What is the accounting equation used for?

Mar 21, 2020 · The Fundamental Accounting Equation • Assets = Liabilities + Owners’ Equity • Illustrated by the Balance Sheet. Asset Accounts • Cash • Property and Equipment • Inventories of Merchandise • Office Supplies • Accounts Receivable • Pre Paid’s.

What is the accounting equation for Assets Liabilities Equity?

60,000 = 40,000 + Owner's equity. 60,000 - 40,000 = Owner's equity. 20,000 = Owner's equity. To check: 60,000 = 40,000 + 20,000. Case 2. Assets = Liabilities + Owner's equity. 45,000 = 70% + 30%. Owner's equity therefore is 30% of 45,000 which is = 13,500. That makes the liabilities 70% of 45,000 which is = 31,500.

Which side of the accounting equation should balance?

View Test Prep - Acct FInal Review.docx from ACCOUNTING 1 at Oklahoma Christian University. Accounting 1 Final Test Review 1. What is the basic Accounting Equation? (Balancing the …

What do you learn in accounting courses?

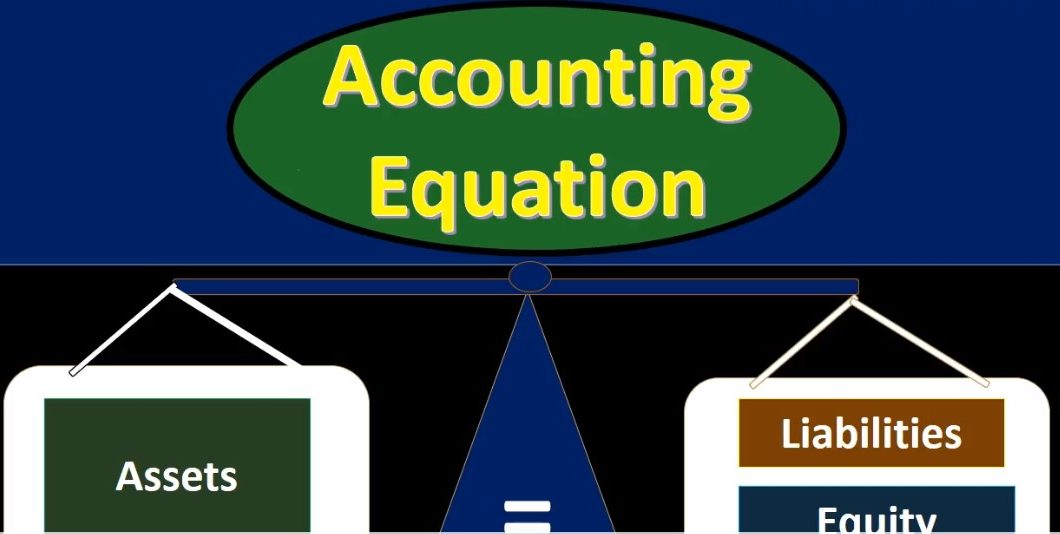

The accounting equation consists of the assets of a business equaling its liabilities and equity, and should always balance on either side of the equation. As the foundation of the double-entry accounting system, the accounting equation is an accounting tool used to measure the assets, liabilities, and equity of a business entity (assets = liabilities + equity, or owner’s equity).

What is the basic equation of accounting?

Fundamentally, accounting comes down to a simple equation. Assets = Liabilities + Equity.Nov 25, 2020

What is the basic accounting equation explain with example?

The basic accounting equation is: Assets = Liabilities + Owner's equity. Therefore, If liabilities plus owner's equity is equal to $300,000, then the total assets must also be equal to $300,000.

What are the four basic accounting equations?

The four basic financial statements are the income statement, balance sheet, statement of cash flows, and statement of retained earnings.

How do you remember the accounting equation?

1:233:06Trick to remember debits and credits - YouTubeYouTubeStart of suggested clipEnd of suggested clipWords on the left side of the credits on the right side your left hand to paint inside and then withMoreWords on the left side of the credits on the right side your left hand to paint inside and then with right put your three little fingers up and so we will put them aside first which is your left side.

What is the most important accounting equation?

Capital + Liabilities = assets is the basic accounting equation. The fundamental accounting equation, also called the balance sheet equation, represents the relationship between the assets, liabilities, and owner's equity of a person or business.Jul 20, 2021

What equations do accountants use?

Accounting formulas for businessesAccounting equation. ... Net income equation. ... Break-even point equation. ... Cash ratio equation. ... Profit margin equation. ... Debt-to-equity ratio equation. ... Cost of goods sold equation. ... Retained earnings equation.

How many formulas are there in accounting?

What are the 11 Basic Accounting Formulas? There are several accounting formulas used to report the financial health of a person or business. These formulas are used to produce the Balance Sheet and Income Statement.

What are the topics covered in financial accounting?

Additional topics include ethical considerations, recording business transactions, and the application of credit/debit rules.

Can you see lectures in audit mode?

Access to lectures and assignments depends on your type of enrollment. If you take a course in audit mode, you will be able to see most course materials for free. To access graded assignments and to earn a Certificate, you will need to purchase the Certificate experience, during or after your audit.

Does Coursera give financial aid?

Yes, Coursera provides financial aid to learners who cannot afford the fee. Apply for it by clicking on the Financial Aid link beneath the "Enroll" button on the left. You'll be prompted to complete an application and will be notified if you are approved.

Popular Posts:

- 1. what is spieth's home course

- 2. how to document course lung soynds

- 3. what course is rutgers kmown for

- 4. what does the real estate course look.like

- 5. what course for software engineer

- 6. what do people do on golf course

- 7. which course is best to start a beauty brand business

- 8. course herocompanies can choose from which three classes of health insurance programs?

- 9. what is course of study for elementary school

- 10. what course is good to do in other to get a job immediately