What is the difference between instrument and holder in due course?

May 05, 2020 · Legal term for an original or any subsequent holder of a negotiable instrument (check, draft, note, etc.) who has accepted it in good-faith and has exchanged something valuable for it. For example, anyone who accepts a third-party check is a holder in due course. Click to see full answer. Subsequently, one may also ask, what does holder in due course mean?

What are the requirements of the holder in due course?

The holder in due course is a concept that refers to the party who holds an important, and often negotiable, document. This document is sometimes referred to as an instrument because it is often an instrument of payment. This might include a bank note, draft, or check.

Is any kind checks cashed a holder in due course?

Sep 13, 2019 · The Uniform Commercial Code establishes the holder in due course doctrine in Article 3, which is the Article dealing with negotiable instruments. Article 3, Part 3 covers issues related to the enforcement of debt, and section 3-302 sets forth the legal definition of a holder in due course. Under UCC Section 3-302, a holder in due course who is entitled to protection of …

Can a holder in due course sue the prior parties?

Feb 25, 2022 · Holder in Due Course is a legal term to describe the person who has received a negotiable instrument in good faith and is unaware of any prior claim, or that there is a defect in the title of the person who negotiated it. For example; a third-party check is a …

What is a holder in due course in law?

The "holder in due course" doctrine, as implemented by Article 3 of the Uniform Commercial Code, says that a party who acquires a negotiable instrument in good faith, for value, and without notice of certain facts, and who also meets some additional requirements, takes the instrument free of competing claims of ...

Who are holder and holder in due course explain their difference with example?

A holder is a person who lawfully obtained the negotiable instrument. The negotiable instrument has his name entitled on it so he can receive the payment from the parties liable. A holder in due course is a person who acquires the negotiable instrument (in good faith) for some consideration, whose payment is still due.Dec 29, 2020

What is a holder in due course and what are the benefits?

Qualifying as a holder in due course (HDC) makes the negotiable instrument more valuable to the holder, as a HDC has a stronger right to payment of the instrument than an ordinary holder. If a holder is not a HDC, her rights in the instrument are the same as the original payee of the instrument prior to transfer.Sep 26, 2021

What is a holder example?

A thief or finder of bearer paper, however, is a holder. Example: Harriet writes a check to John. John is a holder of this draft. If he indorses the check and transfers it to Kyle, Kyle is the new holder.Jan 9, 2022

What do you mean by holder in due course negotiation?

In commercial law, a holder in due course is someone who takes a negotiable instrument in a value-for-value exchange without reason to doubt its legitimacy. A holder in due course acquires the right to make a claim for the instrument's value against its originator and intermediate holders.

Who is a holder in due course distinguish between holder and holder in due course?

1. Entitlement: Holder is a person who is entitled for the possession of a negotiable instrument in his own name. Hence he shall receive or recover the amount due thereon. Whereas a Holder-in-due-course is a person who has obtained the instrument for consideration and in good faith and before maturity.

Who is called holder in due course?

Definition of holder in due course : one other than the original recipient who holds a legally effective negotiable instrument (such as a promissory note) and who has a right to collect from and no responsibility toward the issuer.

When a holder becomes holder in due course?

—“Holder in due course” means any person who for consideration became the possessor of a promissory note, bill of exchange or cheque if payable to bearer, or the payee or indorsee thereof, if 1[payable to order], before the amount mentioned in it became payable, and without having sufficient cause to believe that any ...

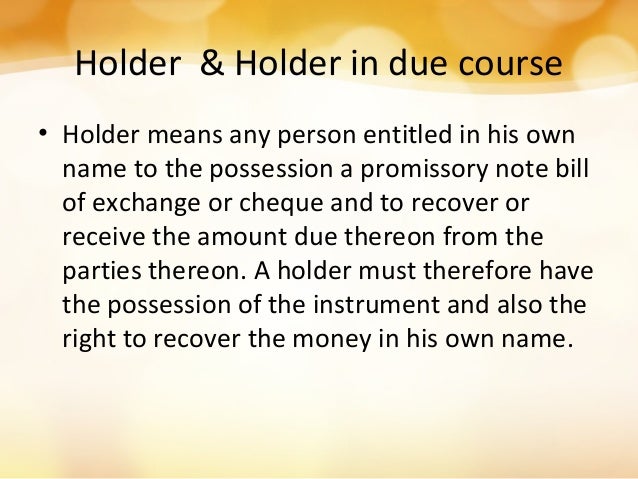

What is a holder?

Holder is a term used to any person that has in their custody a promissory note, bill of exchange or cheque. It should be entitled in his own name. Holder means a person entitled in his own name to the possession of a negotiable instrument and to receive the amount due on it. This legal term article is a stub.

Holder in Due Course - iEduNote.com

slideshare.netImage: slideshare.netHolder in Due Course is a legal term to describe the person who has received a negotiable instrument in good faith and is unaware of any prior claim, or that there is a defect in the title of the person who negotiated it. For example; a third-party check is a holder in due course.

Holder In Due Course: Everything You Need to Know

The holder in due course is a concept that refers to the party who holds an important, and often negotiable, document. This document is sometimes referred to as an instrument because it is often an instrument of payment. This might include a bank note, draft, or check. The holder is temporarily the owner of the document that holds value.

Holder in Due Course - Negotiable Instruments

Rights of holder in due course. - A holder in due course holds the instrument free from any defect of title of prior parties, and free from defenses available to prior parties among themselves, and may enforce payment of the instrument for the full amount thereof against all parties liable thereon.

What is a holder in due course?

In Banking or Commercial law, a holder in due course is a person who accepts a negotiable instrument in a value-for-value exchange without doubting its legitimacy so ultimately in a good faith. Now the person who took it for value in good faith now becomes a real owner of the instrument and is known as “holder in due consideration”. According to Section 9, “Holder in due course means any person who for consideration became the possessor of a promissory note, bill of exchange or cheque is payable to bearer, or the payee or endorsee thereof, if payable to order before the amount mentioned in it became payable and without having sufficient cause to believe that any defect existed in the title of the person from whom he derived his title”.

What is a holder in a contract?

Holder refers to a person, the payee of the negotiable instrument, who is in possession of it. A person, who is entitled to receive or recover the amount due on the instrument from the parties to that, whilst the holder in due course connotes a person who incurs the instrument for value and in good faith without having any knowledge ...

What is the holder of a negotiable instrument?

What is the holder? Sec 8 of Negotiable Instrument act defines the term, “Holder”-The holder of a negotiable instrument is any person who is for the time being entitled in his own name and right to the possession of the instrument and to receive and recover the amount due on the instrument.

Can a holder sue all the prior parties?

A holder cannot sue all the prior parties but a holder in due course can sue all the prior parties. The instrument is obtained regardless of good faith but holder in due course the instrument is only accepted in good faith. A person can become a holder before or after the maturity of negotiable instrument, on the other hand, ...

Popular Posts:

- 1. other things being equal, when the market price increases, the producer surplus course hero

- 2. a. during spring semester 2017, when is the deadline to drop a full semester course without a “w”?

- 3. how do i write the name of a course in a paper

- 4. how do you say "of course" in hindi

- 5. how do you gift a course on udemy

- 6. uiuc conmmunity health course mental health and human sexuality which is better

- 7. when you pass the msf course

- 8. how to open a course to students in blackboard

- 9. how many course hours in a semester hour?

- 10. which hypothesis regarding the environmental paradox has not been supported? course hero