Dishonored note receivable is the note receivable that has already reached maturity, but the debtor or borrower does not pay back the amount owed. In this case, the company that is the holder of the note should make the journal entry for the dishonored note receivable.

Full Answer

What is the journal entry for Dishonored note receivable?

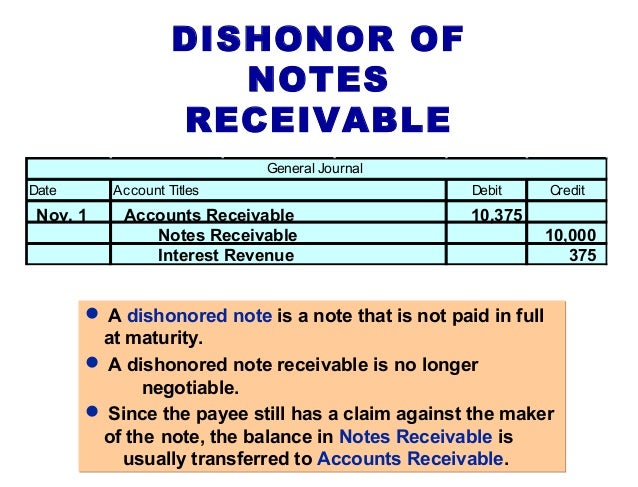

The dishonored note receivable journal entry is for the company to convert its form from the notes receivable to the accounts receivable. Likewise, the outstanding balance of the dishonored note receivable together with its interest receivable will be transferred to accounts receivable.

What should an accountant do if a note is Dishonored?

If the note is dishonored, then the accountant should do as follows: Necessary entry should be accounted with regards to the interest accrued to date by crediting an interest receivable account. The bank will inform about the legal procedures and bank charges will be applicable, which should be recorded as per the actual.

What is an example of a note receivable?

For example, on December 31, 2020, the company ABC has the note receivable of $10,000 that has been dishonored due to it has already reached maturity but no payment has been received yet. Also, the $500 of interest receivable belongs to such note.

How is the amount transferred from a promissory note to receivable?

In accounting terms, the amount, therefore, is transferred from the note receivable account to the receivable account. Promissory note is a written document without any condition to honor a certain amount of the funds on a specific date or on demand.

What happens after dishonoring a note?

How to understand a dishonor note?

What is debit side of account receivable?

What happens if a note is not paid on the due date?

What happens if a customer fails to pay a payment on the due date of a note?

What is a promissory note?

Is a note receivable considered a current asset?

See 4 more

About this website

What happens when a note receivable is dishonored?

Definition (3): A dishonored note refers to a note that the maker has failed to pay at maturity. The payee or holder records the due amount in accounts receivable and removes the note from notes receivable because it has been matured. The maker is bound to pay the principal and interest at a note's maturity date.

When a note receivable is dishonored it is preferably debited to?

What is the journal entry for the dishonored note? A dishonored note should be moved to Accounts Receivable. So debit Accounts Receivable for the 2,000 notes + $75 in interest = 2,075.

How do you record notes receivable in Dishonored?

The company can make the dishonored note receivable journal entry by debiting the accounts receivable and crediting the notes receivable account and interest receivable account.

How do you Journalize notes receivable?

What is the journal entry for interest on a note receivable? The journal entry for interest on a note receivable is to debit the interest income account and credit the cash account.

When a note receivable is dishonored or unpaid?

A dishonored note is a note that the maker failed to pay at maturity. Since the note has matured, the holder or payee removes the note from Notes Receivable and records the amount due in Accounts Receivable. At the maturity date of a note, the maker is responsible for the principal plus interest.

When a note is accepted to settle an open account note receivable is debited for the?

Answer and Explanation: When a note is accepted to settle an open account, Note Receivable is debited for the accounts receivable balance. This transaction is a transfer of the amount receivable from one asset account (Accounts Receivable) to another (Note Receivable).

How do you journal a dishonored check?

1:414:34Chapter 5.3 Recording dishonored checks, electronic funds ... - YouTubeYouTubeStart of suggested clipEnd of suggested clipAnd we're going to debit it for the amount of the dishonored. Check plus the fee as most times inMoreAnd we're going to debit it for the amount of the dishonored. Check plus the fee as most times in almost all businesses. They always pass all expenses on to the customers.

Where is a note receivable reported in the balance sheet?

current assets sectionThe notes receivable is an account on the balance sheet usually under the current assets section if its life is less than a year. Specifically, a note receivable is a written promise to receive money at a future date. The money is usually made up of interest and principal.

Is notes receivable debit or credit?

debitThe normal balance of notes receivable is a debit. Like all assets, debits increase notes receivable and credits reduce them.

What is an example of a note receivable?

Examples of Notes Receivable If a company borrows $100,000 from its bank and signs a promissory note to pay 6% interest quarterly and the principal amount in 9 months, the bank will debit its current asset account Notes Receivable and will credit Cash or Customers' Deposits for the principal amount of $100,000.

What is the difference between an account receivable and a note receivable?

Meaning: Note receivable is a written promissory note extending a line of credit to the other party, receivable in the future at a specified date along with interest. On the other hand, money owed by customers for purchasing goods or services on credit is known as accounts receivable.

When a promissory note is used to replace an outstanding accounts receivable balance the entry to record this transaction requires a debit?

When a promissory note is used to replace an outstanding accounts receivable balance, the entry to record this transaction requires a: Debit to notes receivable.

What account to debit if the company pays a delinquent Notes Receivable that was previously discounted?

When proceeds are received for the discounted notes, the Cash account is debited, and the Notes Receivable account credited. If the proceeds exceed the face value of the note, the Interest Income account is credited. If the proceeds are less than the face value of the note, Interest Expense is debited.

Is allowance for doubtful accounts debited when uncollectible accounts are written off?

The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No expense or loss is reported on the income statement because this write-off is "covered" under the earlier adjusting entries for estimated bad debts expense.

What are bad debts expense?

A bad debt expense is recognized when a receivable is no longer collectible because a customer is unable to fulfill their obligation to pay an outstanding debt due to bankruptcy or other financial problems.

Is accounts receivable an expense or revenue?

Does accounts receivable count as revenue? Accounts receivable is an asset account, not a revenue account. However, under accrual accounting, you record revenue at the same time that you record an account receivable.

Dishonored Note Receivable | Journal Entry - Accountinguide

Dishonored note receivable example. For example, on December 31, 2020, the company ABC has the note receivable of $10,000 that has been dishonored due to it has already reached maturity but no payment has been received yet.

Solved Dishonor of Notes Receivable: A dishonored | Chegg.com

Transcribed image text: Dishonor of Notes Receivable: A dishonored (defaulted) note is a note that is not paid in full at maturity. The payee still has a claim against the maker of the note for both the note and the interest. Therefore, the note holder usually transfers the Notes Receivable account to an Accounts Receivable account.

Financial Accounting Chapter 7 Flashcards | Quizlet

(1) Expense recognition requires expenses be reported in the same period as the sales they helped produce. The direct write-off method usually does not best match sales and expenses because bad debts expense is not recorded until an account becomes uncollectible, which often occurs in a period after the credit sale.

What is dishonored note receivable?

Overview. Dishonored note receivable is the note receivable that has already reached maturity, but the debtor or borrower does not pay back the amount owed. In this case, the company that is the holder of the note should make the journal entry for the dishonored note receivable.

How to make dishonored notes receivable journal entry?

The company can make the dishonored note receivable journal entry by debiting the accounts receivable and crediting the notes receivable account and interest receivable account.

Why do companies convert dishonored notes to accounts receivable?

The company usually converts the dishonored note receivable to the accounts receivable in order to mark the dishonored note and separate it from those of the collectible notes receivable. This also helps the company to easily keep track of the dishonored notes and make a better decision regarding the credit term or credit policy in the future.

What is the note receivable of ABC?

For example, on December 31, 2020, the company ABC has the note receivable of $10,000 that has been dishonored due to it has already reached maturity but no payment has been received yet. Also, the $500 of interest receivable belongs to such note.

What happens after dishonoring a note?

After dishonoring a note, the necessary accounting entries must be affected by the accountant.

How to understand a dishonor note?

In order to understand the formation of a dishonored note, consider the example of company ‘A’ such that the company sold a product to customer ‘X’, which was worth $5000. The customer was unable to pay the amount to the company and promised to give a 2 month note to the company. As per the note, the customer will pay the amount with an interest of 10% per month.

What is debit side of account receivable?

The debit side of the account receivable depicts that the amount was expected to be collected including the interest.

What happens if a note is not paid on the due date?

In the event, if the maker of a note is not able to pay the amount promised on the due date, the note receivable is dishonored. This note is non-negotiable. In accounting terms, the amount, therefore, is transferred from the note receivable account to the receivable account.

What happens if a customer fails to pay a payment on the due date of a note?

However, on the due date of the payment, that is, the maturity date , the customer failed to make the payment to the company. The note will then be considered a dishonored note and will be prepared as follows:

What is a promissory note?

Promissory note is a written document without any condition to honor a certain amount of the funds on a specific date or on demand. It is signed by the maker and stamped. It is generally used in scenarios where one of the parties involved is in the money lending business. It is used as a safety measure when the amount of transactions exceeds the normal limits. For the payee, the note is notes receivable. For the maker, it is notes payable.

Is a note receivable considered a current asset?

If the note receivable is due within 12 months, it is classified as current asset and similarly, if the period exceeds 12 months, it is classified as non-current asset.

What happens when a note fails to pay on the due date?

When the maker of a note fails to pay on the due date, the note receivable is considered to be dishonored. A dishonored note is no longer negotiable. In the books of creditors, the following entry is made : Debit Accounts Receivable. Credit Notes Receivable. Credit Interest Income or Interest Receivable.

How much is volume discount?

The volume discount is $1.50. This means that a 2% discount will be given to a customer for the amount paid within 15 days while the unpaid amount should be settled in 30 days. Cash discount – discount is given if full amount is paid within a normal credit period.

What happens after dishonoring a note?

After dishonoring a note, the necessary accounting entries must be affected by the accountant.

How to understand a dishonor note?

In order to understand the formation of a dishonored note, consider the example of company ‘A’ such that the company sold a product to customer ‘X’, which was worth $5000. The customer was unable to pay the amount to the company and promised to give a 2 month note to the company. As per the note, the customer will pay the amount with an interest of 10% per month.

What is debit side of account receivable?

The debit side of the account receivable depicts that the amount was expected to be collected including the interest.

What happens if a note is not paid on the due date?

In the event, if the maker of a note is not able to pay the amount promised on the due date, the note receivable is dishonored. This note is non-negotiable. In accounting terms, the amount, therefore, is transferred from the note receivable account to the receivable account.

What happens if a customer fails to pay a payment on the due date of a note?

However, on the due date of the payment, that is, the maturity date , the customer failed to make the payment to the company. The note will then be considered a dishonored note and will be prepared as follows:

What is a promissory note?

Promissory note is a written document without any condition to honor a certain amount of the funds on a specific date or on demand. It is signed by the maker and stamped. It is generally used in scenarios where one of the parties involved is in the money lending business. It is used as a safety measure when the amount of transactions exceeds the normal limits. For the payee, the note is notes receivable. For the maker, it is notes payable.

Is a note receivable considered a current asset?

If the note receivable is due within 12 months, it is classified as current asset and similarly, if the period exceeds 12 months, it is classified as non-current asset.

Popular Posts:

- 1. what course or plan will i take as a photographer

- 2. how to copy a quiz from one canvas course to another

- 3. hallelujah course which song

- 4. federal judges are appointed for how long? course hero

- 5. course hero which of the following best describes the tertiary structure of a protein?

- 6. what happens when i remove a course from my avsio plan

- 7. video course how to make money with plr

- 8. which of the following was a common goal of the spark and catch programs? (points : 1) course hero

- 9. of course miss lee plays favorites in her class; notice how the same students get a's every time.

- 10. what is a competency based course