Where is the Income Tax Course at H&R Block?

H&R Block has been approved by the California Tax Education Council to offer The H&R Block Income Tax Course, CTEC# 1040-QE-2355, which fulfills the 60-hour “qualifying education” requirement imposed by the State of California to become a tax preparer.

What do I get for completing the Income Tax Course?

Mar 01, 2022 · The H&R Block tax course is a boot camp for learning about taxes – you’ll cover a lot of material, learn about a range of financial topics, and come out able to prepare different kinds of returns. The experience can be valuable for your career and can help you save money on your own taxes too.

What is the income tax level 1 course?

The H&R Block Income Tax Course consists of 27 sessions that includes a mid-term and a final exam. There are 51 hours of instructor-led sessions (45 hours of federal tax and 6 hours of state tax), and 21 hours of self-study, and 6 hours of dedicated software practice.

What is Henry Harvin income tax course?

The H&R Block Income Tax Course, which started in 1978, gives students the opportunity to learn new skills from an industry leader. Not only will they better understand their own taxes, students also can learn to prepare taxes like a professional. Oct 3 2019

How hard is the H&R Block Test?

It's not very complicated. You go through training and the answers are provided during that time. It is not difficult.Oct 28, 2018

Is it hard to learn tax preparation?

The task of becoming a tax preparer can be relatively easy compared to the rocky road of some similar ventures, such as becoming a real estate agent or an insurance agent. Tax preparation can be a quirky profession, meaning it is essentially not a year round profession but a more seasonal one.Aug 13, 2013

Is tax preparation a good career?

High Income Potential Experienced tax preparers may earn $25 per hour or more and self-employed tax professionals can earn more than $100 per hour. During the 3-month tax season (mid-January to mid-April) it is possible for a self-employed tax preparer to earn $50,000 or more.Nov 19, 2012

Is tax preparer a stressful job?

Stress and High Pressure Even income tax preparers who love their job are not immune from stress during tax season. Pressure is intense to meet with clients every hour of the day. In your role of tax preparer, you will scramble to find time to research questions related to IRs regulations.

How do I start a career in tax?

Courses in Taxation A B.Com degree is mandatory to take admission in the two-year M.Com course. Students who do LLB or LLM can also specialise in Taxation Laws and join the field. Bachelor of Management Studies (BMS) or an MBA degree with specialization in Finance may also give you an edge in the field.

How do I become a tax accountant?

These basics can be the knowledge of taxation, inclination towards the subject and the existing qualification. The tax consultants in India are mainly those having the qualification in law, commerce, ICWA, CA, CS, mathematics, science or other such accounting qualification.Feb 24, 2018

What are the benefits of being a tax accountant?

6 Benefits of Becoming an AccountantAccountants Have a Better Understanding of Finances. ... The Growing Demand for Accountants. ... Opportunities for Advancement. ... The Pay Range for Accountants is Competitive. ... The Ability to Start Your Own Business. ... Gaining a Better Understanding of Taxation and Business Law.Jan 23, 2020

What skills do you need to be a tax preparer?

Required Skills/Abilities:Excellent verbal and written communication skills.Excellent interpersonal and customer service skills.Ability to understand and apply tax laws and changes in the preparation process.Excellent organizational skills and attention to detail.Accurate math and accounting skills.More items...

How do I become an income tax practitioner?

According to the rule the qualification to become an income tax practitioner are:Law degree with second division.Commerce degree with subjects such as income tax law and accounting.Degree in business administration and management with the subject of accounting, law at the very least.Bachelor of Accounting.

Is tax accountant hard?

Becoming a tax accountant requires hard work in school, but the skills you build can benefit you in numerous ways beyond the accounting field. In fact, most successful tax accountants improve their skills over time, meaning their learning doesn't stop after graduating from an undergraduate program.Dec 8, 2021

How do I prepare for a tax preparer interview?

Are You Making the Most Out of Your Tax Prep Interviews?Smile and welcome your client. ... Gather personal information. ... Ask for last year's return. ... Ask for all possible sources of income, not just W2s. ... Be sure to ask about all possible adjustments to income. ... Determine if your client qualifies for any tax credits. ... Payments.More items...•Mar 5, 2015

What are the five tax filing statuses?

Here's a list of the five filing statuses:Single. This status normally applies if you aren't married. ... Married Filing Jointly. If you're married, you and your spouse can file a joint tax return. ... Married Filing Separately. ... Head of Household. ... Qualifying Widow(er) with Dependent Child.Feb 1, 2016

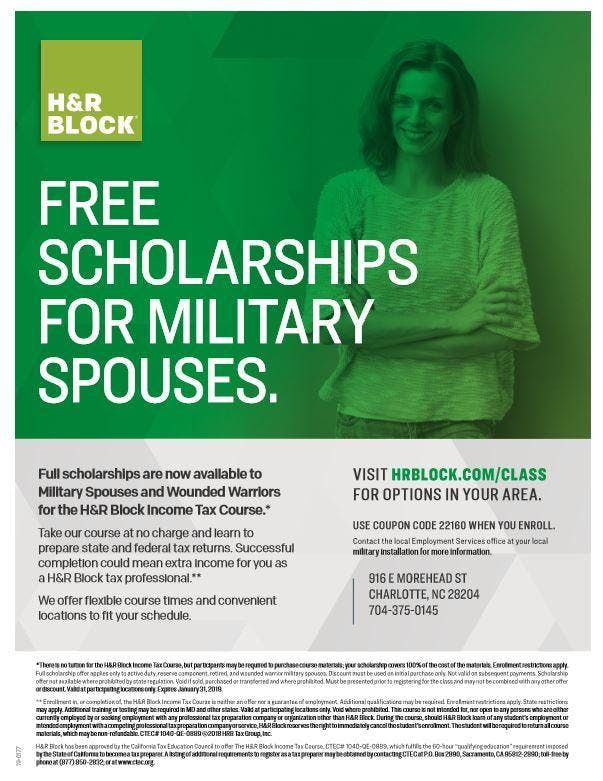

What is the H&R Block Income Tax Course?

With the H&R Block Income Tax Course, you can learn how to prepare taxes like a pro Go to disclaimer for more details 160 . Classes are offered i...

What topics could I expect to cover?

Qualifying dependents and support Retirement distributions Tax planning Dependent-related filing statuses Itemized deductions Farms Interest and Di...

What can I expect from the class?

The course consists of 71-73 hours* of instruction which includes instructor-led sessions, online training, and practice sessions. Additional time...

How much does the class cost?

The Income Tax Course is offered with no charge for tuition or course fees. Students are required to purchase course materials in all states except...

Are there additional costs for books and materials?

Students are required to purchase course materials in all states except for New York and Tennessee, where the purchase of some materials is optiona...

How often does the class meet?

Classes generally meet for 3-hour sessions, two times per week, or on weekends for multiple 3-hour sessions. Class schedules can vary by location a...

When are classes available?

Classes typically begin in late August through September and run through the end of November. Specific dates will be listed with the class you have...

Will class times meet my schedule?

We vary our class times and locations to accommodate our students. Additionally, we offer classes that can be taken online through our Virtual Clas...

What happens if I miss a class?

Classes are held on days, evenings, and weekends. If you miss your regular time for an in-person class, you may be able to take a class at another...

What is H&R Block tax?

The H&R Block tax course is a boot camp for learning about taxes – you’ll cover a lot of material, learn about a range of financial topics, and come out able to prepare different kinds of returns. The experience can be valuable for your career and can help you save money on your own taxes too. For example, one of my friends who took the course learned about amended returns and all the commonly overlooked personal tax deductions she should have been claiming. As a result, she amended a previous year’s return and got a check from the IRS for over $1,000!

What is a 1040 class?

The class instructs on basic concepts, such as claiming dependents, what’s on the 1040 tax form, different filing statuses, types of income, common credits and deductions, and how to deal with capital gains tax and self-employment income.

Does H&R Block pay for additional classes?

H&R Block offers additional classes that you become eligible for once you’ve passed the basic class. In many locations, your base pay will increase every time you take an additional class. Once you take on more complicated returns, your bonuses will be even bigger as well.

How many hours does a class last?

These classes are pretty intensive! Overall, you’ll spend at least 84 hours actually in the classroom. The most common class schedule breaks it into two 3-hour periods per week, and most sessions will run from August to November. Alternatively, some locations have September to November classes which meet three times a week. There are also evening classes available as well as ones during the day. Some locations offer all-day Saturday classes that run for several weeks in a row.

Is H&R Block open in the off season?

Since most H&R Block locations are not open in the off-season, they typically convert these spaces into classrooms. To see if there is one in your area, enter your zip code here . You’ll usually meet at the same location for every class period.

How often do H&R Block classes meet?

Due to this flexibility, classes may meet twoorthree times per week in three- or four-hour sessions, or once per weekend in longer sessions. Classes may begin as early as the middle of August and finish by the end of the year. Specific dates and times are available in the local H&R Block office in which the class is held or by going to the H&R Block website to search available

Does H&R Block refund students?

For students who withdraw, H&R Block will refund 100% of the required course materials cost to all students who return theprinted workbook unused at any time prior to the end of the class. Unfortunately, because the course materials are updatedannually, and the Income Tax Class is only offered during one time of year, H&R Block cannot reuse or resell used coursematerials, and the course materials cannot be returned by H&R Block to its supplier. Therefore, H&R Block will not providerefunds for printed workbooks that are used. See our standard H&R Blocke

Can you cancel H&R Block in Wisconsin?

Note: In Wisconsin, H&R Block cannot require the student to give notice of termination. Instructors need to be aware of therequirements in their state and cancel student enrollments accordingly. Upon cancellation of your enrollment, access to the electronictextbook will be removed.

Key Features

Henry Harvin® Income Tax Course is Ranked No. 1 in the industry by BestCourseNews.com

About the Income Tax Course

Henry Harvin Income Tax Course offers a 360-degree insight on Income Tax and latest taxation policies, taught by an Income Tax expert who speaks at Aaj Tak, NDTV and other popular media platforms.

Income Tax Course Curriculum

In this module the candidate will learn about The Validity of Scrutiny Notice, Information Collect, Document Collect and Commissioner Appeal Filing.

Our courses and Course Certificates are trusted by these industry leaders

Henry Harvin® is the only institute to launch Income Tax Specialist Course offering prestigious CITS -Income Tax Certification.

Income Tax Course Training Certification Process

Consult with our counselors to check your eligibility and the right batch before registering for the Income Tax Course.

Reviews

The Income Tax course in India allowed me to expand on my basic understanding of tax preparation and has given me a good grounding for other areas. This course also helped me strengthen my research skills and has given me avenues to explore. It has been overall a rewarding experience.

Commonly Asked Questions

If you opt for one of the comprehensive Income Tax courses covering taxation foundations and latest changes in taxation policies from an institution of repute, then there is no doubt that you can become an Income Tax Specialist.

Learn to earn at our online tax school

You'll have the opportunity to apply to work with H&R Block ♦ and build a flexible career.

Flexibility

With so many online classes available, you’ll be able to find a day and time that works for you. Find your class.

Career development

Gain a solid foundation that can lead to a fulfilling career in tax preparation with H&R Block. Learn tax theory, current tax laws and filing practices.

Convenience

Our online classes are available at convenient times that work with your schedule. Total course time is 72 hours.

Unique approach

In our guided online classroom setting, the course includes tax theory and hands-on interactive learning with the latest tax preparation software. You’ll complete real-world tax preparation exercises and receive live one-on-one instructor assistance. ++

Build Your Career

Once you complete Income Tax Level 1, you could have the opportunity to interview for employment at an H&R Block office near you. If you're hired you'll enjoy a career that offers a flexible schedule where you can build your client list and advance your career through our continuing education program.

Work and Grow with Us

We have the tools that will help further develop your career in advanced tax preparation and allow you to specialize in areas like corporate taxes, U.S. taxes and other tax preparation areas. You'll also enjoy the convenience of working at one of more than 1,000+ office locations.

What happens if you withdraw from a course?

Students who withdraw from the course and are entitled to, and receive any portion of their fee according to the refund policy, will have their access to the online materials deactivated.

How to notify SPL students of withdrawal?

Students withdrawing from the SPL course must notify via email sent to the Tax Training Co-ordinator. The date and time of the sent email will be used as the notice of intention when applying any refund available.

When does the Refer a friend gift card expire?

There is a limit of one gift card per Referred Student. The $100 gift card refer a friend offer expires 24 February 2021.

Does H&R Block offer deferment?

H&R Block cannot guarantee the Income Tax Course will be offered in all locations or in its current format in subsequent years and as such, no deferment options are available.

Can you transfer a SPL course into another course?

Once a student registers into one of the course formats, they cannot be transferred into any other course once the course commences. Students registered in the SPL course can request in writing a transfer to the Instructor Led Courses only BEFORE February 13 2021 and must also pay the difference of the fee.

Popular Posts:

- 1. how can you request a course substitute/equivalency ldsbc

- 2. explain how two specific governance strategies our course described failed wells fargo chegg

- 3. what is an exchange list course hero nutrition

- 4. the answers of how to learn math course

- 5. where is the best place to take a korean language course in korea

- 6. what can i name a review math course for high school transcript

- 7. a voter who is not registered as a republican course hero

- 8. how many students managed to pass the course even though they failed the diagnostic test?

- 9. what is the course number for the ccna certification?

- 10. gatech what is an audited course