universities Offering Diploma in Taxation & Its Related Variants

- There are numerous universities who provide Diploma/Certificate Courses for Taxation and Accounting and their related variants. Below we have listed some of the prominent academic institutions across the globe that you must consider for studying a Diploma in Taxation: 1. Porto Business School, Portugal 2. Kwantlen Polytechnic University, Canada 3. ...

Career Prospects

- Diploma in Taxation is a great option for those interested in exploring this specialised field irrespective of what they have studied in graduation. Since it is a short term program with the flexibility of doing it full-time or in distance mode, it is a perfect one for working professionals as well. Further, if you are at an entry-level position in the domain of Finance and Accounting, you c…

Popular Posts:

- 1. from where on earth could you observe all of the stars during the course of the year

- 2. what do the filberts symbolize course hero

- 3. how much to play the masters course

- 4. how to play mongraal edit course

- 5. treehouse how to use webstorm course

- 6. how to do th time course of reaction

- 7. how much to charge for a 9 course golf

- 8. how to find course material on lion path

- 9. what effect did the presence of union troops in the south have on slaves? course hero

- 10. 1. what does the word “sustainable” mean? frame your answer in the context of this course