Adverse selection occurs when one party in a transaction possesses more accurate information compared to the other party. The other party, with less accurate information, is usually at a disadvantage since the party with more information stands to gain more from that transaction.

What is meant by the term adverse selection?

Adverse selection refers to the tendency of high-risk individuals obtaining insurance or when one negotiating party has valuable information another lacks.

How to avoid adverse selection?

How to Minimize Adverse Selection Risk

- Adverse selection risk. Adverse selection puts one party at risk or at a higher risk than normal. ...

- Risk management process. ...

- Steps to minimize adverse selection risk. ...

- Methods to minimize adverse selection risk. ...

- Conclusion. ...

How do health insurance companies prevent adverse selection?

The Affordable Care Act has put the following limits on health insurers:

- Health insurers cannot refuse to sell health insurance to people having pre-existing conditions.

- Insurers cannot charge more premiums from people having pre-existing conditions.

- Health insurance companies cannot impose annual or lifetime caps on benefits.

How adverse selection is impacting healthcare?

Adverse selection in health insurance is a case where sick people, who require greater health care coverage, purchase health insurance while healthy people do not. The situation can lead to an unbalanced distribution of healthy to unhealthy people who are insured. Adverse selection can present financial risks to insurance companies if left unchecked.

What is the meaning of adverse selection?

adverse selection, also called antiselection, term used in economics and insurance to describe a market process in which buyers or sellers of a product or service are able to use their private knowledge of the risk factors involved in the transaction to maximize their outcomes, at the expense of the other parties to ...

What is adverse selection with example?

Adverse selection occurs when either the buyer or seller has more information about the product or service than the other. In other words, the buyer or seller knows that the products value is lower than its worth. For example, a car salesman knows that he has a faulty car, which is worth $1,000.

Which is the best example of adverse selection?

An example of adverse selection in the provision of auto insurance is a situation in which the applicant obtains insurance coverage based on providing a residence address in an area with a very low crime rate when the applicant actually lives in an area with a very high crime rate.

What is the process of adverse selection?

Adverse selection refers to a situation in which the buyers and sellers of an insurance product do not have the same information available. A common example with health insurance occurs when a person waits until he knows he is sick and in need of health care before applying for a health insurance policy.

What is adverse selection PDF?

Adverse Selection. Adverse selection is the phenomenon that bad risks are more likely than good risks to buy insurance.

Why does adverse selection occur?

Adverse selection occurs when there is asymmetric (unequal) information between buyers and sellers. This unequal information distorts the market and leads to market failure. For example, buyers of insurance may have better information than sellers.

What is adverse selection in healthcare?

In health insurance, adverse selection refers to the scenario in which higher-risk or sick individuals, who have greater coverage needs, purchase health insurance, while healthy people delay or decide to abstain. This can lead to an atypical distribution of healthy and unhealthy people signing up for health insurance.

What is adverse selection in government?

Adverse selection describes a situation in which one party in a deal has more accurate and different information than the other party. The party with less information is at a disadvantage to the party with more information.

How can you reduce adverse selection risk?

Steps to minimize adverse selection riskRisk identification.Risk evaluation or assessment.Risk handling or response.Risk monitoring and control.A feedback loop or iterative process to ensure risk management is continuous.

What is adverse selection and moral hazard?

Adverse selection results when one party makes a decision based on limited or incorrect information, which leads to an undesirable result. Moral hazard is a when an individual takes more risks because he knows that he is protected due to another individual bearing the cost of those risks.

What is an adverse selection in auto insurance?

Another example of adverse selection in the case of auto insurance would be a situation where the applicant obtains insurance coverage based on providing a residence address in an area with a very low crime rate when the applicant actually lives in an area with a very high crime rate. Obviously, the risk of the applicant's vehicle being stolen, vandalized, or otherwise damaged when regularly parked in a high-crime area is substantially greater than if the vehicle was regularly parked in a low-crime area.

What are some examples of adverse selection?

A prime example of adverse selection in regard to life or health insurance coverage is a smoker who successfully manages to obtain insurance coverage as a nonsmoker.

How to avoid adverse selection?

For example, life insurance companies go through underwriting when evaluating whether to give an applicant a policy and what premium to charge.

Definition of adverse selection

Note: An example of adverse selection is the used-car market in which the seller knows more about the true condition of the car than the buyer, providing incentive to attempt to sell vehicles that are in worse condition than they appear, thus lowering the overall price buyers are willing to pay for used cars.

First Known Use of adverse selection

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

What is adverse selection?

Adverse selection occurs when one party takes advantage of the other when they hold back some information that could potentially put the ignorant party as a loss. An example of adverse selection is when a company takes advantage of the buyers ignorance regarding the demerits of a financial asset introduced by them.

What is adverse selection in insurance?

Adverse selection is common in the insurance industry, where there is excessive information asymmetry. It is also a case where the buyer is the one with more information than the seller. Insurance companies need the information to price their premiums and determine the terms of their policies.

Why does a salesperson hide the demerits of a motorbike?

This is because the salesperson leveraged the information asymmetry and successfully sold the motorbike due to the buyer’s ignorance regarding the demerits.

Is moral hazard the same as adverse selection?

Do not confuse adverse selection and moral hazard as a similar concept. Adverse selection is an incidence of information asymmetry, and moral hazard arises from sharing the wrong information while entering a deal.

What is adverse selection?

Adverse selection is a situation where one party in a transaction has more information about the quality or legitimacy of a product or service than the other party. This can apply to situations where the seller knows more than the buyer or, if the reverse is true, and the buyer withholds relevant information from the seller.

Why is adverse selection important?

Adverse selection is important because it can have serious consequences for both buyers and sellers depending on the situation. For example, if a seller is aware of a defect in a product and chooses not to disclose that defect, the buyer is a victim of adverse selection.

Adverse selection vs. moral hazard

Adverse selection has some overlap with moral hazard, another term used in economics, risk management and insurance. They both describe situations where one party disadvantages another because of withheld information.

Examples of adverse selection

Here are some examples of adverse selection that can help illustrate how the concept works in practical applications:

What Is Adverse Selection?

Understanding Adverse Selection

- Adverse selection occurs when one party in a negotiation has relevant information the other party lacks. The asymmetry of information often leads to making bad decisions, such as doing more business with less-profitable or riskier market segments. In the case of insurance, avoiding adverse selection requires identifying groups of people more at risk than the general population …

Adverse Selection in The Marketplace

- A seller may have better information than a buyer about products and services being offered, putting the buyer at a disadvantage in the transaction. For example, a company’s managers may more willingly issue shares when they know the share price is overvalued compared to the real value; buyers can end up buying overvalued shares and lose money. In the secondhand car mark…

Adverse Selection in Insurance

- Because of adverse selection, insurers find that high-risk people are more willing to take out and pay greater premiums for policies. If the company charges an average price but only high-risk consumers buy, the company takes a financial loss by paying out more benefits or claims. However, by increasing premiums for high-risk policyholders, the company has more money wit…

Moral Hazard vs. Adverse Selection

- Like adverse selection, moral hazard occurs when there is asymmetric information between two parties, but where a change in the behavior of one party is exposed after a deal is struck. Adverse selection occurs when there's a lack of symmetric information priorto a deal between a buyer and a seller. Moral hazard is the risk that one party has not entered into the contract in good faith or …

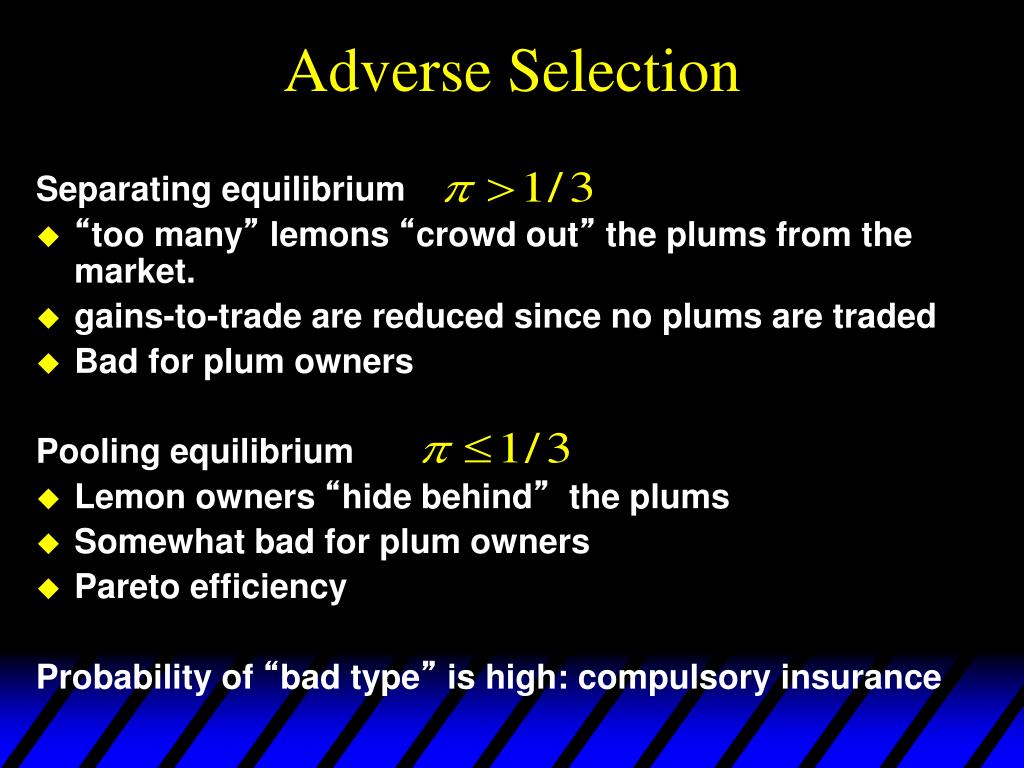

The Lemons Problem

- The lemons problemrefers to issues that arise regarding the value of an investment or product due to asymmetric information possessed by the buyer and the seller. The lemons problem was put forward in a research paper, "The Market for 'Lemons': Quality Uncertainty and the Market Mechanism," written in the late 1960s by George A. Akerlof, an economist and professor at the U…

How Does Adverse Selection Work?

Adverse Selection Example

- Let’s look at some examples. You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked For eg: Source: Adverse Selection(wallstreetmojo.com)

How to Solve The Adverse Selection Problem?

- There are a few ways to deal with it which are listed below. 1. The most obvious solution is for the disadvantaged party to find out all the information. This is why insurance companies hire underwriters who investigate insurance applicants and ensure that what is said on the application matches reality. 2. It could also be solved financially, with the disadvantaged party getting comp…

Recommended Articles

- This has been a guide to adverse selection definition. Here we discuss how it works, along with some real-life examples and how to handle it. You can learn more from the following articles – 1. Real Estate Commission 2. Insider Information 3. Insider Trading 4. Efficient Market Hypothesis

What Is Adverse Selection?

- Adverse selection, also known as anti-selection, is when one party in a transaction has more or better information about the quality or legitimacy of a product or service. They use that private knowledge to maximize their outcomes at the expense of the other party. This can apply to situations where the seller knows more than the buyer or vice vers...

Why Is Adverse Selection Important?

- Adverse selection is important because it can have serious consequences for both buyers and sellers depending on the situation. For example, if a seller is aware of a defect in a product and doesn’t disclose it, the buyer is a victim of adverse selection. Similarly, someone in a high-risk group might withhold information from an insurance company to secure a lower insurance prem…

Adverse Selection vs. Moral Hazard

- Adverse selection has some overlap with moral hazard as both describe situations where one party withholds important information from the other. Moral hazards, however, occur after the transaction has been completed compared to adverse selection, which takes place before the agreement. Moral hazard is the risk that one party has not entered into a transaction in good fait…

Examples of Adverse Selection

- Here are some examples of adverse selection that can help illustrate how the concept works in practical applications:

Popular Posts:

- 1. richard la ruina how to seduce a woman course

- 2. how long is cima course

- 3. how to write an attention getter for a speech about course curriculum

- 4. how to pass course 15 set b

- 5. when the fed increases the required reserve ratio, a bank's course hero

- 6. why the farm and industry short course

- 7. adolescent who have bulimia course hero

- 8. what to course in canada after mechanical engineering degree

- 9. what is a nascar road course

- 10. crash course rescue where do we go