What are the two most important assumptions in all of economics crash course?

Crash CourseQuestionAnswerWhat are the two most important assumptions in all of economics?Scarcity (people have unlimited wants but limited resources) and everything has a cost18 more rows

What is macroeconomics crash course?

1:0113:42Macroeconomics: Crash Course Economics #5 - YouTubeYouTubeStart of suggested clipEnd of suggested clipSo macroeconomics is the study of the entire economy macro economists stay the big stuff likeMoreSo macroeconomics is the study of the entire economy macro economists stay the big stuff like economic output unemployment inflation interest rates and government policies.

What are the 3 things you want to know about economics?

In Economics you learn about supply and demand, perfect and imperfect competition, taxation, international trade, price controls, monetary policy, exchange rates, interest rates, unemployment and inflation amongst many other topics to understand individual markets, the aggregate economy and government policies.

What is the first important assumption of economics?

“A basic assumption of economics begins with the combination of unlimited wants and limited resources.” “All of economics, including microeconomics and macroeconomics, comes back to this basic assumption that we have limited resources to satisfy our preferences and unlimited wants.”

How difficult is macroeconomics?

Macroeconomics is one of the dreaded courses in a high school career. When hearing anything relating to economics, a student automatically associates the subject with daunting long form formulas that require specialized knowledge and years of research.

Is macroeconomics easier than microeconomics?

It's impossible to understand microeconomics without a study of macroeconomics first. Research has shown students who study macro first perform better academically in both macro and micro than students who study micro first.

What every economist should know?

12 Things You Should Know About Economics1) Microeconomics vs Macroeconomics. Macroeconomics is the study of the economy as a whole. ... 2) Opportunity Costs. ... 3) Supply and Demand. ... 4) Comparative Advantage. ... 5) Diminishing Marginal Utiltiy. ... 6) Economic Growth and GDP. ... 7) Externalities. ... 8) Inflation and Deflation.More items...•

What is economics course all about?

What is economics? Economics, at its very heart, is the study of people. It seeks to explain what drives human behaviour, decisions and reactions when faced with difficulties or successes. Economics is a discipline which combines politics, sociology, psychology and history.

What are the 5 main assumptions of economics?

Warm- Up:Self- interest: Everyone's goal is to make choices that maximize their satisfaction. ... Costs and benefits: Everyone makes decisions by comparing the marginal costs and marginal benefits of every choice.Trade- offs: Due to scarcity, choices must be made. ... Graphs: Real-life situations can be explained and analyzed.

What are 4 assumptions made by most economists?

These assumptions are used to help predict the decisions of players in an economy and how different players use scarce resources. Assumptions can include unlimited wants, self-interest in decision-making, and rational decision-making.

What are the two basic assumptions of economics?

A basic assumption of economics begins with the combination of unlimited wants and limited resources. We can break this problem into two parts: Preferences: What we like and what we dislike. Resources: We all have limited resources.

What are the two basic assumptions that economists make about individuals and firms?

-The two basic assumptions that economists make about individuals and firms are that individuals act to make themselves as well off as possible, and that firms attempt to maximize profits. -The role and significance of prices in the market economy has to do with supply and demand.

Who was responsible for the financial crisis?

Failures in finance were at the heart of the crash. But bankers were not the only people to blame. Central bankers and other regulators bear responsibility too, for mishandling the crisis, for failing to keep economic imbalances in check and for failing to exercise proper oversight of financial institutions.

Why did investors seek out securitised products?

Investors sought out these securitised products because they appeared to be relatively safe while providing higher returns in a world of low interest rates. Economists still disagree over whether these low rates were the result of central bankers’ mistakes or broader shifts in the world economy. Some accuse the Fed of keeping short-term rates too low, pulling longer-term mortgage rates down with them. The Fed’s defenders shift the blame to the savings glut—the surfeit of saving over investment in emerging economies, especially China. That capital flooded into safe American-government bonds, driving down interest rates.

What was the regulator's most dramatic error?

The regulators’ most dramatic error was to let Lehman Brothers go bankrupt. This multiplied the panic in markets. Suddenly, nobody trusted anybody, so nobody would lend. Non-financial companies, unable to rely on being able to borrow to pay suppliers or workers, froze spending in order to hoard cash, causing a seizure in the real economy. Ironically, the decision to stand back and allow Lehman to go bankrupt resulted in more government intervention, not less. To stem the consequent panic, regulators had to rescue scores of other companies.

What is the biggest shortcoming of Lax Capital?

Lax capital ratios proved the biggest shortcoming. Since 1988 a committee of central bankers and supervisors meeting in Basel has negotiated international rules for the minimum amount of capital banks must hold relative to their assets. But these rules did not define capital strictly enough, which let banks smuggle in forms of debt that did not have the same loss-absorbing capacity as equity.

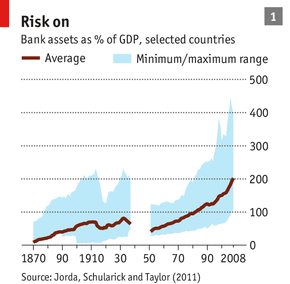

Why did banks operate with minimal equity?

Under pressure from shareholders to increase returns, banks operated with minimal equity, leaving them vulnerable if things went wrong. And from the mid-1990s they were allowed more and more to use their own internal models to assess risk—in effect setting their own capital requirements. Predictably, they judged their assets to be ever safer, allowing balance-sheets to balloon without a commensurate rise in capital (see chart 2).

Did the Euro create an expansion of the financial sector?

In other words, although Europeans claimed to be innocent victims of Anglo-Saxon excess, their banks were actually in the thick of things. The creation of the euro prompted an extraordinary expansion of the financial sector both within the euro area and in nearby banking hubs such as London and Switzerland. Recent research by Hyun Song Shin, an economist at Princeton University, has focused on the European role in fomenting the crisis. The glut that caused America’s loose credit conditions before the crisis, he argues, was in global banking rather than in world savings.

What is Crash Course?

Crash Course is a platform designed to open up debate on how we can move out of the current crisis and make the necessary steps towards achieving social, economic, ecological and regenerative justice.

How can I get involved with Crash Course?

Feel free to contact us with ideas for webinars – or to help out in organising events.

Why do students study macroeconomics?

Furthermore, the subjects favored the study of macroeconomics as they value their power to influence world policies and outcomes. That feeling of intellectual empowerment is common among the interviewed subjects.

What is macroeconomics in news?

Macroeconomics is the stuff that finance news and reports on TV, radio, or in print are usually made of. When news outlets like CNN Money, CNBC, MSNBC, Bloomberg, or Wall Street Journal talk about a nation’s GDP, inflation, employment rate, interest rates, exchange rates, or the stock market, they are all speaking the macroeconomic language. Macroeconomics examines the economy from a larger lens – could be from a global perspective or a national perspective.

What is the complementary subfield of economics?

Macroeconomics and Microeconomics are two of the complementary sub-fields of economics (a third subfield has been recently acknowledged, and this is Econometrics, which is the application of statistics and mathematics in interpreting economic data).

Why is GDP captured using current prices?

This is so because the GDP is captured using current prices and is used to compare economic health between two periods in time, say two different years or quarters or even periods. Using a price deflator, the real GDP is captured by statistically adjusting the nominal GDP value to account for inflation.

What is the purpose of microeconomics?

Microeconomics plots the income, output, and expenditure of individual consumers or businesses. The aggregate of these variables representing a nation is what macroeconomics examines.

What caused the Great Recession of 2008?

For example, the so-called Great Recession of 2008 is caused by the housing bubble due to high-risk mortgage loans, or “Ninja” loans (IRLE, 2018), where banks lent money to high-risk borrowers. The impending Coronavirus recession (or depression, depending on how long this downturn will last) is caused by the viral pandemic that resulted in nations locking down their boundaries, leading to market and employment stoppage. Should a recession or depression happen 20 years from now, even the brightest economists would not be able to indicate how would countries or industries react precisely. The economic landscape and the players would undoubtedly be different by then, and also because economics is not an exact science. Again, it is a social science.

What is the general theory of employment, interest, and money?

In 1936, John Maynard Keynes released the book “The General Theory of Employment, Interest, and Money.” As the title implies, Keynes focused on the behavior of the factors that were ignored in the classic al approach: the aggregated indicators which are unemployment, production or output, and money. His ideologies are what gave birth to the subfield of macroeconomics because at the core of his new approach is the vital role of the government in maintaining stable economic growth or interfering with fiscal and monetary policies when a downturn is imminent. Keynes also added that downturns are inevitable, even recessions, and private entities are expected not to spend given these phenomena. This is where the government comes in. Ever heard the terms “government spending” or “stimulus package”? That is the government doing its part to keep its nation’s economy rolling even if it’s only minimal. In the short-term, after all, any economic movement is better than economic stagnation.

Popular Posts:

- 1. during the course of the experiment, which of the following happens to the no3- ions?

- 2. what happens if i drop a course and end up as a part-time student gi bill

- 3. what is the catalog number of a course

- 4. cma course what to expect

- 5. how much would a training course for firearm carry

- 6. what documents should an international student with reduced course load take when returning home

- 7. what his course has in store for me

- 8. which of the following is the definition of white-box testing course hero

- 9. "the ______ has a landmark called the ______, which marks the course of the radial nerve"

- 10. which is the best 6 hour driving course tx