- If you are a new to this site, and are interested in taking the H&R Block Income Tax Course or the Tax Knowledge Assessment, click on the Register here link on the left to register and create an account.

- To search for available courses as a guest, click on the Browse Catalog link on the left.

Full Answer

How can I learn income tax?

Irrespective of your employment start date, the tax year is fixed from April to March.Understand this with an example,Sum of all income = Gross income.Gross Income – Deductions = Taxable Income.Understand this with an example,Tax to be paid = Tax Liability – TDS.

How do I become a tax preparer in Florida 2022?

To do so, you must:Take a 60-hour qualifying education course from a CTEC approved provider within the past 18 months.Purchase a $5,000 tax preparer bond from an insurance/surety agent.Obtain a Preparer Tax Identification Number (PTIN) from the IRS, and.Pay a $33 registration fee.

How do I become a certified tax preparer in Colorado?

Apply for the exam Meet the education requirements, including 150 hours of education. Pass the Uniform CPA Examination. Take the AICPA Ethics course and pass the AICPA Ethics Examination with a score of 90 percent or better within 2 years preceding your application. Meet the experience requirements.

How do I become a tax preparer in Utah?

How To Become A CPA In UtahComplete 150 Hours of Coursework. The Utah Board of Accountancy requires that a person complete 150 semester hours before they can become a Utah CPA. ... Get the Required Hours of Experience. ... Take the AICPA Ethics Course. ... Pass the Utah CPA Exam. ... Apply for a License.

How do I become a licensed tax preparer in Florida?

As of July 2017, Florida does not require tax preparers practicing in the state to be licensed, but there is legislation being considered. To become a tax preparer in Florida, you will need to attend a tax preparation school online or in person and pass tax preparation exams.

Which course is best for taxation?

Master of Commerce (M.Com) in Accounting & Taxation....Courses & EligibilityDiploma in Accounting & Auditing.Post Graduate Diploma in Accounting.Diploma in Taxation.Diploma in Tax & Company Law.Advance Diploma in Financial Accounting & Taxation.Advance Diploma in Taxation.Post Graduate Program in Tax Management.

How do I get started as a tax preparer?

How to become a registered tax preparerTake a 60-hour qualifying education course from a CTEC approved provider within the past 18 months.Purchase a $5,000 tax preparer bond from an insurance/surety agent.Get a Preparer Tax Identification Number (PTIN) from the IRS.Approved Lives Scan.More items...

Is it worth it to become a tax preparer?

High Earning Potential According to the U.S. Bureau of Labor Statistics, or BLS, tax preparers earned an average salary of $52,710 per year as of May 2020. The BLS reports that accountants working in tax preparation services averaged an annual salary of $85,050 per year as of May 2020.

Is it hard to be a tax preparer?

The task of becoming a tax preparer can be relatively easy compared to the rocky road of some similar ventures, such as becoming a real estate agent or an insurance agent. Tax preparation can be a quirky profession, meaning it is essentially not a year round profession but a more seasonal one.

How long does it take to get an EFIN?

about 45 daysHow long does it take to get an EFIN? The EFIN process typically takes about 45 days, so be sure to get started well in advance of tax season.

How long does it take a tax preparer to do your taxes?

Need Professional Help? Talk to a Tax Attorney.Primary form filed or type of taxpayerReturn %Total timeAll taxpayers100%13 hoursNonbusiness Taxpayers72%9 hoursBusiness Taxpayers28%23 hours

What is an IRS enrolled agent?

An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service by either passing a three-part comprehensive IRS test covering individual and business tax returns, or through experience as a former IRS employee.

How long does it take to become a tax preparer in Florida?

The Professional Tax Preparer Program is composed of 20-67 hours of training. The training takes place over four models, three while in the program and one following the completion of your exam.

Do you need to be a CPA to do taxes in Florida?

According to Florida law, only CPAs can perform certain services such as audits, reviews, compilations and issue opinions regarding financial statements. If an individual or business requires these services, they must use a licensed CPA. An accountant is not required to have a state-issued license to prepare taxes.

What is the H&R Block Income Tax Course?

With the H&R Block Income Tax Course, you can learn how to prepare taxes like a pro Go to disclaimer for more details 160 . Classes are offered i...

What topics could I expect to cover?

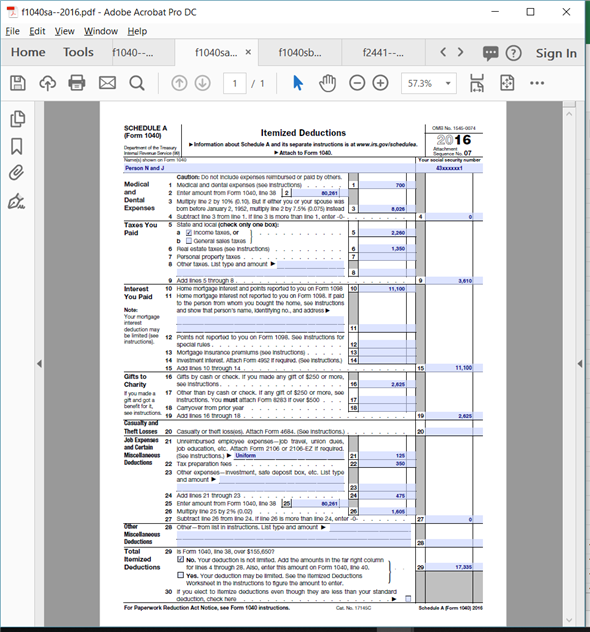

Filing Requirements Qualifying Dependents & Support Wages & Income Interest & Dividend Income Capital Assets Deductions & Credits Itemized Deductio...

What can I expect from the class?

The course consists of 61-62 hours* of instruction which includes instructor-led sessions, online training, and practice sessions. Additional time...

How much does the class cost?

The Income Tax Course is offered with no charge for tuition or course fees. Students are required to purchase course materials in all states except...

Are there additional costs for books and materials?

Students are required to purchase course materials in all states except for New York and Tennessee, where the purchase of some materials is optiona...

How often does the class meet?

Classes generally meet for 3-hour sessions, two times per week, or on weekends for multiple 3-hour sessions. Class schedules can vary by location a...

When are classes available?

Classes typically begin in late August through September and run through the end of November. Specific dates will be listed with the class you have...

Will class times meet my schedule?

We vary our class times and locations to accommodate our students. Additionally, we offer classes that can be taken online through our Virtual Clas...

What happens if I miss a class?

Classes are held on days, evenings, and weekends. If you miss your regular time for an in-person class, you may be able to take a class at another...

What is H&R Block?

The H&R Block Income Tax Course will provide learners with knowledge and ability to complete basic tax returns and potentially succeed as a tax professional. Think of it as an educational boot camp for taxes… Students will learn about a range of tax and financial topics, including how to prepare personal and business tax returns. The course focuses on the following areas:

What are the requirements for H&R Block?

Interested individuals must submit an employment application and meet all applicable hiring requirements to include successful completion of the Income Tax Course with a passing score . Candidates will interview, and those hired will be required to complete additional paid training. (View H&R Block job opportunities here.)

How old do you have to be to take H&R Block?

H&R Block requires students to be 18 years of age to attend the Income Tax Course. A GED or diploma, however, is not required.

What is blended learning in tax?

The course has a blended learning delivery method; meaning it combines face-to-face classroom sessions from experienced Tax Professional instructors with self-study online learning and activities. This innovative approach provides students with the best features of both classroom and self-study learning environments.

What is H&R Block tax?

The H&R Block tax course is a boot camp for learning about taxes – you’ll cover a lot of material, learn about a range of financial topics, and come out able to prepare different kinds of returns. The experience can be valuable for your career and can help you save money on your own taxes too. For example, one of my friends who took the course learned about amended returns and all the commonly overlooked personal tax deductions she should have been claiming. As a result, she amended a previous year’s return and got a check from the IRS for over $1,000!

When do H&R Block preparers work?

Keep in mind that most preparers work only January to April, so you can’t expect this to be a full-time income. However, if you have a flexible schedule, are retired, or are looking to parlay this experience into something else, an H&R Block job can be a great opportunity. A lot of preparers come back to work during tax season every year, but only a handful stay on full-time in each area.

What do tax preparers do?

In the off season, these preparers deal with IRS letters and tax audits, back taxes, taxes for the deceased, tax extensions, and amended tax returns. Typically, full-time preparers are very experienced and have several years or more with the company. If you’re interested in a management track and are willing to travel, positions may open up for you once you’ve completed a season of tax preparation. Most of the upper-level people I met started out in the basic class like everyone else, and a lot of them had no prior tax training or finance background either.

What is a 1040 class?

The class instructs on basic concepts, such as claiming dependents, what’s on the 1040 tax form, different filing statuses, types of income, common credits and deductions, and how to deal with capital gains tax and self-employment income.

How many hours does a class last?

These classes are pretty intensive! Overall, you’ll spend at least 84 hours actually in the classroom. The most common class schedule breaks it into two 3-hour periods per week, and most sessions will run from August to November. Alternatively, some locations have September to November classes which meet three times a week. There are also evening classes available as well as ones during the day. Some locations offer all-day Saturday classes that run for several weeks in a row.

Is H&R Block open in the off season?

Since most H&R Block locations are not open in the off-season, they typically convert these spaces into classrooms. To see if there is one in your area, enter your zip code here . You’ll usually meet at the same location for every class period.

Is tax saving bug a good fit?

If you’re interested in spreading the tax-savings bug and like to help, this job might be a good fit for you. However, if you want to avoid people and just type numbers on a screen, it is probably going to be torture.

When is H&R Block tax academy?

H&R Block Tax Academy™ runs mid-September to mid-December. Specific dates for the Income Tax Level 1 course will be listed with the schedule of the class you have chosen to attend. Registration is now open.

What is the first step in employment at H&R Block?

The first step in employment at H&R Block is successfully completing the Income Tax Level 1 course. During the course, you'll learn more about employment and career development opportunities at H&R Block. To register for the course, click here.

How long is the Income Tax Level 1 course?

The course consists of 72 hours of instruction which includes instructor led sessions, covering tax theory and tax preparation software and practice sessions. Additional time commitments outside of class homework will vary by student. Some examples of additional time spent outside the classroom may include: tutoring to understand more complex tax concepts, participating in study groups and completing generally assigned homework.The Income Tax Level 1 course starts with a foundation of tax theory where concepts build upon each other. Students are encouraged to actively participate in classroom discussions to understand concepts and ideas as early as possible. Issues with foundational topics should be addressed prior to moving on to other topics. Basic computer skills and reliable internet access are required.

What is tax academy?

Tax Academy is a fully online course. It begins with guided classroom discussion on tax theory, followed by computer-based learning with tax preparation software. There is directed discussion with custom-designed textbooks and exercises to reinforce the material.

What to do after income tax level 1?

Once you complete Income Tax Level 1, you could have the opportunity to interview for employment at an H&R Block office near you. If you're hired you'll enjoy a career that offers a flexible schedule where you can build your client list and advance your career through our continuing education program. It's a dynamic career that works with your goals, and lifestyle.

How many people have been trained to prepare taxes?

Over the past 20 years, we've trained more than one million North Americans to prepare taxes. As a tax training leader, it's the quality of our courses and record for reliability and accuracy that ensures you get the best training possible.

How old do you have to be to get into income tax?

You must be at least 18 years of age at the time of enrollment to enroll in Income Tax Level 1.

Popular Posts:

- 1. how long does it take to complete a driving school course for an adult

- 2. which of the following is the responsibility of a finance manager? course hero

- 3. many people who have an autism spectrum disorder course hero

- 4. 1. what does the yick wo case have to do with this chapter? course hero

- 5. course hero what is the difference between film and video art

- 6. what if you fail chapter test in aapc course

- 7. what is meant by malnutrition course hero

- 8. what golf course was xarelto commercial filmed at

- 9. what are the economic order quantity course hero 15.81

- 10. irvine valley college which course to take first bio 80 or bio 81