Should I become a CFP?

The Capstone Course. All candidates for CFP® certification must complete the Capstone course through a CFP Board Registered Program. The Capstone course is a comprehensive financial plan development course created to enhance your knowledge, skills and abilities. This requirement was implemented in 2012 to assess your ability to deliver professional and …

Is Cfa a better course than CFP?

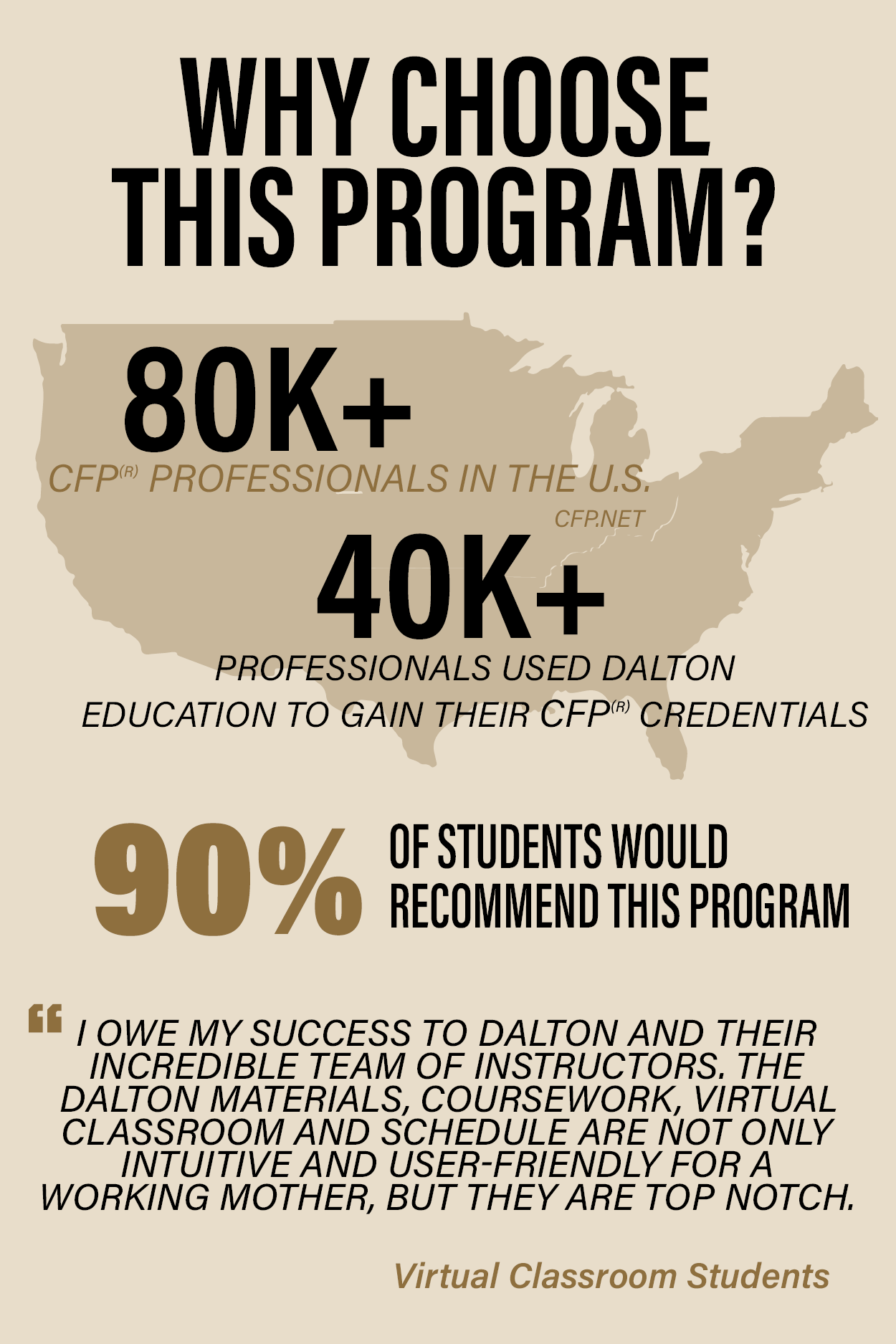

Designed to enhance the fundamental knowledge, skills and abilities of individuals seeking to attain CFP ® certification, Dalton Education Capstone Courses will prepare you for the CFP Board's Accelerated Path. With Dalton Education, we can help you fulfill the CFP Board's Capstone course requirement and ultimately fast track your CFP ® certification. You will pass, …

What are the qualifications for CFP?

Jan 27, 2020 · The Capstone course is a comprehensive financial plan development course created to enhance your knowledge, skills and abilities. This requirement was implemented in 2012 to assess your ability to deliver professional and competent financial planning services to the public. Click to see full answer. Similarly one may ask, how long does CFP Capstone take?

How to become a CFP professional?

The Capstone Alternative course allows Accelerated Path candidates who have met the experience requirement an opportunity to bypass certain components of the Capstone requirement. The coursework requirement for CFP ® certification includes completion of a 45-hour financial plan development Capstone course through a CFP Board Registered Program.

How long does CFP Capstone take?

45-hourThe coursework requirement for CFP® certification includes completion of a 45-hour financial plan development Capstone course through a CFP Board Registered Program.

What is the hardest CFP course?

Case studies may present the most difficulty to certified financial planner (CFP) test-takers. Case study questions may present a personal situation along with financial statement information from which the test taker must base a decision.

Can you study for CFP in 3 months?

That means you'll need to study for about 2.5 – 3 months (100hrs/10hrs per week) before attending the review class. So, the best rule of thumb is to determine how many hours you can study each week and how many hours it takes to complete the pre-study materials.

How many hours should you study for the CFP?

250 hoursCFP Board recommends you spend at least 250 hours studying for the exam. While that sounds overwhelming, the time goes pretty quickly between pre-study, the Candidate Handbook, required education courses, question bank time, review, practice exams, and your own preparations.Mar 30, 2021

Is CFP easier than CFA?

Overall, the CFP program is shorter and less-rigorous than the CFA program. If you think this could be the program for you, you can learn more about CFP certification requirements here.Sep 28, 2021

Does a CFP need a Series 7?

To take this exam, the person must be sponsored by a broker-dealer, and continue working for a broker-dealer to maintain the license. There's a conflict of interest for a CFP® who holds an active Series 7 because they're sales representatives of the brokerage firms they work for.Mar 21, 2018

What is the Series 66 pass rate?

65-70%The Series 66 exam has approximately a 65-70% pass rate.

Is the Series 7 Hard?

Is the Series 7 Exam Difficult? Clocking in at 125 questions to be answered in three hours and 45 minutes, the Series 7 exam is considered the most difficult of all the securities licensing exams. The minimum passing score is 72, which may not seem that difficult.

What is the pass rate for the CFP?

During the July 2021 CFP® exam window, 2,539 candidates took the CFP® exam, with 13% of the candidates testing remotely. The pass rate for the July exam was 62%. Historical exam statistics, including those from the July 2021 exam, can be found on CFP Board's exam statistics webpage.Aug 11, 2021

Is the CFP worth it?

Unlike some certificates that are worth little more than the paper they're printed on, the CFP designation is one of the most prestigious financial certificates around. “The CFP designation offered by the CFP board is one that is actually significant because it requires so much preliminary work," said Sotudeh.

Is CFP a professional degree?

Certified Financial Planner or CFP is a professional certification course offered at a duration of 6 months to 2-years. It imparts the knowledge in the field of Financial Planning and it is offered by the Financial Planning Standards Board (FPSB).

What happens if you fail the CFP exam?

If you fail the CFP® exam and elect to retest, you are required to retake the entire exam and to pay the applicable exam fee for each retake.

What is a capstone course?

The capstone course consists of both online, self-paced study, and live-online instruction and is presented in two phases.

What is phase 1 financial planning?

During Phase I students are introduced to the financial planning process and taught how to gather and analyze client data, develop recommendations, and read and understand a complete financial plan presentation.

Popular Posts:

- 1. how to unregister for a course ubc

- 2. what quatitative data is the chemist likely to collect over the course of her experiment

- 3. what is be course

- 4. is a course name capitalized when referred to in a paper

- 5. ub how much is each course

- 6. how to light a dark running race course cheap

- 7. how can we “change the course of history” as obama suggests?

- 8. how is reasoning like planning a course in a boat

- 9. how much does it cost to create a print out educational course

- 10. what is the final step in the career planning process course hero